These are clever ways to save money

If you are struggling to save and want to become a money saver then this is the post for you. We saved over £1000 last year by just doing this simple money saving tips. They really do make a difference! We have covered all the money saving tips you need to save more.

The Money Advice Service recently predicted that nine out of ten of us will have a credit card hangover come January, with some shoppers racking up over £11 billion in debt, that’s around £636 a household!

Anyone can become a money saver! You just need to know how to budget and how to get your outgoings down to a level that you can afford. Tt’s more important than ever to set yourself some strict rules to help manage your finances in the year ahead.

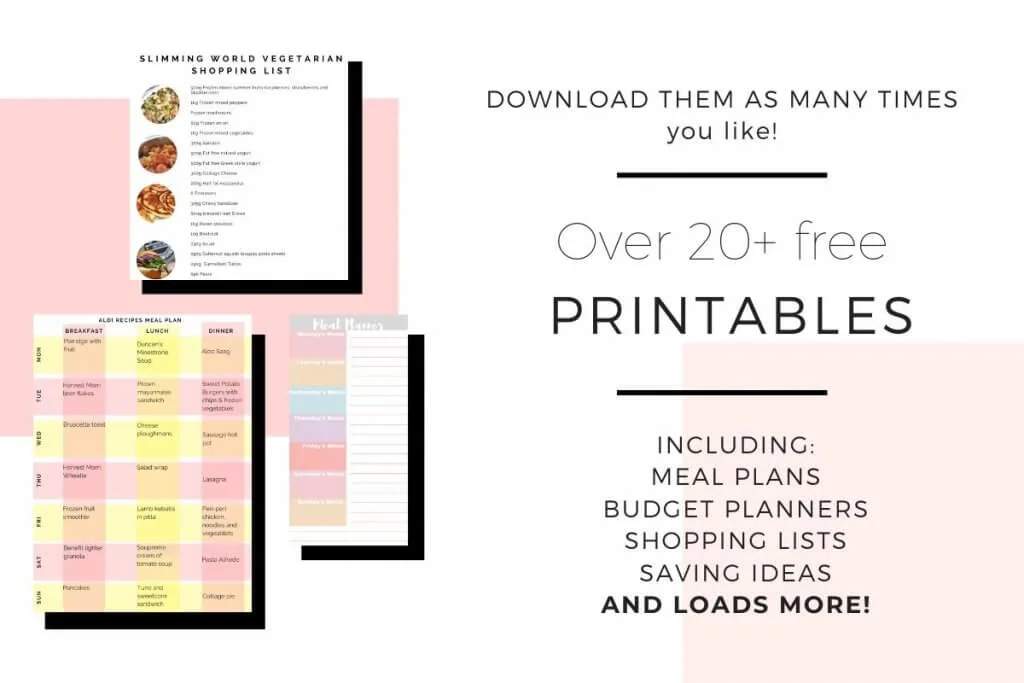

Free money saving printables

If you are looking to save money as a family then come join our free Resource Vault. It’s packed full of money printables that you can use over and over again.

Join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

The best ways to save

Before you start saving money, you need to decide how you are going to do it. You need to start with a budget.

How to budget

Knowing your income and outgoings is the first step you need to take when you are trying to take back control of your finances.

Despite the name, creating a budget doesn’t mean you have to be frugal or only spend the same amount every week. Having a budget means knowing exactly what you’re spending compared to your incomings.

You should also remember to account for annual costs, such as Christmas, birthday presents, car costs, etc.

Creating your budget will give you a clear starting point, so that you know where your finances stand before you decide to either start cutting back or make more money.

The first thing to work out is, do you spend more than you earn?

Use your instincts. Do you have any money left over at the end of the month? Are you eating up your savings or building up debts?

Major overspending can lead to a debt spiral and severe problems, that’s why using a budget planner every month is a good idea and can answer these questions quickly for you.

Yet before you can solve any issues it’s important to get an accurate idea of the size and scale of the problem.

