Including what frugal living in 2024 in the UK really means

We all want to save money while raising a family, and becoming a frugal family is a good way to do it. Frugal living doesn’t mean going without, it’s more about living life to the full, on less.

Living frugally doesn’t have to mean sacrificing your lifestyle. By making smart choices and being mindful of your spending, you can live well on a budget.

Thrifty living in the UK is sometimes looked down on as “being tight”, but actually living frugally can help you afford more in life.

If you want to learn how to be frugal and are looking for all the best frugal living tips then keep reading as we have 103 of the best frugal living tips that will help you save money throughout 2024. This is frugal living for UK families.

We love frugal living. It gives us the freedom to do things with the children that we’ve always wanted to do. This post explains how to be thrifty in the UK and make it work for your family.

By incorporating these frugal living tips into your daily routine, you can achieve financial stability while still enjoying life to the fullest.

What does frugal living mean?

Frugal living doesn’t mean that you go without. Living a frugal lifestyle means that you save money on your daily living expenses so that you can spend money on the items that are really important to your family.

That could mean that you pledge to stop eating take-outs and put that money towards a dream holiday or switch your bills regularly and put the savings towards paying off your mortgage.

What is frugal living?

Frugal living, in the real world, means making sure you have enough food and enough money to live while not going into debt or worrying about you are going to pay the bills next month.

Being frugal means that you and your family get to live the lifestyle that you want. Decide what’s important as a family. What do you all want to save for? You all have to be invested to be able to achieve your goal.

Wikipedia explains the meaning of frugal living as “The quality of being frugal, sparing, thrifty, prudent or economical in the consumption of consumable resources such as food, time or money, and avoiding waste, lavishness or extravagance.”

For us, it’s more about being free from debt and no longer living month to month. Our frugal money saving tips in this post are all easy to do and great for the whole family.

The good thing about living a frugal lifestyle to that it’s as flexible as you are. You can be as frugal as you want while still watching your savings grow.

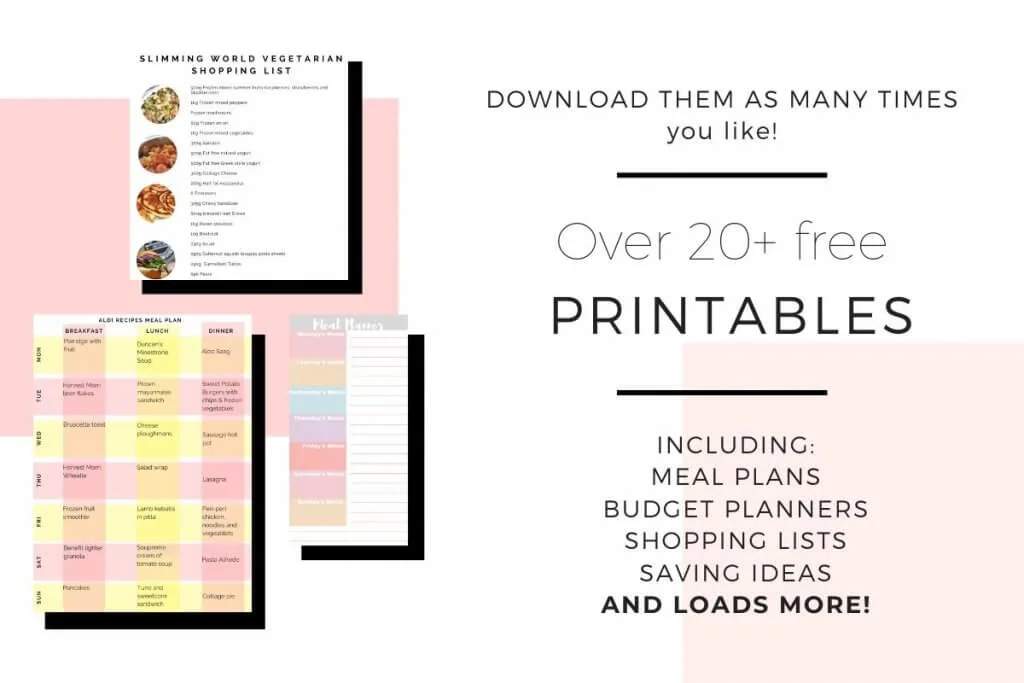

Frugal Living Printables

If you find meal planning hard then come join our Facebook group Money Saving Mums and get access to The Resource Vault with access to over 20+ money saving printables. This includes our easy slow cooker meals meal plan, available exclusively to subscribers!

