Including how to budget and save money on a small income

We have the best money saving tips when you are on a tight budget. Saving money while supporting a family is really hard but we are here to help make it a little bit easier.

The hard part is knowing where to start and find out what savings you can make RIGHT NOW to keep more money in your pocket.

This post walks you through exactly how to save money on a tight budget and how to keep more money in your pocket.

How to live on a budget and save money

The first step is to learn how to budget. If you feel like you and your family know how to budget then please move on to the next section.

To start budgeting, you need to know what is going in and out of your bank accounts.

You can track this in two ways. You can either use an Excel spreadsheet from our free Resource Vault and add in your wages and your outgoings, so any bills that come out of that. Add everything. Go through your account. Be honest with yourself as getting a true picture of what you are spending is the first step to taking back control.

If you prefer to do this on your phone then try Snoop or Plum. Both of them are free to use. They use open banking which means that they can see your bank account information and give you tips on the best ways to save money.

Read more about how Snoop works here.

Read more about how Plum works here.

Once you know what is going in and out every month it’s time to decide what can go and what needs to stay. This is where our ways of saving money come in below to help you decide what can be taken off.

Make sure you have a look at our other money-saving posts for families here:

103 Frugal Living Tips That Will Save You Thousands in 2021

The 7 Best Budgeting Apps in the UK Right Now

How to Get Out of Your Overdraft

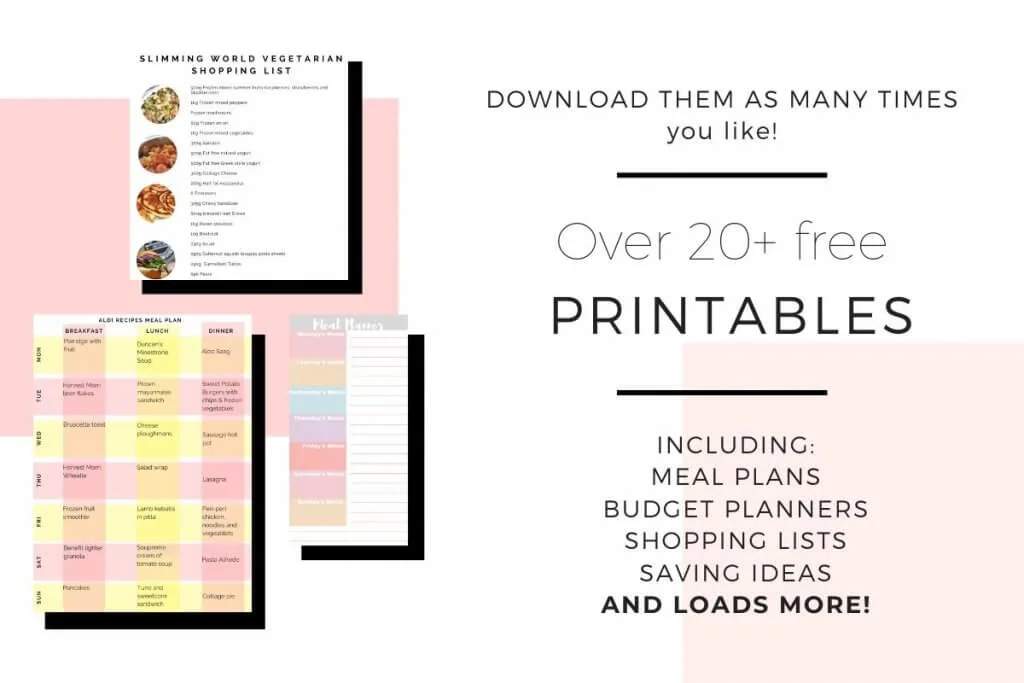

Money saving printables for the whole family

If you are looking to save money as a family then come join our free Resource Vault. It’s packed full of way you can save money and you can download and use the printables as many times as you like!

Join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

101 ways to save money on a tight budget

We’ve listed 101 living on a tight budget tips that can help you save money as a family. All of these are easy to do and can really make a huge difference to your bank balance!

Make sure you have a look at our money saving challenges as they can help you save money without you really noticing:

1p Saving Challenge: How to Save Over £100 in 30 Days

Penny Saving Challenge: Save Over £600 in a Year

If you are struggling to save any money then have a look at our 6-week money saving challenge. This is a free email course that helps you to put a little money away. Join our Money Saving Challenge for free now.

