This is the easiest money saving challenge to follow

We all know that the cost of raising children is on the up, with it currently estimated at £230,000, many of us are drowning from month to month, with no emergency fund in case the worst happens.

This year we really want to give back and help all our readers save some money this year, so we are launching our 365 savings challenge. You don’t have to start in the New Year either, you can start at any time.

This is a great way to start saving money if you struggle to save.

If you prefer to save month by month then read our guide to the 30-day money saving challenge here and have a look at:

103 Frugal Living Tips That Will Save You Thousands in 2022 – This is our biggest post on how to save money. All these tips we use ourselves and can really save you thousands.

The Ultimate Guide to Food Shopping on a Budget – Struggling to save money on food? Then this is the best post for you. It walks you through exactly how to save hundreds off of your shopping bill.

101 Ways to Save Money on a Tight Budget – Struggling to save your family money? Then read our post here which walks you through exactly how to do it.

Money saving challenge

You’ll learn how to save your family money every month and hopefully, help you to build a nest egg to use to treat your family.

This free email course is run over 6 weeks, with 12 different lessons as follows:

Day 1: Laying the groundwork

Day 2: Create a budget

Day 3: Setting financial goals

Day 4: List debts and savings

Day 5: Reduce outgoings

Day 6: Saving money on annual spending

Day 7: Increasing your income

Day 8: Quick cash hits

Day 9: No-brainers

Day 10: Thinking outside the box

Day 11: Staying motivated

Day 12: Choosing the next steps

There are 2 lessons every week. Don’t worry if you can’t keep up every week. Just keep them in a folder and refer back when you’re ready.

(This is a FREE course. The cost of this course is nothing. Zero) That’s right, this course is 100% FREE.

Join our free six-week money saving course here.

What is the penny saving challenge?

The penny saving challenge is a way to save a small amount of money daily. In this case, it’s saving 1p less every day and at the end of the time frame you have a nice amount of savings.

You can save either in reverse, which is what we do, so the biggest amount is saved first then every day you save 1p less. For example, if you start with £3.65 on day 1, you’d then save £3.64 on day 2 and so on.

Some people do this for the whole year and save over £600 for Christmas. If you prefer a shorter goal then a 30-day challenge like this really helps to kick start your saving.

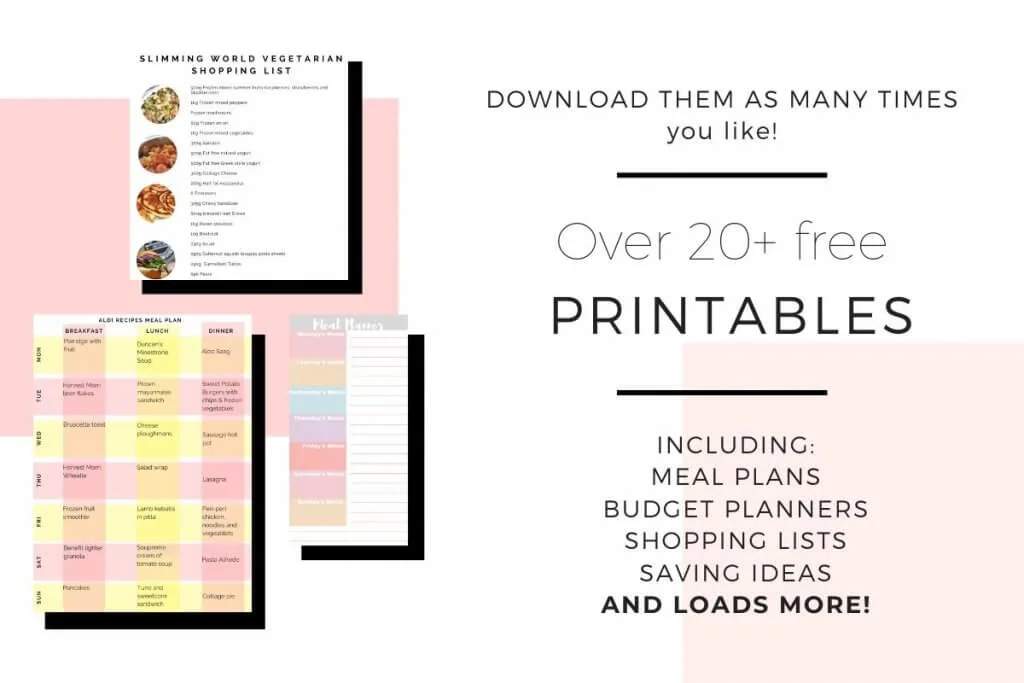

Free Money Saving Printables

Come join our free Resource Vault. It’s packed full of free money saving printables including the money saving challenge plus gives you access to our free Facebook group with dedicated daily tasks to help you save monthly. If you want to take part in the saving a penny a day challenge, track your savings plus meal plans, shopping lists, and a monthly budget planner.