Join our free Resource Vault here

Everything is included from budget planners to meal plans and pre-made shopping lists plus a link to our Money Saving Mums Facebook group!

How to Live Frugally in the UK

Frugal living gives you options as a family. Debt limits your options!

For our family; frugal living means that we really think about what we spend our money on as a unit. That whatever we spend it on is essential and not just a want.

That doesn’t that you have to live like this too. Living frugally could mean something different to you. It could mean that you’ve now decided to start making prudent money choices.

How to save money living frugally?

To start living more frugally as a family you need to make smart money choices. Make your money work for you and really start to budget are the first steps to saving money while raising a family.

If you haven’t started already, then creating a household budget is a good place to start. It allows you to see what you’re spending money on and if and where you need to cut back.

Try and decide how much you’re going to spend on food, petrol, and treats and stick to it. If you prefer to use cash to budget then drew it out and put it in envelopes to use. Anything leftover gets put into the money pot.

If you need to start saving money but don’t like the idea of going frugal then try these top three posts to get you on your way to helping your family save money:

How to Stop Spending Money Right Now – If you are looking to stop your spending from getting out of control then this is the post for you. It covers everything you need to gain back your financial control back.

25 of the Best Ways To Save Money In The UK Right Now – These are quick and easy ways to start saving money as a a family.

101 Aldi Recipes That Will Give You Dinner Ideas For Tonight – Food is a big part of most families budgets. This gives you over 100 meals to try.

If you have any sort of debt like credit cards or loans then it is always worth paying them off as quickly as possible before saving money.

How to be more frugal in the UK

These frugal money-saving tips work if you live in the UK and can be used across the world. It really is easy to start living a frugal lifestyle without it impacting your life at the start.

What you eat can make a big difference to your spending habits.

Whatever you and your family plan on eating that week put down in a meal plan. This could be in a notebook, an app or even just on your phone.

Make this your one and only shop for the week.

Start by listing every mealtime and plan out the week. Get everyone involved to pick a meal.

Having trouble filling up your meal plan? Then use these meal plans as ideas.

Write down whatever ingredients you need for your meal plan to work including drinks. Then look through your kitchen staples and check you don’t need anything. We have a full list of our kitchen staples here. They are all cheap but can bulk out a meal if needed.

Managing the money you do have can be hard when it needs to be pulled in so many directions.

There are loads of budget phone apps that can help you keep on top of your finances wherever you are.

We use Snoop. It’s completely free and it lets you input your salary and outgoings, plus links to all your accounts including savings and investments.

Using money management apps are a great way to keep control of your family budget.

Download Snoop for Apple or Andriod phones for free here*

Read more about how Snoop works here

If you seriously are struggling for money then please take a look at our No Money for Food? This is What You Do When You Really Have No Money To Feed your Family post which walks you through all your options.

Please don’t suffer in silence. Get help now so you and your family can move forward.

If you have never budgeted before or it’s been over 6 months since you reviewed your finances then why not join our Money Saving Mums group.

It’s a group for mums who want to overhaul their money and get some real frugal tips on how you can stretch your money. It’s a closed group so only those that have accepted the challenge can see your posts.

We are all at different parts of our money saving journey so there’s no shame. We talk openly about how all save money to try and help each other. Living frugally can mean different things to us all. No Judgement!

So what are you waiting for? Our 103 thrifty tips will help you to start frugal living in 2024. This is simple frugal living at its best.

Frugal money-saving tips UK for beginners

The great thing about frugal living is that you and your family get to live how you want. Decide what is important to you all as a family. What can your family not live without? What do you all want to save for?

If you’re all invested in living a frugal lifestyle then you will make your dreams happen.

1. Set your own goals

Have monthly chats with the whole family to keep everyone on track and on the same page. You can’t start saving more without the whole family invested. Extreme frugal living is a lifestyle choice so find out how far your family want to fgo before you start.

2. Start a monthly budget

That way you know what you have leftover, if anything that month. Use my FREE downloadable budget planner to help.

If you prefer to use your phone then make sure you have at Plum and Snoop. They are both money budgeting apps that help save you money.

