This is how Snoop could help you save up to £1500

Snoop is a personal finance app that aims to help users better manage their money. In this blog post, we’ll take a closer look at the app’s features, benefits, and whether it’s worth considering for your financial needs.

If you are looking to try and manage your money then a money management app may be for you. Knowing what is coming in and out of your account is vital when it comes to your personal finances.

There are loads of ways to control your budget including using Excel or even a pen and paper. Using a money management app like Snoop means that all your accounts are in one place and you can overview your finances in seconds.

Snoop is free to use and you can download it here for free on your Apple or Android phone*.

If you are looking for more budgeting help then have a look at:

How to Stop Spending Money Right Now – This is our biggest post on how to stop spending money as a family and how to start saving money.

Penny Saving Challenge: Save Over £600 in a Year – We use the penny challenge as a way to save money and it really adds up.

25 of the Best Ways To Save Money In The UK Right Now – These are really simple ways that you can save money as a family.

Free Money Saving Printables

If you are looking for ways to save money as a family or learn how to budget then come join our free Resource Vault. It’s packed full of 20+ downloadable and printable resources that can help you save every day.

Join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

What is the Snoop app?

Snoop is a free money management app that was created to help you manage and save money. Snoop wants to help you make smarter choices and get on top of your money.

You can download the Snoop app onto your Android or Apple device for free*.

Snoop’s key features include automated transaction categorisation, personalised spending insights, and bill tracking capabilities. The app connects to your current accounts and credit cards to provide a view of your finances, making it easier to stay on top of your budgeting and savings goals.

One of the standout aspects of Snoop is its user-friendly interface, which shows you your financial information in a clear and digestible manner. The app’s AI-powered analysis provides tailored recommendations to help you identify areas for improvement in your spending habits.

So for example, it might suggest deals for your travel insurance or pet insurance.

Is the Snoop app safe?

Yes, Snoop is safe. The Snoop app connects through Open Banking which means all your accounts can be shown through the one app.

Snoop are regulated by the Financial Conduct Authority which means that your money is completely safe. They don’t ask for your bank passwords or login details and they have the same standards as your well-known high street bank.

it only takes 3 minutes to set up and is a great way to manage your money.

How does snoop work?

Snoop works by connecting all your bank accounts through Open Banking. This means that you can see all your accounts, even with different banks, all in one place.

A great feature that they have is that they also offer you money-saving tips and ways you can cut your bills by offering you switching opportunities. This saves you from having to look around yourself and making sure you are on the best deal.

Snoop can have a look at your energy bill, broadband and even your mobile phone bill and suggest ways you can save.

You can download the Snoop app onto your Android or Apple device for free.

Because Snoop uses Open Banking, they can connect to all the retail banks so all your accounts are in one place.