Come join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

How does the penny saving challenge work?

You can start by saving just 1p a day. That may sound very little but it really does add up over 30-days or even a year.

Start by printing out either our 365 days money saving printable or 30-day printable. We prefer to start with the largest payment first and work backward, So for example, start at saving £3.65 on day one, the £3.64 on day two.

You can start the money saving challenge anytime. There’s no need to wait in till January. We normally start September time in till the end of November to help pay for December.

365 Day Money Saving Challenge

This 365 Day Money Saving Challenge is just that. It’s a way to help you save over £600. You don’t have to do a year saving challenge. We’ve also added a 30-day printable so if you’d prefer to give it a try then use that.

The great thing about this penny challenge is that you can either start saving with cash or via a free banking app that does it all for you.

If you decide to go down the cash route then make sure you have a pot to put the money into that you can’t get in very easily. We use this Pot of Dreams Holiday Fund Money Pot. It helps to have a goal when you are saving.*

We prefer to use free banking apps to help us save money. Our favorites so far are:

Plum – Plum is a free app that helps boosts your bank balance*. It’s the smartest app for managing your money. It analyses your spending patterns and automatically puts your money away for you, so you don’t have to think about it.

We use it to set our own saving goals so that every day some money comes out.

It’s a great way to forget you are saving as you don’t have to touch anything!

Download Plum for free here. It works on iPhones and Android*.

Read more about how Plum works here

Snoop – Snoop is a free app that, like Plum, helps you to manage your money. You can see all your bank accounts together, exactly where your money is being spent and gives you ideas on how you can save.

It gives you daily balance alerts, helps you to switch to suppliers that could save you money and monitors what’s going on in your account.

Download Snoop for free here. It works on iPhones and Android*.

Penny Saving Challenge Printables

Remember it’s easier to save money when you are tracking your progress. You our free 30-day money saving printable or 365 money saving printable to start saving money.

Join our free Resource Vault[ here to get access to our printables

How to save money with the penny saving challenge?

If you feel like you have no money spare then it’s time to start getting to grips with your finances.

Read more about how you can stop spending money and start saving money:

How to Stop Spending Money Right Now

25 of the Best Ways To Save Money In The UK Right Now

Money Saver: This is How we Saved Over One Thousands Pounds in a Year

Our top tips to help you have money to save are:

- Set a financial goal

No matter what your goal is, having a goal will help you to stay on track. Get the family involved in the money saving challenge too. Everyone gets to tick off the day.

- Start to budget

Know exactly what comes in and out of your account. You can do this by using a simple spreadsheet or one of the free money saving apps like Plum or Snoop will do it for you.

This is the best way to know exactly what you have and how much you can save.

- Reduce your outgoings

This could be anything from not having that coffee at Starbucks to walking one day extra a week to save fuel money. The great thing about this money saving challenge, especially if you do it in reverse is that the first few days are the hardest, after that, it gets a lot easier as the amount you need to save keeps getting lower.

- Leave Your Money at the Door

It’s pretty simple. When you go out leave your cash and cards at home as you can’t spend.

- Think about what It Costs in Real-Time

Before you buy, have a quick think about how many hours you’ve had to work for it. That normally stops us in our tracks!

6. Use cash back sites

Every time you buy online you could be getting cashback. Have a look at:

OhMyDosh is a cashback website that you can use every time you are shopping online. They offer a range of cashback offers so make sure you always check the site before you buy.

Join OhMyDosh here using our link and get £1 added to your account for free*

Read more about how OhMyDosh works here

Related Posts:

- £18 a Week Food Budget Shopping List UK

- The 7 Best Budgeting Apps in the UK Right Now

- Living With Less: Sorting Your Home Finances When You Are Living With Less

7. Meal plan

You can make your own weekly meal plan or download my meal plans and shopping lists for free from the Resource Vault.

Having several copies on hand will help inspire you to get started and keep up the meal plans for several weeks.

Before you know it, meal planning will become a natural part of your routine.

If you are struggling to meal plan then have a look at:

The Ultimate £1 Per Head Budget Meal Planning List

One Month of Family Meal Ideas on a Budget

21 Cheap Meals for a Week for a Family

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.