Read more about how Snoop works here

Read more about how Plum works here

3. Celebrate when you reach a goal

A big scary goal will really help motivate everyone to keep going but you do need to celebrate when you reach it. That doesn’t mean blowing everything you’ve saved. Have a day out together or a treat meal. Something to keep everyone going.

4. Check your bills

Go through all your bills and check you’re on the best deal. Phone them and ask. What’s the worst that can happen? We use:

Switch energy suppliers EVERY year without fail.

Make sure you check them regularly to avoid any surprises or errors. It’s all about keeping your finances in check and making sure everything adds up correctly. So, take a few minutes to review your bills and stay in control of your expenses.

5. Use budgeting apps

Use a FREE app to help keep track of your family’s spending habits. It’s completely free and it lets you input your salary and outgoings, plus links to all your accounts including savings and investments.

Using Open Banking means that these apps can bring up all your bank accounts with different banks. They are regulated by the FSA like any high street bank are.

Read about what we think of Snoop here

Read more about what we think of Plum here

6. Move to a water meter

This tracks your exact water use so you have complete control.

7. Have a guilt-free money day

Try once a month. Don’t go crazy but go out for dinner or have a treat. It will help keep you all on track and feel less like you are missing out.

8. Switch bank accounts

Do this every 12 months to get the best interest rate and take advantage of the cashback offers. Use Experian to check your credit score to make sure you get the best rates possible.

9. Have an emergency fund

Make sure you have an emergency fund for if or when something happens out of your control. This should be your first saving goal.

10. Ask hard questions

Ask yourself “Do I really need that?” before you buy anything new.

11. Sell, sell, sell

Sell old or unused items on Facebay or eBay.

12. Use Facebook

Use Facebook communities to help you find deals. Facebook’s Marketplace is a great way to find the cheap items you need.

Join a money-saving challenge

This could help you to kick start your savings. Read how to start saving with a money-saving challenge here.

13. Keep loose change

The odd 1p and 2p really start to add up. Put them in a jar and count them when it’s full.

Frugal Living Ideas For Transportation

14. Annual payments

Pay for as many annual payments yearly if you can. This will save you paying interest in the longer term.

15. Walk more

Try and walk instead of taking the car. We now walk any distances that are under 2 miles. It’s a great free exercise too!

16. Turn your car off

When you’re sat in a queue don’t leave the car on. Not only can it save you fuel but it also helps the environment.

17. Wash your own car

Get the kids involved and make it a family task. It’s a great way to spend time together too.

18. Carshare

Split the petrol cost with a colleague or friend. If you are both going the same way then it makes sense to share and saves you both money.

19. Do your own small repairs

YouTube is amazing for walking you through anything from changing a tyre to the battery. Give it a go and learn a new skill too.

20. Tyre Pressure

Check your tyres are at the correct pressure. Most petrol stations let you check and fill them for free.

21. Research and find free parking

When you go out, research first and see if you can park for free anywhere. Parking charges are big and this could save you a lot over a longer period of time.

22. Find the cheapest petrol station

You can research this online really quickly.

23. Clear out your car

This helps to keep the weight down and uses less fuel.

24. Could you go down to one car

It might not be easy but that saving could be the difference between having a holiday and not having one!

Frugal lifestyle Meal planning and Shopping

25. Meal plan

Everything gets put down, including snacks and desserts. Meal planning is the best way to start saving money. Put your meal plan up somewhere so the whole famly can see it. You don’t have to stick to it daily. Swap and change the meals around as they suit you. Use it as a guide.

If you are looking for meal ideas then have a look at:

101 Aldi Recipes That Will Give You Dinner Ideas For Tonight –

The Ultimate £1 Per Head Budget Meal Planning List –

26. Build your shopping list

Use the meal plan to then make a shopping list. Take it with you and stick to it!

27. Check your cupboards

Before you go shopping, check what you have in your freezer, fridge, and cupboards already. Can you take anything off your shopping list because you already have it?

No point in having too much food in the cupboard as the kids may change their mind and not like something.

F28. ind cheap recipes

Let everyone pick one. It helps fill up your meal plan and have less waste. If you are looking for cheap meal ideas then have a look at:

The Ultimate £1 Per Head Budget Meal Planning List – This is our biggest list of £1 a head family meals that you can use to fill up your meal plan.

Store Cupboard Meals: 41 Store Cupboard Recipes to Try – Using what you have in your store cupboard is a really great way to save money and use the food you have.

