Including how to save for a house on a low income

Saving for a house as a first time buyer or even as a seasoned home buyer, isn’t easy.

In this post, we run through all our very best money saving tips that can help you to save for a house.

If this is your first home then a few things to think about are:

- Is the mortgage that you are applying for the right one for you? Can you afford the monthly repayments? Is it going to be a struggle? Do you have any breathing room if something goes wrong with your job?

- How big is your deposit? Do you have enough to lower the interest rate on the mortgage enough to help you to be able to afford your new home? Have you looked at any government-backed schemes to help you get your foot on the property ladder?

- Check what your chances are of getting a mortgage. What is your credit score like? Do you have a good income stream that you can prove? Do you have a big enough deposit?

- What kind of mortgage is best for you? Are you thinking of a repayment mortgage or an interest-only? An interest-only mortgage is when you only pay off the interest which still leaves you the capital, as in the remaining mortgage amount to pay. A repayment mortgage is when you pay off a little bit of the capital and the interest at the same time.

- Remember to include any fees into your budget. This could be mortgage fees, lawyers and any stamp duty fees.

- It can take ages to buy a house so make sure that you have funds to cover any rental gap or anything else that may come your way.

- Check the mortgage rates by using a broker. They will find you the best rates with the deposit you have. They then take commission off the package you choose so you don’t pay a penny.

- Remember that when you are applying for a mortgage that all your outgoings are taken into consideration. That includes any car finance, phone bills and your food shop.

If you are looking for more ways to save money as a family, have a look at:

101 Frugal Living Tips That Will Save You Thousands – This runs through all our best money saving tips that you can use to save your family money. Nothing is off limits!

How to Stop Spending Money Right Now – This post goes into how you can stop spending money and get on top of your finances.

How to save for a house on a low income

Saving money, regardless of your income isn’t easy. As first time buyers, you may feel a bit overwhelmed with how much money you are spending. Money worries are the worst! Please don’t let it get out of control.

Have a savings plan in place before you do anything.

Have a chat with the whole family

Sit everyone down and get the whole family on board. You can’t start saving without the whole family invested and helping out.

Start a budget

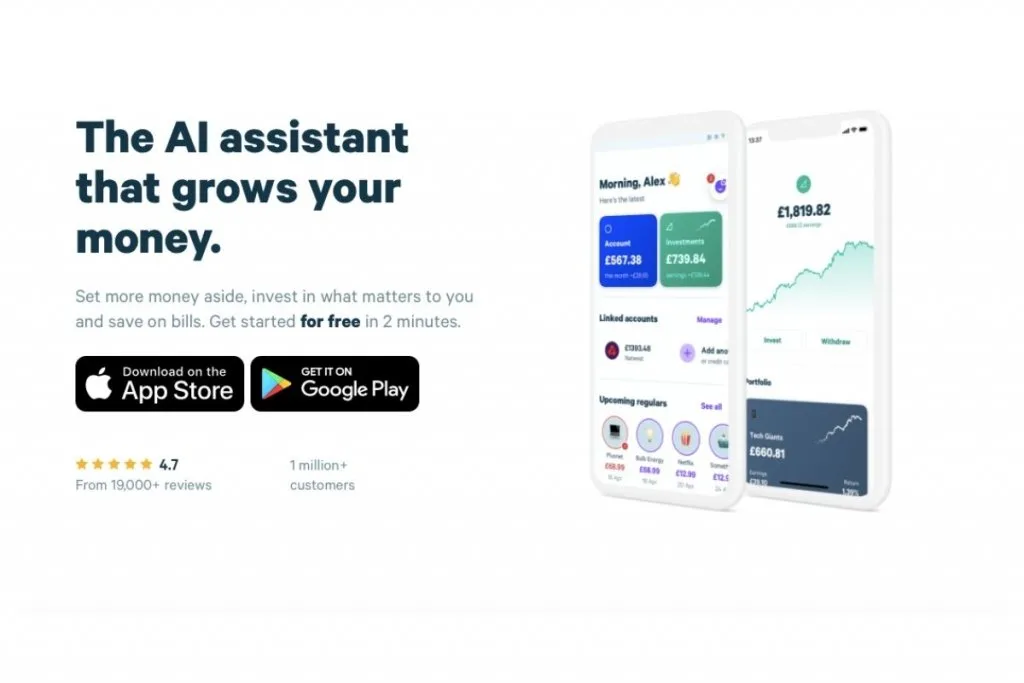

Moving home is expensive and keeping track of how much you need to save as well as how much you are spending now is really important. You can use a simple spreadsheet-like our one in our Resource Vault or use an app like Plum that is also free to use.