You may find that only one system works for you. If so, then have a go at one of these saving ideas:

Cash envelopes

This system is a great way to save £5000 over the space of a year. Label 100 different envelopes with the numbers 1 to 100. Each week, pick two random envelopes and put the amount that’s written on the inside. For example, if you pick envelopes 6 and 15, you’ll be saving £21 that week.

If you don’t like carrying cash, transfer the amount into a bank account instead. If it’s proving too much, you can always cut down to 50 envelopes to make it easier on your bank balance. We use Snoop as a banking app as it is really easy to use.

Use cash in hand

We’ve all gone into the shop with three things on the list but left with a full trolley. Avoid this by setting yourself a price limit.

Know how much you want to spend before you go shopping, then withdraw the amount you want from an ATM and leave your card at home. This way, you can make sure you’re only spending what you planned. Take a calculator and work it out as you go.

No petrol challenge

Could you cycle, walk to work or car share? By doing this, you could save money. Any money you save put away into your account ready for when you need it.

Put a set amount away

If you have a set amount of money that you want to save then it may be worth putting a set percentage away every month. It doesn’t have to be a lot, but by saving a small set percentage every month can really help boost your savings.

Account cleanse

Be real honest with yourself and go through your bank account. Could you cut anything down at all? Any cuts you can add straight to savings as a reward.

Downgrade brands

This mainly counts for food but works with everything. What can you cut to start saving money? Could you try a month of buying unbranded food? Set yourself the challenge and see if anyone else in the house notices.

Plan ahead

Write down birthdays, Christmas present budget and anything else you can think of. Start by putting money away for these events as this means that you won’t be as hard hit when they come along.

Ways to save money on bills and utilities

This is our complete list of money saving ideas for your bills and utilities. If you are looking for more ideas to save money on your bills then have a look at:

93 ways to save energy at home

Saving on Electricity: How to Save Electricity at Home

The Best Way To Save For a House

9 Secrets To Saving Money on Your Car Insurance

Best deals

Are you getting the best deal from your energy supplier? Phone up and haggle the price, remembering to check comparing sites first, so you have a ballpark figure. If the idea of haggling makes you cringe then read this post from The Lifestyle Blogger UK on how to be more confident which should help.

Energy saving lights

Energy-saving light bulbs could save you money in the long run. Many claim that they give up to 25,000 hours of light compared to 1,000 hours from a traditional bulb.

Water meter

Find out if a water meter is better for you. It may take in sewage costs, but you may be using less than you think.

White goods

When it comes to white goods, remember to compare cost, size, features, and energy efficiency. All these things could save you money in the long term.

Direct debit

Pay by direct debit. Not only can you forget about it for a bit but some companies offer a discount if you pay this way.

Price comparison

Use price comparison websites for all things bill-related. Get a ballpark figure and phone up and haggle. What’s the worst that’s going to happen? I did this and saved over £200 on my car insurance renewal!

Duel fuel

Duel fuel accounts. Sometimes they can be cheaper than having your energy separately. Do your research.

Biggest debt

Work out your biggest debt and aim to pay that off before you save. For us, it’s the mortgage as that’s not only our biggest outlay but also has the highest interest. Aim to overpay if you can, leaving you with less interest to pay as you go.

Water butt

Ask your council if they would supply a free water butt. Many do and use this to water your garden in the summer months.

Travel insurance

Dump any travel insurance you may have if you don’t have any holidays planned. You can always start it up again when you go.

New auto-renewal

Never auto-renewal your annual bills like home insurance. Look at price comparison sites and see what you can get. Match it against your renewal and see which one’s cheaper.

Cashback sites

Wake up 10 minutes early every day and look around for the latest offers, deals, or discounts. Remind yourself to use any cashback apps that you have to claim on any bills you’ve just paid. The savings will soon rack up. Our favorite cashback site is OhMyDoh. Get a free £1 added to your account here.*

Property value

Have your property valued every three-five years to check how much its worth. There’s a chance you could be overpaying on your council tax and could apply for a rebate.

Loyalty doesn’t pay

Switching banks or suppliers can normally earn you special deals with your new provider or even extra cash in your pocket.

Broadband costs

Watch out for any extra broadband costs. Would it pay for you to go unlimited instead of going over each month?