31 Aldi Slow Cooker Recipes For The Whole Family – We love our slow cooker! It’s a great way to have a meal ready even if you are not at home.

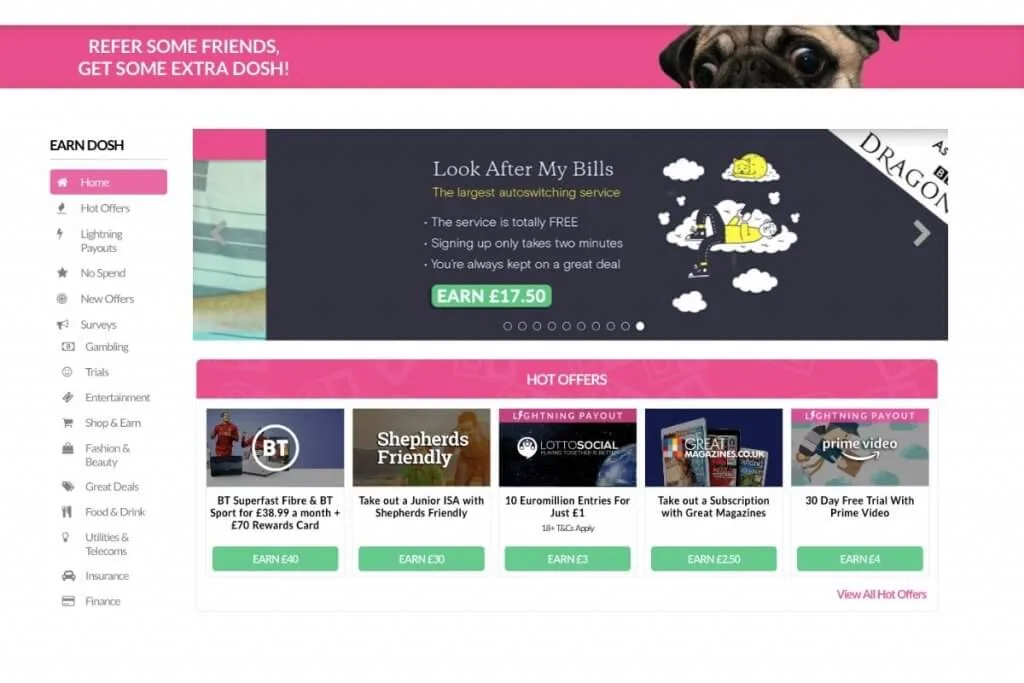

29. Use cashback websites

We use OhMyDosh whenever we can. Whatever you want to buy online, check if you can buy it through their website first. They then give you money back.

Join OhMyDosh here and get £1 added to your account for free.*

Read more about how OhMyDosh works here

30. Use loyalty cards

Like Tesco Clubcard or Boots Advantage Card as you get freebies back. You can also use these points on weeks when you need items that you just can not afford.

31. Use eBay

Before you buy anything check eBay or Facebook Marketplace. You may be able to get that item cheaper.

32. Use pre-made meal plans

If you are looking for easy-to-cook family meals that help you stick to a budget then have a look at Spicentice.

Spicentice sends out packs of spices that help to liven up your meals. What we love the most about Spicentice is that they include the exact ingredients you need and instructions down to the letter. This means that if you are a beginner cook then you can use this to start to cook your family great homecooked meals.

You can keep using them again and again. We started using them when we got stuck in a food rut and we didn’t know what to cook. What we liked was that they had family-friendly meal ideas that you could pick from.

Try Spicentice here using our code LASAVE20 and save 20% off every purchase*.

We have cooked loads of meals with Spicentice including:

Beginner Chilli Con Carne Recipe for Just 95p a Head

Vegan Shepherd’s Pie For Just 82p Per Portion

Spaghetti Meatball Recipe For 73p a Head

Easy Chicken Fajita Recipe: A Family Meal for 94p a Person

Chinese Chicken Curry For Just £1.54 For 4

Really Easy Homemade Beef Burgers For Under £1 a Head

The Best Southern Fried Chicken Recipe For Under £1 a Head

Chicken Tikka Masala Curry For Under £4 a Head

The Best Katsu Curry Recipe For Under £1 a Head

The Best Turkey Curry For Under £1 a Head

The Best Firecracker Chicken For Just 99p a Head

33. Stop buying coffee

When you go out, bring your own hot drink.

