Is using AI the best way to save?

We all have times in our lives when we find saving really hard. We all know that we need to save money for a rainy day or an emergency.

There are loads of ways you can set money aside and here we talk you through how to do it with Plum.

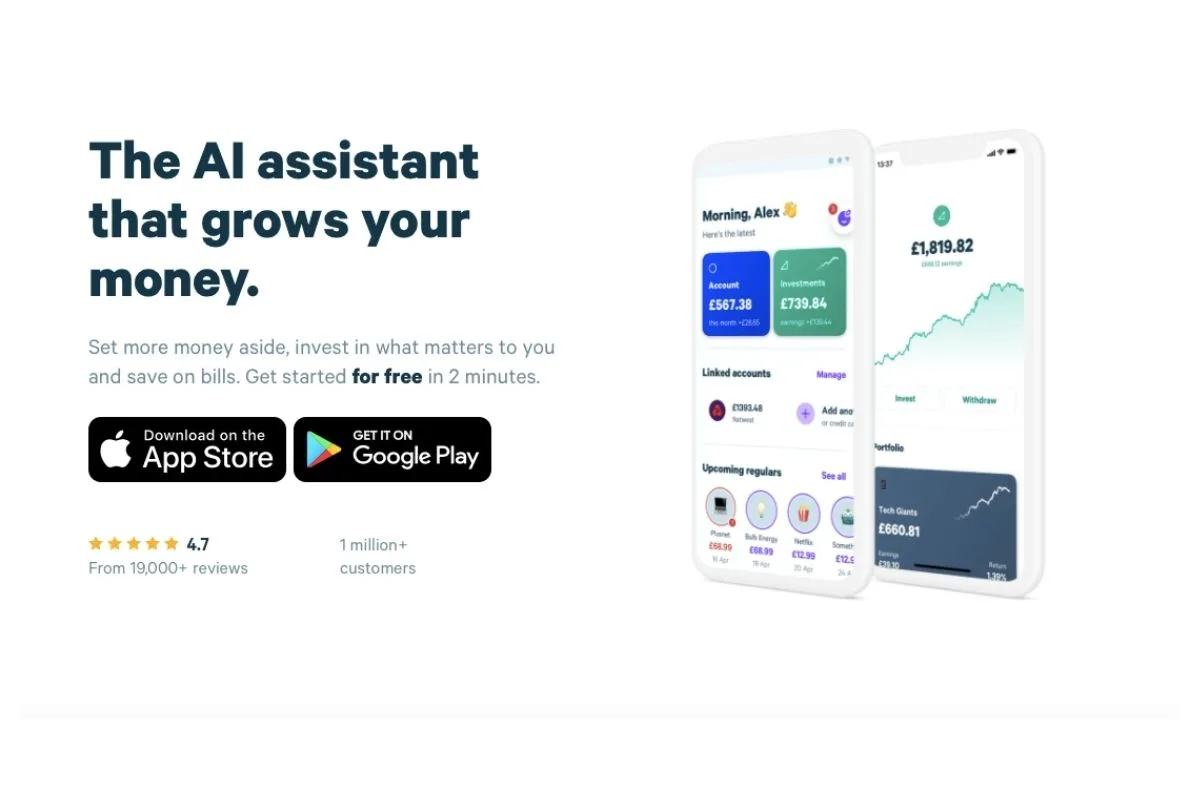

Plum is a smart savings app that is designed to help users like you and me effortlessly grow their money. In this blog post, we’ll explore the key features and benefits of the Plum app, equipping you with the knowledge to determine if Plum is the right savings solution for you.

If you are looking to save money as a family then have a look at:

103 Frugal Living Tips That Will Save You Thousands – These are what we do as a family every single day to save money. Some may be small things like remembering to turn the lights off or not flushing the toilet until later on, but they all add up.

93 Ways to Save Energy at Home – Saving money on your energy bill is possible! Use our list here to help you make the small changes that can make a big impact on your bill.

How to Get Out of Your Overdraft – If you are stuck in your overdraft then use our tips here which are a mixture of saving money and making money. All these tips we do ourselves as a family.

6-Week Money Saving Challenge

If you’re struggling to save money then why not join our FREE money saving course that takes you step by step through saving money as a family. All simple steps to help you build an emergency fund or save towards that mega holiday.

Join our FREE Money Saving Course here and I can’t wait to see how I can help you!