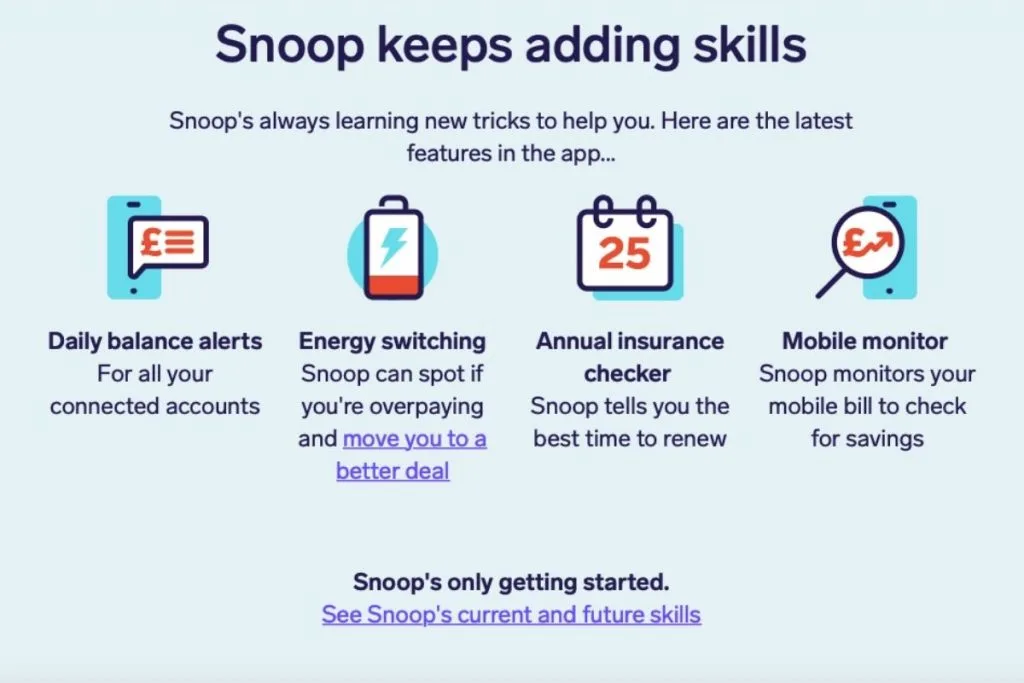

Some of our favourite features are that snoop can:

- Give you daily balance alerts for all your connected accounts. This means that you know exactly how much money is in each account.

- Snoop spots when you are overpaying on your energy bills and will help to suggest a switch to a new provider.

- If you forgot when your annual bills come out, like insurance then Snoop will help remind you when the best time to renew is.

- Snoop helps to keep track of your mobile phone bill so you aren’t overpaying and may suggest a new tariff.

Snoop product features

The Snoop app could help you save up to £1500 by using a mixture of different ways to save money unique to that user.

You can download the Snoop app onto your Android or Apple device for free.

No two apps will show the same details.

The money dashboard is there to help you manage your savings and spending.

The Spending Sorter is a great way to quickly see what is going on with your account. This is an overview of what you are spending and the first step to how you could possibly save money.

Keep track of all your bills and payments using Payment Hub. You can see everything from which bills have been paid to which bills you have coming up. You can link any of these to Snoop so that it can search for the very best deal for you. If you add when your renewal or contract dates are up then Snoop will remind you of the best time to start renewing too.

One the best features we like is the Discount Finder. Snoop gives you voucher codes for places that it thinks you will visit based on your past history. Helping you save money before you go anywhere.

Before you switch, check out the Snoop app. It keeps an eye on your energy bills and warns you if and when they raise. This not only helps you to keep track of your money but also helps you to decide when it’s time to switch. We made a big saving here ourselves as Snoop noticed that we were overpaying on our energy bill.

We like the Daily Account Alerts the most. They give you a quick daily summary of what your accounts looks like.

The Money Saving Scanner is quite a good tool. It pulls through all the latest offers including any sales straight to the app.

Broadband Checker helps to save you money by making sure you aren’t overpaying. Snoop can help you switch if you are. This is the same for the mobile contract too.

The Card Checker is a handy tool. It looks over your cards daily and checks if you are paying any charges you shouldn’t be or if you are missing out on rewards you should be getting.

Insurance Checker is great if you haven’t renewed your annual bills in a while. Getting the best price can be time-consuming so Snoop helps to remind you in enough time when to renew.

Look Ahead is one of our favourite features as it shows you what bills are due to go out that week. It’s just a really easy way to make sure that we have enough money in our accounts for what is due. It’s saved me going over my overdraft quite a few times.

Related Posts:

- Plum Review – This Is How It Can Help You Grow and Manage Your Money Effortlessly

- Penny Saving Challenge: Save Over £600 in a Year

- The Best Way To Save For a House

What is Snoop Plus?

Snoop Plus is £4.99 a month and gives you extra features within the app. These features include:

– Tracking your spending from pay day to pay day and giving you tips to help you with your money.

– You can set as many custom categories as you like. So for example, we have meals out, days out etc so we know how much we are spending.

– You can create unlimited spending alerts.

– Add offline accounts.

– Create as many custom spending reports as you like.

– Track your total net worth.

Do I need Snoop Plus?

We used it for a full year and did find it helpful and intuitive. It helped keep our budget on track when money was really tight and helped us to figure out where our money was going.

Snoop Review: Our Opinion

We love the Snoop app as we are technology driven. For anyone that likes to see all their accounts in one place and for a ready-made budget then Snoop works.

Snoop is free to use and you can download it here for free on your Apple or Android phone*.

If you prefer paper and pen or Excel then the Snoop app may be too much for you as they offer so many different sides to the app it can be a little hard to navigate around in till you are used to it.

If you find Snoop a bit too much then have a look at Plum which offers open banking but with less notifications. Read about what we think about Plum here.

We love having all our accounts in one place as it’s really easy to see what is going on at a glance. Open Banking really has come a long way since the start and it’s exciting to know that this is just the start.

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.