Before you start using a budget planner remember that:

Your bank account lies! When you check it, it only shows you a simple snapshot of the scene that day. It misses out what payments are due in or out, when direct debits are paid, and when you need to go shopping.

Never think that having cash in your bank account means your budget is balanced. Being overdrawn is definitely a good indicator that it isn’t.

Look at the last three months shopping bill, your last energy bill, annual bills and anything else you spend your money on. Be honest with yourself. Then divide it by three to come up with your outgoings.

The aim is to have your books balancing – so you’re not spending more than you earn. To do that, you need to work out how much you spend on and on what.

Once you’ve done that, you need to scan through and decide what your categories will be. This could be petrol, Christmas saving, clothes, food, hobbies etc.

Now you need to decide how much from your wages you can use for each of your categories.

What to use to save

Well that’s up to you. If you like a physical copy of something that you can see written then you can use my FREE Budget Planner that it’s the Resource Vault.

My family, being technology driven use apps. We use:

Plum – Plum is free and compatible with most UK bank accounts. Once you connect it to your online banking, it gathers information about your spending and uses that data to work out how much you can afford to save. Every few days it transfers an amount it believes to be affordable automatically. The best thing is you can get to your money anytime so if you suddenly need it you can transfer back straight away!

Download Plum for free here for Apple and Android phones*

Read more about how Plum works here.

Snoop – We use Snoop as a family. Snoop uses open banking which means that you can link all your bank accounts from different banks to it. What we love about Snoop is that once your accounts are connected they help you budget by suggesting things you can save on like your energy bills and mobile phone. You can set a saving target and it won’t take it out without checking your account first.

Download Snoop for free here for Apple and Android phones*

Read more about how Snoop works here.

Make sure you have a look at our full list of budget saving apps here.

Using one of these tools will really help you to work out what you have left at the end of the month if anything.

Of course you could set the above up yourself and have 5 different bank accounts for your categories so you can always see what you have left in your main account. This is fine but does require a bit of set up including monthly standing orders and you phoning each company to change your account details.

Now you should have a much clearer picture of what is going on.

Having a savings goal

When it comes to setting financial goals, there are no right and wrong goal. Only you know your financial situation and what is realistic for you and your family.

You want to choose financial goals that are SMART. That means that they are:

• Specific

• Measureable

• Achievable

• Rewarding

• Trackable

Remember to keep your financial goals realistic. There’s no point saying you’re going to cut out all treats every month as that will just make you resent saving. Try to be specific. Something like “I will put £5 per week into my savings account by making extra online.”

If you unsure how much to save then have a look at our money saving challenge. The penny saving challenge is a way to save a small amount of money daily. In this case, it’s saving 1p less every day and at the end of the time frame you have a nice amount of savings.

You can save either in reverse, which is what we do, so the biggest amount is saved first then every day you save 1p less. For example, if you start with £3.65 on day 1, you’d then save £3.64 on day 2 and so on.

Some people do this for the whole year and save over £600 for Christmas. If you prefer a shorter goal then a 30-day challenge like this really helps to kick start your saving.

Read more about our money saving challenge here and how we save over £600 with it.

The best ways to save money in the UK

You really can save money on everything from your grocery shop to buying gifts, or even on your Christmas dinner.

No secrets or tricks, just easy tips on how you can get your shopping bill down to under £45 a week for 4, and keep more money in your pocket.

Living frugally doesn’t mean boring though. The cash you save could help pay for family treats, fun days out or even a massive holiday.

It’s not just your food shop you can save money on. Being consistent about budgeting, stockpiling as you go, upcycling and car boot sales can save you hundreds.

Just by being a little cautious and watch what you’re spending everyday will quickly tot up. Shopping around for deals on your energy, broadband, home insurance and phone tariffs can save you £1000s.

Whether you’re pregnant or already have kids, there are loads of ways you can save day to day, meaning a bit of financial breathing space for you and your family.

Ways to save on your food bill

These are the best ways to get your food bill down as a family. This is a great way to cut costs and can really help you save money.