Plum tracks your money for you while giving you helpful suggestions on how you can save more as a family.

Read more about how Plum works here.

Sign up to Plum for free using our link here*

We’ve also used Snoop as well. Snoop is another great app that can help you save your money and shows you clearly were your money is going.

Sign up to Snoop here for free using our link*

Create financial goals

This is really important when you have a huge financial goal to reach. Start small but celebrate when you reach your financial goals. We use a payment plan to hit our goals. That does mean that we sometimes have to miss out of doing something fun, but when you have a big goal, you havr to work hard to achieve it.

Use money saving challenges

If you find it hard to save then use money-saving challenges to help. We use the 1p penny challenge that you can read about here. It starts by you saving £3.65 for the first day then reducing it by a penny every day. By the end of the year, you have over £600. That’s just one way to save!

Read more about how the money saving challenge works here

Go through your bills

This may seem simple but it’s so important when you are trying to save a big amount of money to go through your current bills and start to cut them down.

Make sure you look and compare your energy bills using websites like Money Super Market to make sure that you are getting the very best price.

Move to a water meter

You may be surprised but having a water meter really can save you money. It tracks how much you use and that’s how much you pay.

Switch bank accounts

Make sure that your money is working for you. This includes your current and saving account. Look around for the best deals and see which one others you the best interest to switch.

Do you need it?

Before you buy, ask yourself if you really need that item. If you do then go for it. If not, then that money could go towards your new home.

Have a clear-out

If you haven’t touched an item in six-months then why not sell it? You can sell it on eBay or even on Vinted for free. Every pound is extra towards your home deposit.

Loose change

We all have loose change in our wallets or coat pockets. Clear it out and add it to your saving sum.

Best way to save for a house deposit

If you are saving for that all-important house deposit then these next tips are for you. These can get you off the starting blocks and really get you saving for that first home.

Check your council tax band

Are you on the right band for your current home? Make sure you research it as it could mean a rebait for you.

Credit cards

If you have credit cards then make sure that you are paying these off first. The interest on credit cards far outweighs the saving amount.

Haggle

Make sure that you haggle for everything. This includes your car insurance, home insurance or anything that you need to compare the cost for. Don’t be scared. What’s the worst that can happen? You don’t even have to do it over the phone either many companies have a chatbox too.

Read how we sort our home insurance quote out here

Use your store points

If you’ve been using your Clubcard points or any other loyalty card points then it may be time to use them as you are saving. Use them to get some money off your weekly shop or even on any days out you have planned.

Tax rebates

Do you wear a uniform to work? Then you may be able to claim up to £74 back. Also, check if you are due any extra benefits from childcare help to tax credits.

Life insurance

Make sure that you check that you have the best life insurance plan for you and your family. Check through what you are paying for. If you are going for a new mortgage then this is a great time to start looking around and switching.

How to save for a mortgage while renting

It is really hard to save money while you are renting as you still have a very big outlay in rent. Use our tips here to save money:

Meal planning

Meal planning and shopping carefully can easily save you money. For us, it was over £50 a week for the four of us. Start by writing down what you plan to eat for the whole week then make a shopping list that.

This should be your only shop of the week.

If you struggle to fill up a 7-day meal plan or come up with budget-friendly family food then have a look at:

The Ultimate £1 Per Head Budget Meal Planning List – This post includes everything you need to plan your weekly food. Pick out of our amazing £1 menu to fill up your meal plan.

Feeding a Family on a Budget: This Weekly Shop is Just £18 – This gives you a meal plan and shopping list that you can use. This isn’t to be used every week but can be used on those weeks that you are struggling with money.

101 Aldi Recipes That Will Give You Dinner Ideas For Tonight – Use this if you plan on shopping at our favorite discounter. This gives you over 100 family-friendly meals that you can cook that will also save you money in the longer term.