34. Shop charity shops

This is a great way to get designer clothes on a budget. We use Vinted to find clothes and presents for the children. You can get anything on there from designer trainers to cuddly toys.

35. Use Google shopping

This is a great place to buy kids birthday presents. Search the item you want and let Google compare all the prices for you.

36. Try season shopping

Try and buy winter clothes when they go on sale in the summer-ready for the following year. If a few items don’t fit exactly right by then, I’m not that annoyed about it as I saved money on all my purchases overall.

Frugal Living Ideas For Entertainment And Activities

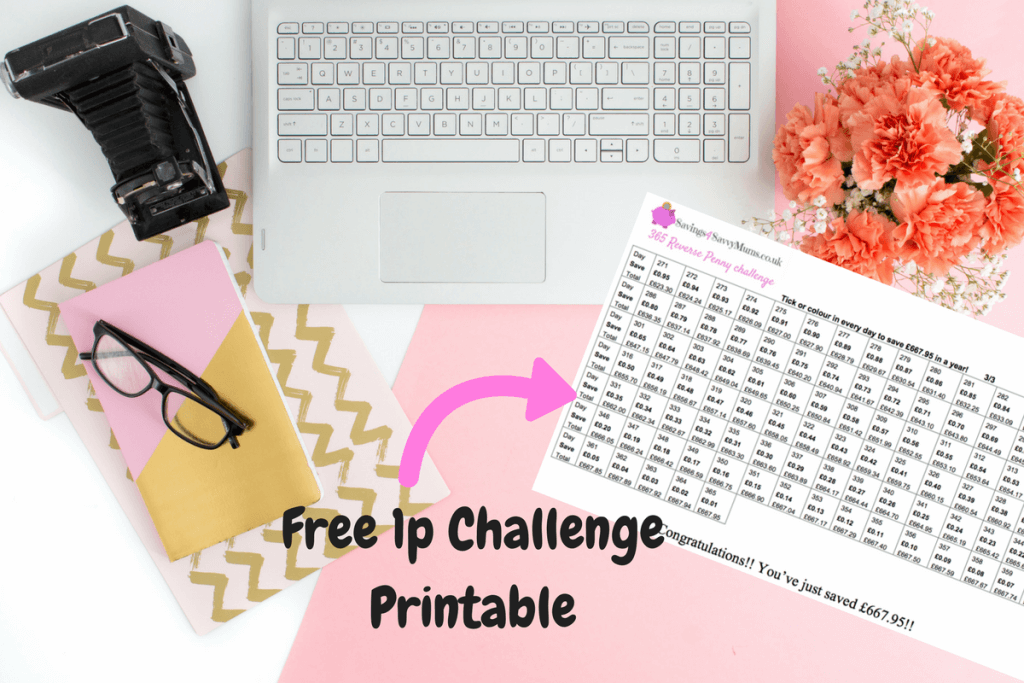

37. Penny challenge

Try the penny challenge for three months and put that saving toward a family trip out. We use this 1p money challenge here.

38. No-spend weekend

Try and have one once a month. Have a jar of free ideas that can help keep you all amused. This could be anything from going geocaching in your local area to Pokemon spotting or chalk drawing.

39. Check offers before you go anywhere

It takes five minutes and a Google search to check offers on places to visit.

40. Sitting in a TV audience

Keep an eye on the big production companies’ websites. They often ask for audience members to come along for free.

41. Use What’s App

What’s App and other free messaging apps like this are great for chatting to the family. They are free to use for all and you can video call as many people as you like.

42. Find free ebooks

Most local libraries offer a free eBook service using your library card.

43. Drink water

Bring your own bottles of water so you don’t need to pay for it and invest in a water filter for your home to save money over the long run.

44. Use your local library

Your library is a great place to rent movies or books you need. Most run great family activities too.

45. Enjoy the outdoors

Visit as many free local parks as you can.

46. Find local walks

Take bikes or scooters and explore your local area. Really get to know where you live.

47. Family board game nights

These are great to get older kids off their devices. You could even play over video call with older family members too.

48. Home spa day

If you love having nails done then do it at home. Get some friends around and help each other.

49. Make your own toys

We’ve all been there. You spend forty quid on a VTech watch or singing Elsa to find the kids would rather play with the box.