Meal planning

Meal planning doesn’t have to be boring. Swapping and changing meals depending on what you have in your cupboards is the aim of the game.

To really save money, find out how to meal plan like a pro and print off our Free meal plan and shopping list to take with you.

By planning ahead you can cut out the impulse trips to the shops, which always turn into a trolley full. Once you’ve done your meal plan, write a list of ingredients you need for the week and go online before you head to the supermarket, so you can check which store has the best prices.

Read our full tips on saving money on your food shop here.

Budget-friendly meals

It is completely possible to cook your family good meals for under £1 a head. If you are looking for family-friendly meals then have a look at our huge list of £1 a head family meals here.

Our favorite recipes are:

Vegan Shepherd’s Pie For Just 82p Per Portion

Spaghetti Meatball Recipe For 73p a Head

Easy Chicken Fajita Recipe: A Family Meal for 94p a Person

Chinese Chicken Curry For Just £1.54 For 4

Really Easy Homemade Beef Burgers For Under £1 a Head

The Best Southern Fried Chicken Recipe For Under £1 a Head

Chicken Tikka Masala Curry For Under £4 a Hea

The Best Katsu Curry Recipe For Under £1 a Head

The Best Firecracker Chicken For Just 99p a Head

We made all these with Spicentice who send you out little packets of spice with the exact shopping list and method that you can follow.

Check Your Freezer, Fridge, and Cupboards

Before you start planning, check what you have already. Do you have any kitchen staples that you could use to bulk out any meals or use on days you’re late home?

Is there anything in your freezer you could eat to bring this weeks shopping list down?

Same goes for vegetables and side dishes. Spending a few minutes checking the freezer, fridge and cupboards can save you money later on.

Foraging

A spot of foraging can save you a fortune on fresh fruit. Blackberries are brilliant growers and freeze well. They are tasty, versatile and completely free when foraged.

Yellow Stickers

Heading for the discount aisle at the supermarket is a great way to find bargains. You can find some great yellow-sticker items that you can freeze and re-use whenever.

Downshift

This means buying the lowest brand first and trying it. You may be surprised and it may taste great. If you don’t like it then go up one level and see. Saver brands normally taste just as good as the branded items but cost a lot less.

Use freezer vegetables

Freezer vegetables are a great way to save money. They are already pre-cut which means no prep and you only need to take out the amount you need.

Grow your own

One of the best ways to grow your own fruit and veg is to have an allotment. If you want to try on a smaller scale, try growing potatoes in a big black bin filled with compost and tomatoes in hanging baskets.

Childcare savings top tips

These are all ways to save money when you have kids.

Check child tax credits

We all know that having kids is expensive, and using tax credits can really help, with some families getting £1000s a year.

Tax credits ate a state scheme that pays out to families to help support their needs, or helps to top up your wage if you’re a low earner.

How much you’ll get depends on your circumstances.

There are two types of tax credits in the UK, and it’s possible you may be able to apply for both.

Child Tax Credit:

Apply if you have children, doesn’t matter if you work or not and you could be eligible.

Working Tax Credit:

Apply if you work, doesn’t matter if you have kids or not, you could still be eligible.

You do need to reapply every year and let HMRC know if your circumstances change. Money Saving Expert has a great guide that explains it all here.

30 Hours Free Childcare

We all know about the FREE 15 hours childcare all 3 and 4-year olds get in England, but from September 2017 some may be entitled to 30 FREE hours of childcare.

To be eligible you (and your partner, if you have one) need to be:

live or work in the UK

are employed or self-employed

are over 21 and earn on average at least £120 a week, unless in your first year of self-employment.

earn less than £100,000 a year each

don’t get other support with your childcare, including from a childcare voucher or salary sacrifice scheme

You may also be eligible if you have a partner and one of you gets any of the following benefits:

Carers allowance

Employment and Support Allowance

Incapacity Benefit

Severe Disablement Benefit

For more details on the 30 free hours of childcare offered, click here.