This is the perfect time to improve your finances.

With this free email course, we cover everything from setting financial goals to ways to earn some extra money in your free time. Over the next 6-weeks, you will receive an email that will help you save your family more money.

Come Join us now and watch your savings grow.

What is Plum and how does it work?

Plum is a free app that helps boosts your bank balance*. It’s the smartest app for managing your money. It analyses your spending patterns and automatically puts your money away for you, so you don’t have to think about it.

It takes all the pressure off you having to do anything. By using a smart AI app, you can get a better grip of your finances and set more aside.

Plum works by linking all your bank accounts and credit cards then analyses your ingoings and outgoings. You still have complete control though over your money. You tell Plum how much you aim to set aside and it will do it over time. If you are unsure, then let Plum work its magic and work out how much you can afford to put away.

It all runs through the Plum app, which can be downloaded for free with either an Android or Apple phone.

Via the app, it’s pretty easy to get a clear view of your finances quickly. If you ever feel out of control then Plum can give you a total overview of your finances at the touch of a button.

Download Plum for free here. It works on iPhones and Android*.

Have to build an emergency money pot easily with Plum

What we love best about Plum is that it keeps track of your money for you. You can adjust how much you want to squirrel away and withdraw your money or move it at any time. Because Plum has access to your linked bank accounts, it can help you put money away without you even knowing that you are saving.

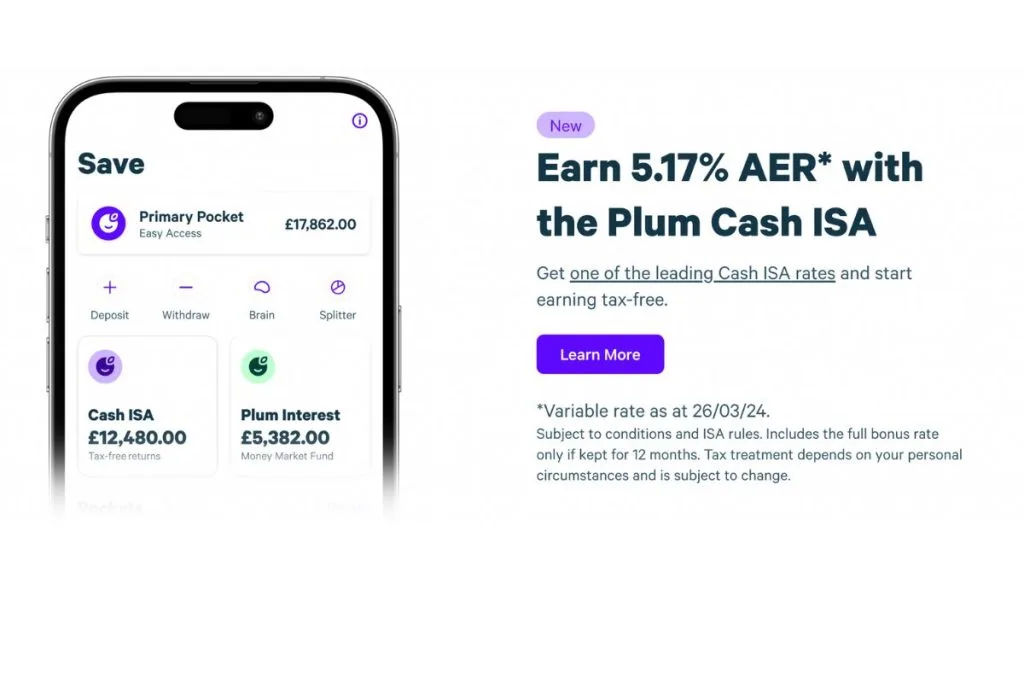

This money can be put into an easy access interest account or a cash ISA so you can start to earn interest on it or it can go into an investment account or a shares ISA. (Please remember that anything invested is at risk and there are always pros and cons to investing. Please do your own research first!)

Plum helps you to identify if you’re overpaying on bills and can switch you to a better supplier quickly, helping you save money.

You don’t earn any interest with the free version of Plum but you’ll be surprised how quickly your funds go up.

How much money can you set aside?

We all have different lifestyles and ingoings and outgoings but with Plum, you can really save stash away a good amount. With the offset of changing utility tariffs, while making sure you aren’t overpaying on your bills, and moving any spare money you have, you should be able to see a raise in your piggy bank quite quickly.