Now, I splash out of one big thing each, then make everything else. One of their favorites is still Cheerios is a plastic box.

If there is a product in particular that you feel you need to buy then have a look at voucher websites like Lowe’s coupon that help you get money off.

50. Park Run

Instead of using the gym search for a local Park Run group in your area. They normally run most weekends and offer kids races too.

Frugal Living Tips For Laundry and Cleaning

51. Ditch the tumble dryer

If you can, hang your clothes up to dry around the house.

52. Make your own detergent

Okay, so this might seem a bit radical but bear with me here. For a little under £20, you can make five gallons of your own detergent. If won’t clean all those weaning bibs or the poonami all over your kids best baby grow, but it’s fine for the average day to day wash:

3 bars of fells naptha

1 box of borax

1 box of washing soda

2lb box of baking soda

Large tub of OxiClean

Purex laundry crystals (optional)

53. Use the sniff test

Check if clothes really need washing. Could they do one more day?

54. Wash at 30-degrees

Unless really dirty, washing at 30 really can save you money in the longer term.

55. Use less soap powder

If you have a smaller load then use less to try and make it last longer.

56. Use an airier

Put it near your radiators so when they are on they can dry your clothes as well as warm you up.

57. Open a window

Instead of using air fresheners.

58. Dry your clothes outside

If you can, wind air is the best way to dry your clothes.

59. Pick an all-purpose cleaner

This means that you can clean your home with one cleaner.

60. Use cheaper brands

The cheaper brands still work. Use them to clean your house.

Utilities Money Saving Ideas

Use a site like Money Super Market for your electricity if you don’t like the hassle of looking around. They automatically switch you to the best deal for you at the end of your term. Find out more here about how Money Super Market could work for you.

61. Take meter readings

Take your own meter readings yourself so that the companies don’t use estimates.

62. Turn down your heating

Turning down your heating by just 2 degrees could save you money. We leave ours on at 18 degrees.

63. Put a jumper on

Ask everyone to put a jumper on before they turn the heating on. Wear extra layers or use a blanket at night if you are cold.

64. Insulation

Check and have added insulation added to your home.

65. Turn off Lights

Turn off lights every time you leave a room.

66. Keep doors closed to keep heat in

Only open them when you have to.

67. Turn off applications

If you aren’t using them then turn them off at the mains.

68. Energy-saving lightbulbs

Install energy-saving lightbulbs every time one fails in your home.

69. The oven

If you need the oven, try and fill it, thinking of the next day’s food as well.

70. Airfryer

We love our fryer and that means we don’t have to warm the oven up. You can pick which side warms up and even look things like bacon in it without the hob.

71. Gas hob

If you’re using gas, try and put a lid on the top to stop the excess heat from coming out.

72. Flush twice a day

Only flush the chain after a poo.

73. Turn off the tap

Turn the tap off while you’re brushing your teeth.

74. Have quicker showers

We time ours at 5 minutes.

75. Use a waterbutt

It’s a great way to collect rainwater and saves you from getting the hose out in the summer months.

Be Frugal And Save Money On Your Household Bills

76. Cash envelopes

Use cash envelopes on anything you need to pay cash with. That way you will stay within budget.

77. Call for help

If you’re falling behind with mortgage or secured loan payments, you may want to consider an auction sale to dispose of the property quickly and release some cash.

78. Don’t auto-renew

Don’t auto-renew insurances. Make sure you price compare first. We use Compare The Market for bills.

79. Mobile phone

Swap to a lower mobile phone contract. Instead of buying a phone plus network package – opt for a sim free smartphone with a sim-only contract so that you’re not tied down for a couple of years. Also, when looking to upgrade to a new phone, consider a refurbished smartphone which is generally much cheaper than buying new. Specialist marketplaces like Back Market, Amazon Renewed or Music Magpie offer a wide range to choose from.

80. Use YouTube

Watch YouTube to learn how to do all the DIY jobs at home yourself.

81. Check everything

Go through your household bills and cut anything you don’t need. Check auto-renew insurances and see if they can save you money.

82. Check subscriptions

Review your subscriptions every 3 months and cancel what you don’t need.

83. Washable wipes

Use them for everything and then chuck them in the wash.

84. Pay by direct debit

You normally get a discount and don’t have to think about it.