Please note: When you apply, you’ll be confirming that you need childcare so that you and your partner, if you have one, can work. If your child’s already in a full-time reception class in a state funded school, you won’t be eligible for 30 hours free childcare.

Childcare Vouchers

If you aren’t eligible or can’t find a setting that offers the 30 free hours, then childcare vouchers may work out and could save you £1,000s a year in tax.

If you’re not using them yet, look into this NOW. This little-known scheme pays out up till your child is 16 and it could be as much as £930 a year per parent on childcare.

These are offered through employers and many companies take part, even small business.

This enables you to pay for childcare out of your pre-tax and National Insurance income. While this doesn’t sound much, the impact can be huge.

Use the HMRC calculator to see whether you are better off with childcare vouchers, as it can affect your child tax credits.

Sign up now though, as in April 2018, this scheme closes for people who haven’t signed up beforehand.

It will be replaced by ‘Tax-Free Childcare’, which has already started for the youngest children and will be rolled out over this tax year (2017-18) for the rest.

With this scheme, working parents (if you’re a couple, both of you must work), can put £80 in an account to pay for childcare and £20 is added.

Both schemes have good and bad points, so you need to decide ASAP which is best for you.

Household money saving

This is our full list of household money saving tips that can help you keep more money in your pocket.

Credit cards

Make sure you check your credit card interest and work out which one is costing you more. Start by paying that one down first then the next highest etc.

Council tax

Make sure you check your council tax band on your home. It’s a well known fact that a lot of us are paying more than we should for our property. You can also ask to pay for your council tax for the whole 12 months which helps to reduce your monthly payments a bit.

Bill switching

It’s really easy and not the faff that you’re led to believe. Shopping around could save you hundreds! Do it with everything you use, from energy, to board band to insurance to even TV packages.

There’s loads of sites out there that will help you to compare, but the trick is to play them off against each other and haggle. Yes, even the big companies expect you to put up a fight. The first price is never their final price.

Make sure you lower utility bills by phoning around and asking for quotes. It does take time but is so worth it! What’s the worst that can happen?

For your energy bills have a look at a price comparison site. They are a free price compassion site that brings up the best price energy companies.

Use cashback sites

Remember to use cashback sites if you buy anything online.

We use OhMyDosh which are am easy to use cashback site that gives you money back when you spend online. Use our link here to get a free £1 added to your account.*

Before you buy

Know what stores are offering discount by checking websites like PromotionalCodes.org.uk, HotUKDeals and social media pages, to find all the current available deals, flash offers and even free delivery codes.

Money saving coupons

Half the cost of your food shop by couponing. It’s just as big here as in America, just less advertised. Look out for coupons in websites, magazines and food packaging.

Shopping outlets

These come in all shapes and sizes. Yep, you get your normal high street variety but they are also available too.

Think Boohoo, Dyson, Argos, Mamas & Papas and AO.

If you need something, check this Outlet List which is full of the cheapest online brands. It means you can still have your branded items but for a lot less!

Actively write to retailers

Another great way to get coupons is to write to manufacturers telling them how much you love their products. Many will write back and give you a money off voucher as a thank you.

Buy for Christmas all your round

The best time to buy presents is just after Christmas as a lot of stores will hold 75% off sales and you can pick some great gift sets as well as perfume and toys at bargain prices. You can save a lot of money on presents for next year.

Ways to save outside the home

Free Days Out

If the weather is bad and you can’t face the thought of being stuck in, then have a look at this Free Museums and Galleries guide which is packed full of free places in the UK that don’t charge a penny for you to enter.

There’s loads to choose from including navy tunnels, roman forts, railways and football.

Car boot sales

You can grab hundreds of bargains every year by buying and selling at car boot sales. If you’re going to buy, always arrive just after it opens or just before it closes in order to bag the best bargains. Be prepared to haggle and keep your eye out for recognisable brands and labels.

If you’re selling, avoid labeling your items (as this can put people off), bring lots of change and carrier bags and be prepared for hagglers.

