We all have times in our lives when we find saving really hard. We all know that we need to save money for a rainy day or an emergency.

There are loads of ways you can set money aside and here we talk you through how to do it with Plum.

What is Plum and how does it work?

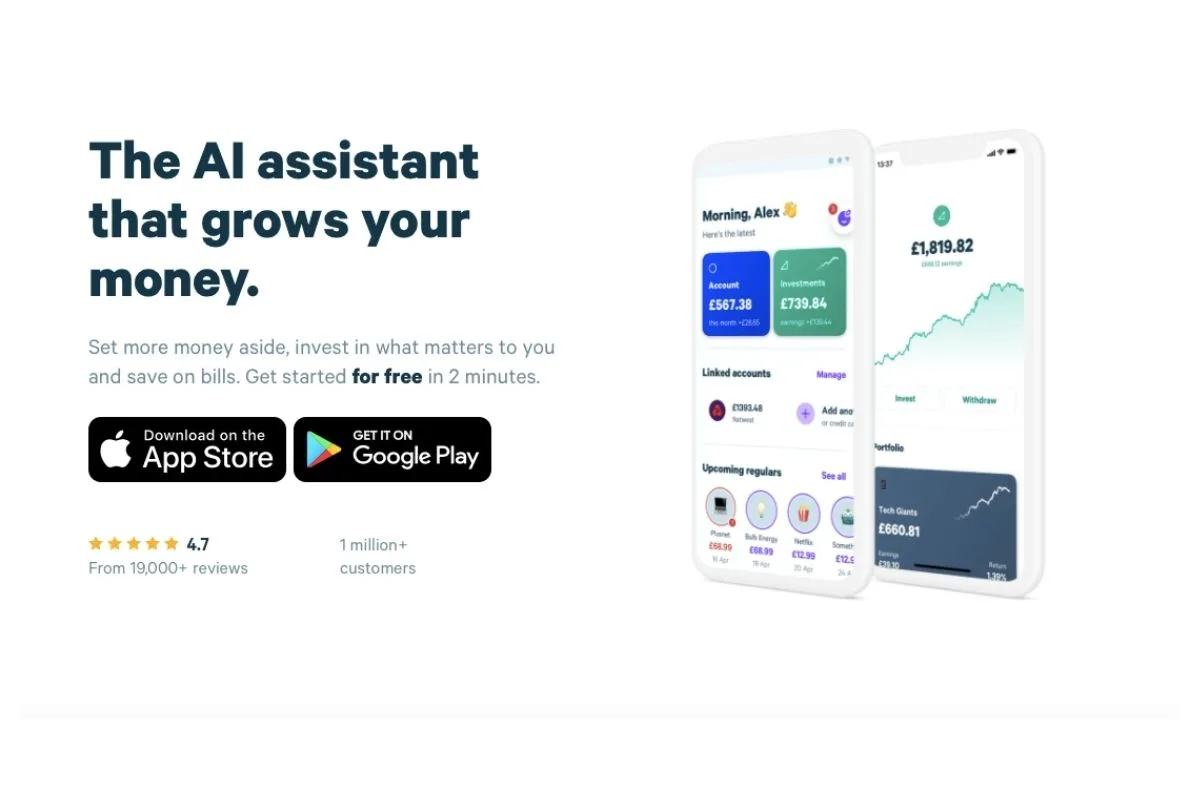

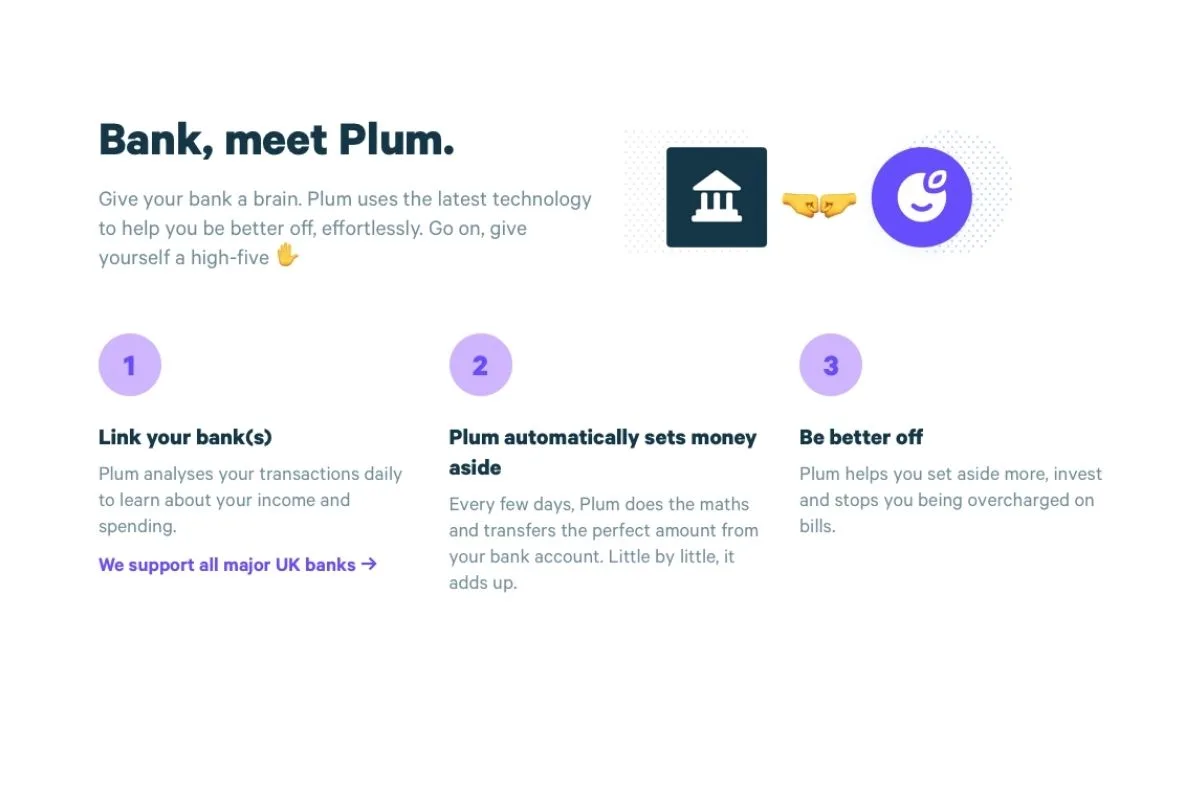

Plum is a free app that helps boosts your bank balance*. It’s the smartest app for managing your money. It analyses your spending patterns and automatically puts your money away for you, so you don’t have to think about it.

It takes all the pressure off you having to do anything. By using a smart AI app, you can get a better grip of your finances and set more aside.

Plum works by linking all your bank accounts and analyses your ingoings and outgoings. You still have complete control though over your money. You tell Plum how much you aim to set aside and it will do it over time. If you are unsure, then let Plum work its magic and work out how much you can afford to put away.

It all runs through the Plum app, which can be downloaded for free with either an Android or Apple phone.

Via the app, it’s pretty easy to get a clear view of your finances quickly. If you ever feel out of control then Plum can give you a total overview of your finances at the touch of a button.

Download Plum for free here. It works on iPhones and Android*.

Free Printables to Save Money

If you are looking to save money for your family then come join our free Resource Vault. It’s packed full of ideas on how to save money as a family including meal plans, shopping lists and budget planners. You can download them as many times as you like.