How To Be Frugal With Food – The Best Frugal Living Tips

85. Check your cupboard

Including freezer and fridge and buy kitchen staples. Try to add one cupboard meal into your meal plan.

86. Grow your own vegetables

This is a great activity for the whole family. Most seeds are cheap to buy and if looked after can give you a lot of vegetables. Start with the easy ones like strawberries, peppers and tomatoes.

87. Use leftovers

Use up any leftover food that’s going off. Smoothies, cakes and slow cooker recipes are perfect for this.

88. Pack lunch for the whole family

No more school meals (unless they’re free) or office outings. Keep track of what you’ve saved.

89. Reduce waste

Reduce your family waste by understanding dates and where items go in the fridge.

90. Buy good meats

Buy better cuts of meat that can last for more than one meal. Muscle Foods* is a good one to start with.

91. Downshift your brands

Start at the bottom and work your way up. You’ll be surprised at how nice a value product tastes. If you don’t like it, then go up one and try that. These meals are all made from food brought from a discount retailer.

92. Switching supermarkets

I’ve saved over £30 a week just be switching from Asda to Aldi. Try it!

93. Buy in bulk

The bigger box of nappies you buy, the cheaper they are. Works with most things, apart from cake, unfortunately.

94. Alcohol

Cut down on alcohol or only buy it from discounters.

Related Posts:

- How to Stop Spending Money Right Now

- Penny Saving Challenge: Save Over £600 in a Year

- How to Stop Spending Money Right Now

Make extra money while being frugal

The thrifty tips above will help you start saving money but if you want to try and earn a little more then why not try apple pay casino or some of our ideas below:

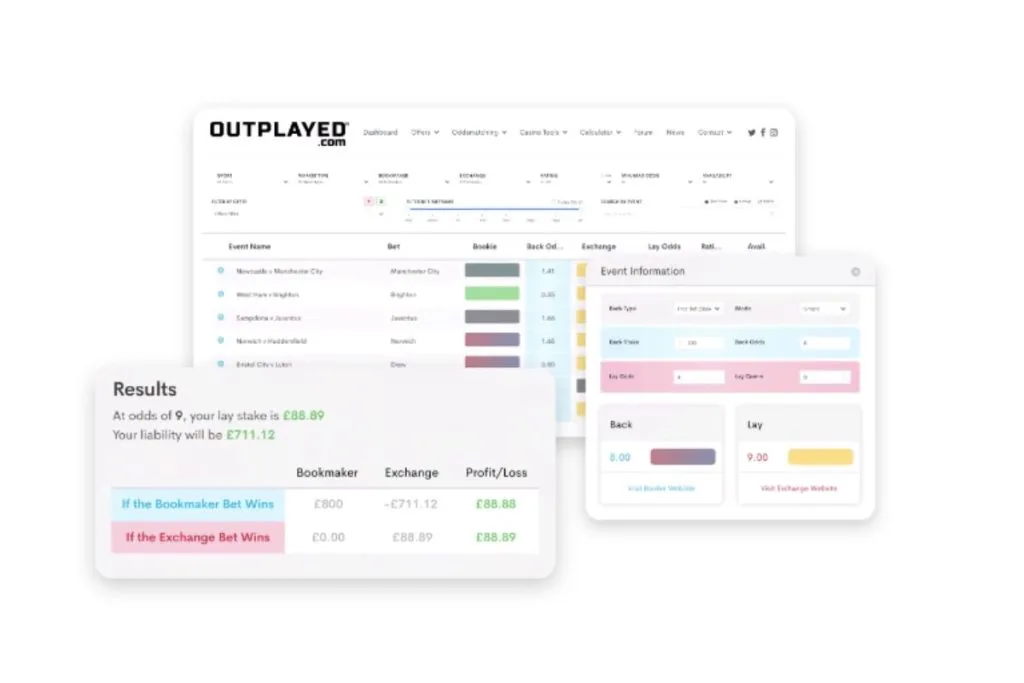

95. Matched Betting

Matched betting is a completely legal, tried and tested way to make money online while you’re at home. It basically turns the tables on the bookmakers, to give you their free bet offers, so you can’t lose. We do it monthly to try and help boost our income.

Read more on here on how to start matched betting

96. Trading 212

If you are looking to earn money from home then have a look at Trading 212 which talks you through how to deposit your first £1 and get a free share worth up to £100.