Charity shops

Charity shops can be a great way to find top branded items for pennies. Always keep an eye out for labels and recognisable brands.

Newspaper promotions

Fancy a cheap holiday for a tenner? Newspaper ticket promotions are a great way to get a cheap family getaway or day out. Save them before a school holiday for something to do over the break

Be creative

There are so many ways you can DIY your house to save money. At Christmas and Halloween , you can decorate your house with homemade items. This is a great way to get crafty with the kids and also save a few pennies in the meantime.

Bargain buddy

Having someone to hit the shops with is great. By taking a bargain buddy you can compare and share coupons and voucher codes with each other and even have someone to do a spot of foraging, charity shopping or car boots with.

Upcycling

By painting and adding a bit of wallpaper to an old chest of drawers or a desk that’s heading for the skip, you can make practical and stylish furnishings for a lot less money.

Quick Ways to Make Money at Home as a Mum

There’s loads of ways to make money as a mum, from sat at home watching TV or even walking the kids to school, there’s no shortage of ways you could be lining your pockets.

That doesn’t mean you need to take on more hours at work or work harder. It means working smarter to make extra money if and when you can.

You don’t have to start a full blown business either. It can just be picking up a few hours being an Virtual Assistant in the evenings or match betting at lunch time.

Declaring Your Income to HMRC

Don’t let the self-assessment part of earning money put you off! You don’t need an accountant to declare every year unless you decide to go limited.

Make sure you have ALL your extra income written down so when it comes to declaring you aren’t looking back over a whole year.

Current account switching

Many banks will pay you to switch to their bank accounts. The funny thing is you don’t have to do anything, just agree and they will do all the hard work and with many paying you £100s to do it. Read more about bank account switching and how you could earn £250.

Matched betting

Matched betting allows you to profit from the hundreds of free bets and promotions offered by bookmakers. This isn’t illegal or under the table. All the bookies advertise these offers to entice new customers in.

Matched betting is a great tax-free way to make money from home by using the free bets that the bookmakers offer.

Read here about how to make £40 for free using matched betting.

We use Outplayed to help us with matched betting. Read what we think about them here and how Outplayed works.

Jobs for stay at home mums uk

There’s to many jobs to list here but there’s loads you can do to earn extra cash. None of these cost you anything and are completely free to do but all will earn you money.

Read our full list of ways to earn money from home here:

101 Genuine Work From Home Jobs in the UK

37 Home Based Jobs You Can Do While Working From Home

7 Typing Jobs From Home That All Mums Could Do

Here a few to give you an idea:

Watch videos and play games

Swagbucks is a fun and easy to use site that pays you to complete shorts online tasks in exchange for virtual money. This can then be swapped for real money or vouchers.

Survey sites

Online survey sites or apps can make you £100s of pounds a year. Just give your view and watch the cash come in. Some only pay pennies but one or two I’ve done do pay £1 a survey. At just 3-5 minutes long sat on your bum, that’s a no-brainer.

OhMyDosh is a great site to start with. They are a cashback site but also pay you to complete surveys.

Join OhMyDosh here for free and get £1 added to your account.*

Money for Googling

Making money online couldn’t be simpler here. Using Qmee, you can earn by just searching the web.

Qmee is an internet add-on, so you can search like you would normally, but next to the searches will be extra results. These are adverts from businesses that have paid Qmee to advertise.

Related Posts:

- The Best Way To Save For a House

- 103 Frugal Living Tips That Will Save You Thousands in 2021

- 25 of the Best Ways To Save Money In The UK Right Now

Fun = cash

Gift Hunter Club gives you points for watching videos or to enter competitions. These can then be swapped for cash through Paypal or for Amazon vouchers.

Competitions

There are loads out there, with dedicated Facebook groups set up for them. Yep, it is luck, but if you enter enough of them, then you’ll win at some point.

Now set yourself a challenge. How much do you want to save or make your family by Christmas? Let me know in the comments below.

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.