Join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

Have to build an emergency money pot easily with Plum

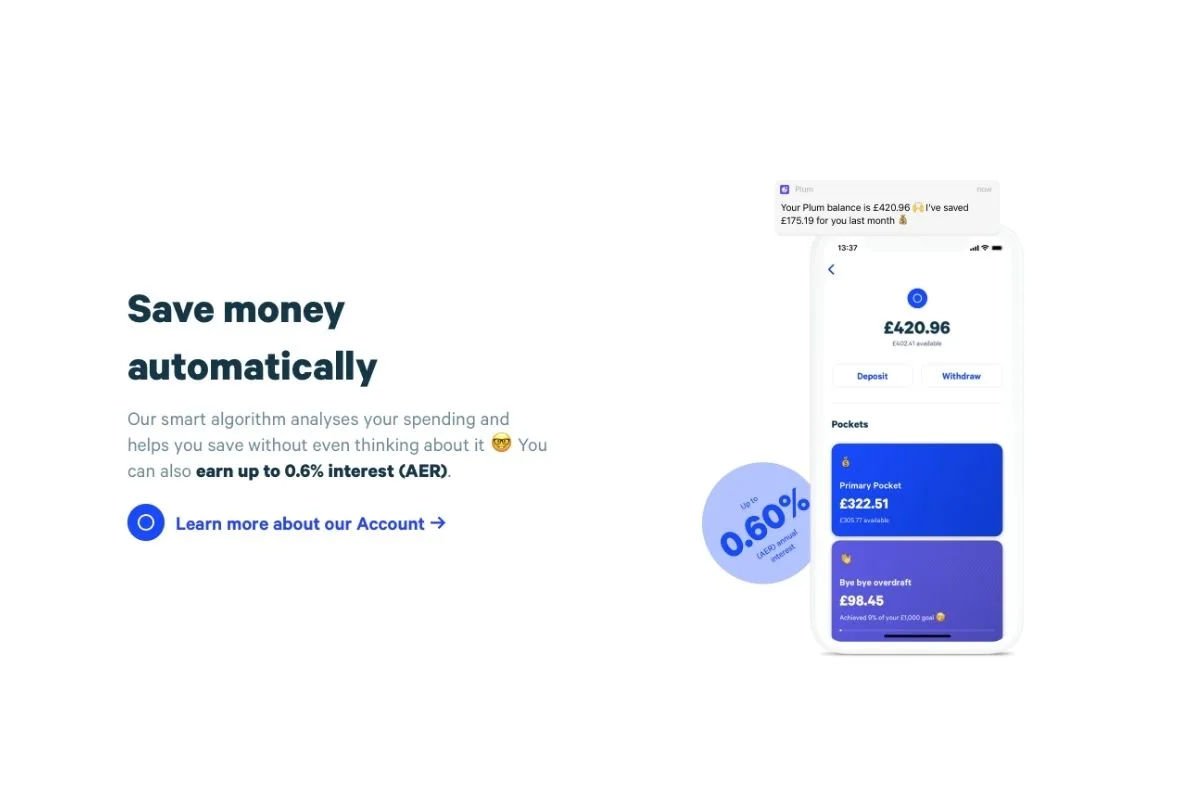

What we love best about Plum is that it keeps track of your money for you. You can adjust how much you want to squirrel away and withdraw your money or move it at any time.