Read more on Trading 212 and how to claim your free share here

97. OhMyDosh!

OhMyDosh!* is an easy to use website that asks you take surveys for payment. Sign up for free and start earning straight away. As soon as you reach £10 you can cash out.

Online survey sites or apps can make you £100s of pounds a year. Just give your view and watch the cash come in. Some only pay pennies but one or two I’ve done do pay £1 a survey. At just 3-5 minutes long sat on your bum, that’s a no-brainer.

Join OhMyDosh here to have £1 added to your account straight away

Read more about what we think about OhMyDosh here

98. Blogging

Blogging can be a great hobby, but also a very good way to earn money and go places with your family that you’ve never even dreamed of before.

You need to find a topic that you are passionate about. Don’t worry if you don’t enjoy writing, you can vlog on YouTube or even just start with a Facebook page.

Read more about how to start a blog in the uk here

99. Virtual Assistant

A virtual assistant is someone who offers virtual help and business support to small and medium-sized businesses.

This could be administrative tasks, a project management task, or customer service help. You could be doing anything from scheduling social media to creating marketing images to just answering emails or amending spreadsheets.

A virtual assistant is useful for any size business, and as someone who’s worked both sides, as an employer and employee, most virtual assistants are very flexible and work on an hour-by-hour payment basis.

If you are thinking of becoming a virtual assistant then have a look at our Virtual Assistant Essential Toolkit. It’s packed full of everything you need to get started from invoice templates to timesheets.

Have a look at our Virtual Assistant Essential Toolkit here.

Are you people-focused? Then you’ll be great at organizing and offering great customer service.

Do you like numbers? Then invoices and data inputting is for you.

If you are a creative person then creating content and marketing may be for you.

As a virtual assistant, you can do anything, from the comfort of your own home and in front of the TV.

Read more about how to become a virtual assistant here.

100. Data Entry Clerk

If you love numbers and figures then a data clerk is for you. A data clerk would normally be given spreadsheets and asked to make sense of them. This could be about anything!

You may be asked to arrange the numbers in a spreadsheet or put them in a presentation. You may be asked to actually find the numbers and make the spreadsheet.

101. Dropshipping

Dropshipping is a great way to bring in money while at home. You can drop ship on loads of different sites which means that you have more ways to make money.

It has a very small outlay to start and you get what you put in time wise.

The biggest difference between dropshipping and a normal retail store is that no product is held by you which can be a plus when it comes to self-assessment.

Read more about how you can drop ship from home here.

102. Dropshipping

Dropshipping is a great way to bring in money while at home. You can drop ship on loads of different sites which means that you have more ways to make money.

It has a very small outlay to start and you get what you put in time wise.

The biggest difference between dropshipping and a normal retail store is that no product is held by you which can be a plus when it comes to self-assessment.

Read more about how you can drop ship from home here.

103. Watch videos and play games

Have a look at Swagbucks. Swagbucks is a fun and easy to use site that pays you to complete short online tasks in exchange for virtual money. This can then be swapped for real money or vouchers.

You can sign up for Swagbucks here and receive a few extra points.

The tasks can be random. Filling in polls, watching videos, and using it to search for products instead of Google is the norm.

The more you do the more earn as each task is paid differently.

This is a great site for those who want a quick task. We do them while waiting for the kids on the school run or while cooking dinner.

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.

Joleisa

Sunday 14th of April 2019

Meal planning for us has been one of our biggest money savers. It is so easy to just ignore what you already have and go buy more. But meal planning helps us to be intentional with what we have, including our money and other resources. Great post.

Catherine Keating

Monday 8th of April 2019

Think twice before you buy clothes, ask if you really do need this and will it match anything else in your wardrobe.

Anneka Avery

Wednesday 3rd of April 2019

What a fabulous post! I’ve learnt so much and found all of your points really helpful! Thank you!

Savings4SavvyMums

Monday 22nd of April 2019

Really hoped it helped x

Kayleigh Watkins

Monday 1st of April 2019

A great post with lots of very helpful tips xx

Savings4SavvyMums

Monday 22nd of April 2019

Thank you. That's very kind x

Savings4SavvyMums

Monday 22nd of April 2019

Thank you so much!

Chloe Taylor

Thursday 31st of January 2019

Have a look in charity shops for cheap clothes - you can often find premium brands and grab a bargain x