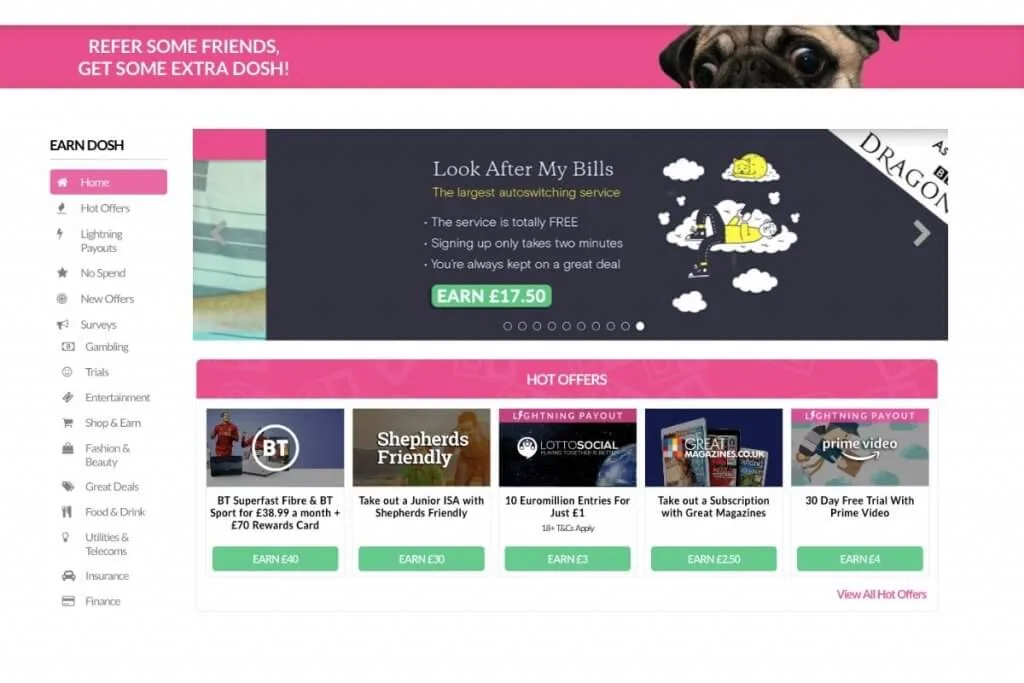

Use cashback sites

Using cashback sites can give you extra money back when you buy anything online. It’s really simple to do and you get money back for buying what you were going to buy anyway.

Our favourite cashback site is OhMyDosh. OhMyDosh is a cashback site that you buy through. This means that you sign into OhMyDosh then pick the retailer. You then click on the link and buy like normal. They then register that and pay you the cashback amount within the set terms.

Join OhMyDosh for free here using our link and they’ll add £1 to your account for free*

Read more about how OhMyDosh works here

Save energy at home

Doing simple things like turning your lights off and turning your heating down 2 degrees can really help you save money.

Read more about how to save money off your energy bills here.

Best account to save for a house

When you start to save, you’ll need somewhere to put your money. Here, we have rounded up our favourite savings accounts that can help you to earn interest as you save.

Try to keep your mortgage deposit in another account so you don’t get tempted to touch it.

Having a regular savings account means that any money you add to the account will earn you interest. While a normal current account gives you options of a debit card and other features, a savings account is there only to help you earn interest on what you have saved.

Lifetime ISA (LISA)

If you are aged between 18 and 39 then a LISA is for you. The government tops it up by 25%. This is for first-time buyers only.

Help to Save scheme

This is government-backed savings account that is for low-income workers. You can save anything between £1 and £50 a month and you don’t have to save anything every month either. You can pick an account that lasts either two years or four years and you get a 50% bonus at the end. What we like the most is that you can withdraw the money at any time so it isn’t tied up.

Related Posts:

- The 7 Best Budgeting Apps in the UK Right Now

- 93 Ways to Save Energy at Home

- How to Get Out of Your Overdraft

ISA

Setting up an ISA means that you won’t get charged for your savings. Choosing the right ISA just means making sure that you’ll be getting the highest interest rate you can and if you can afford to leave your money in there without touching it.

Make sure that wherever you choose to put your money that the bank are regulated by the Financial Conduct Authority.

Make sure you check the rate on the savings account first as these really can differ.

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.