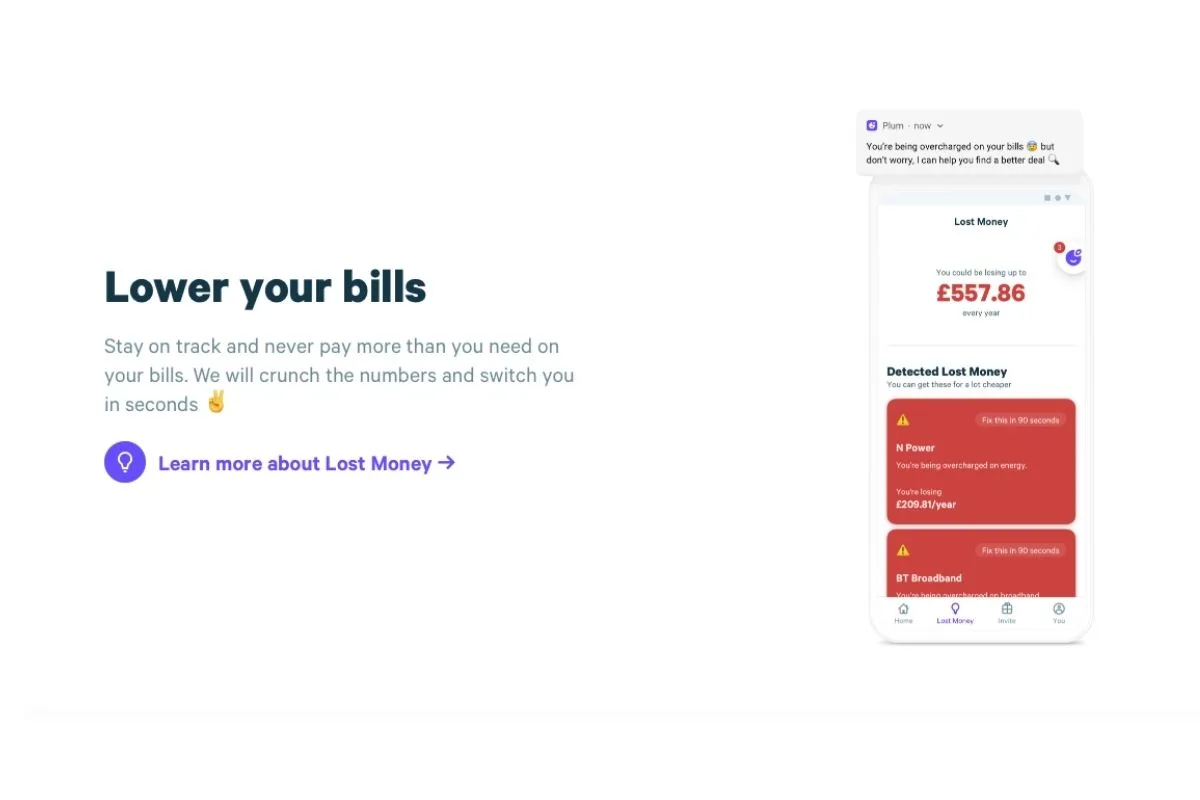

Plum helps you to identify if you’re overpaying on bills and can switch you to a better supplier quickly, helping you save money.

You don’t earn any interest with the free version of Plum but you’ll be surprised how quickly your funds go up.

How much money can you set aside?

We all have different lifestyles and ingoings and outgoings but with Plum, you can really save stash away a good amount. With the offset of changing utility tariffs, while making sure you aren’t overpaying on your bills, and moving any spare money you have, you should be able to see a raise in your piggy bank quite quickly.

Plum uses an Electronic Money Provider to set up and administer an E-Wallet for you. This means that their e-money partner hold the money for you. All your money is protected by the E-Money Safeguarding Rules.

That means that if anything was to happen to Plum or their provider, then you can claim your money back. They are also regulated by the Financial Conduct Authority.

Download Plum for free here. It works on iPhones and Android*.

What do you need to get started?

To get started with Plum you need a current account that you can link to Plum. That way, it can fully analyze your spending happens patterns and starts setting money aside.

You will then allow Plum to set up a direct debit to your linked account. This might not happen straight away as it goes through your bank and can take up to five working days.

Plum looks at your funds over a ninety-day period so that it gets a real view of what day to day life is like. It gives you your most up-to-date financial information so you know exactly what’s going on at all times.

You get notified about all your automatic deposits. You can see how much you have in your account by tapping into your Plum Account.

Related Posts:

- 101 Frugal Living Tips That Will Save You Thousands in 2020

- This is What You Do When You Really Have No Money To Feed your Family

- How to Get a Free Holiday

Plum Review

We used Plum for over a year now as a family. We find it an easy to use app.

The fact that it sets money aside is great for us and really works if you have a different amount left over every month as we do. A standard direct debit just wasn’t flexible enough for us.

The Plum account settings are easy to manage and change as you go. You never have to feel out of control. It did feel a bit weird letting a machine take money automatically the first time, but we soon got used to it, especially as, on our bank statements it states “Plum” clearly so we know where the money is.

We started by setting Plum up to only take a small amount per month then slowly upped it as we felt more comfortable. Watching our pot grow was a real motivator for us and kept us on the straight and narrow so to speak.

We recommend it to anyone who struggles to save regularly. It takes the hassle out of remembering to move the money.

The fact that it helps us to save money on our bills is just a bonus to us as well. Even if we don’t take up their recommendations, it reminds us to do our own research and switch.

Download Plum for free here. It works on iPhones and Android*.

Laura x

If you enjoyed this post and would like some more family friendly money managing ideas, then head over to the managing money section here on Savings 4 Savvy Mums where you’ll find over 30 blog posts dedicated to helping you manage your family’s finance. There’s enough tips to help you save over £300 a month! You could also pop over and follow my managing money Pinterest boards for lots more ideas on how to keep more of your money in your pocket: Managing Money Printables, Managing Money for Families and Family Finance.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.