Plum uses an Electronic Money Provider to set up and administer an E-Wallet for you. This means that their e-money partner hold the money for you. All your money is protected by the E-Money Safeguarding Rules.

That means that if anything was to happen to Plum or their provider, then you can claim your money back. They are also regulated by the Financial Conduct Authority.

Download Plum for free here. It works on iPhones and Android*.

Account types in Plum

Plum has a few account options depending on what you are looking for.

Stocks & Shares ISA – With this account you can save up to £20,000 a year which is tax free. Remember that it runs from April to April though so if you have one open elsewhere and paid money in then you need to wait till the next April.

General Investment Account – This is the standard account and most common. With this account you do pay tax on anything over £3,000 if you decide to sell up. Please check with HMRC as this could come under Capital Gains Tax, Income Tax and Dividend Tax.

Personal pension account – This is a great idea if you are self-employed or looking to save extra on top of your workplace scheme. With this though, you can not take the money out until you reach 55.

Like all investments, please do seek professional advice first before you invest any money.

What do you need to get started?

To get started with Plum you need a current account that you can link to Plum. That way, it can fully analyze your spending happens patterns and starts setting money aside.

You will then allow Plum to set up a direct debit to your linked account. This might not happen straight away as it goes through your bank and can take up to five working days.

Plum looks at your funds over a ninety-day period so that it gets a real view of what day to day life is like. It gives you your most up-to-date financial information so you know exactly what’s going on at all times.

You get notified about all your automatic deposits. You can see how much you have in your account by tapping into your Plum Account.

Is Plum safe to use?

Yes, Plum is safe as they are regulated by the Financial Services Authority so your money is safe, just like a normal high street bank.

They have over 6,000 reviews on Trustpilot which is pretty good, as Plum has only been around for the past 6 years or so.

How much is Plum to use?

Plum has a couple of different levels depending on what you are looking to do. We would reccomend you start with the £2.99 plan as it means the app will do everything for you like invest any spare money you have and set goals.

The differences are:

– Free plan: With the free plan you can make your own investments, make 2 pockets or 2 seperate accounts and get automated deposits.

– Pro plan which is £2.99 a month: This means you can get automated deposits, a spend tracker, and up to 15 new pockets.

– Ultra plan which is £4.99 per month: This is the most popular plan that Plum do. This offers everything above plus fund investing with £1, set financial goals and get Plum card you can use in shops.

– Premium for £9.99 per month: You get everythign above plus 4.70% AER on your savings and more access to investments.

Please remember that there is investment fees with Plum called a Fund Management Fee. This is a fee that manages your investment. You will pay this every time you invest.

Read more here on the Plum website about fees and investing.

Plum Review

We used Plum for over a year now as a family. We find it an easy to use app.

The fact that it sets money aside is great for us and really works if you have a different amount left over every month as we do. A standard direct debit just wasn’t flexible enough for us.

The Plum account settings are easy to manage and change as you go. You never have to feel out of control. It did feel a bit weird letting a machine take money automatically the first time, but we soon got used to it, especially as, on our bank statements it states “Plum” clearly so we know where the money is.

We started by setting Plum up to only take a small amount per month then slowly upped it as we felt more comfortable. Watching our pot grow was a real motivator for us and kept us on the straight and narrow so to speak.

We recommend it to anyone who struggles to save regularly. It takes the hassle out of remembering to move the money.

The fact that it helps us to save money on our bills is just a bonus to us as well. Even if we don’t take up their recommendations, it reminds us to do our own research and switch.

Download Plum for free here. It works on iPhones and Android*.

The customer service is really good. They have a live chat feature which gets you talking to a real person really fast if you have an issue. They don’t have a telephone number you can call but are happy to email you if needed.

We like Plum as it’s great for beginners who want to invest and save money. If you are lookign for something more for your pension then someone like PensionBee may be better to talk too.

Overall it’s a great app to use and can help you save money on a regular basis.

Laura x

If you enjoyed this post and would like some more family friendly money managing ideas, then head over to the managing money section here on Savings 4 Savvy Mums where you’ll find over 30 blog posts dedicated to helping you manage your family’s finance. There’s enough tips to help you save over £300 a month! You could also pop over and follow my managing money Pinterest boards for lots more ideas on how to keep more of your money in your pocket: Managing Money Printables, Managing Money for Families and Family Finance.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.