Cancel subscriptions

Cancel any subscriptions and the ones you just can’t live without call. Threatening to leave or downgrade your package normally works but don’t go too far in case they call your bluff!

Just in case you can’t get what you need, there’s always good alternatives. For instance, TV subscriptions still has their predecessor like aerials or sky dish. Local providers like TV Aerials Preston, surprisingly, still works well. Better something than nothing, right?

How to save month on clothes

Go through your wardrobe

Anything you haven’t worn in the last year sale on Facebook or eBay. You may only get a couple of quid, but it’s better than a cupboard full of dusty old clothes.

Hunt for bargains

Be thrifty and hunt for bargains. Always start your shopping spree in the charity shop and work your way up. Vintage is cool you know!

Repair holes

Repair any holes or tears yourself instead of binning it.

Reuse clothes

Reuse any clothes you can’t be bothered to fix. Can your old work uniform be used as a dressing up costume for the kids? Or as a painting or cooking apron. Kids really don’t care.

Think before you buy

Before you buy anything, think to yourself: Do I really NEED this item? Can I honestly afford this item? If the answer is yes, then buy it, but shop around first.

Swap party

Hold a swap party with your friends. You all bring your old clothes and do a swap.

Stable clothes

Fashions come and go, the classics don’t. Have some stable clothes you can full back on when the fashion changes.

Think gender natural

Things like t-shirts and hoodies don’t matter. If your partner isn’t wearing it then you should.

Only buy what fits now

Buying for the future never works.

Ask a friend

If you need something for a night out, ask a friend or family member if they have it to use. No point buying something new for just one night.

Avoid store cards

Avoid store cards at all costs. Don’t let the introductory 10% or 20% offers to tempt you.

Mix and match

Mix and match your summer clothes with your winter ones. Use everything and don’t save anything for best, it’s generally not worth it.

Look online first

If you need to buy new, then look online first. Many sites like Everything 5 Pound or Very offer good quality clothes for low prices and normally offer free delivery too.

Follow the one in and one out rule

For everything you buy, one item must go. This not only helps you think before you spend but also helps to curb excess.

Make discounts count

Use any loyalty card points or coupons when you need something new. No one sees the label or how much it cost.

Shopping habits

If you have a shopping habit that set yourself a challenge. Can you not spend anything on clothes for a week? A month? Three months? You’ll soon see the difference in your pocket.

Vouchers

Ask for vouchers for special occasions so you can buy clothes YOU want instead of having to give them away.

Keep your cupboard tidy

Keep everything tidy in your cupboard so you can see what you have and what you need. I do mine by colour but my husband does his by clothing type.

Ways to save on travel

Car share

Does anyone come close to where you live? Even if you share the petrol costs, it’s still cheaper than a bus, train or driving yourself to work.

Research first

If you need a new car then first research what’s going to be cheaper for you in the LONG TERM. Factor in fuel costs, car tax and wear and tear.

Train tickets

If you take the train, then find out if a season ticket would be cheaper. Normally you’d receive a nice discount paying in advance too.

Park and walk

Find the cheapest place to park and walk. If it means you have to get up earlier than do it. A £1 saving a day for a month is £30. That’s £360 a year saving.

Renting a drive

Would renting someone’s drive be cheaper than a car park? Ask around, especially if you work near a hospital or station where parking costs are higher.

Walk or cycle

Walk or cycle if you can. If you’re just nipping to the shops, chuck the kids in the buggy or on a scooter and walk. Might as well burn some calories and think of all that petrol you’ve saved.

Book in advance

Book whatever mode of transport you need in advance. Trains, taxis, and planes all offer better deals when booked months in advance.

Open a window

The classic air con vs open window debate. I open my window as I think it’s cheaper but my husband uses the aircon due to the drag of this car. Do some Googling and find out what’s cheaper.

Petrol prices

Use Petrol Prices to keep an eye out for price drops in your area. 3p a litre less than your convenient station is worth a small trip out of your way.

Walk if you can

After a busy day out, could you walk home instead of taking the bus or bus it instead of the normal taxi? Or get out a mile before your door and walk. The extra small saving could pay for the kids to have an extra ice cream or two.

Fuel offers

If you have a loyalty card then some supermarkets offer fuel deals, like 1p off a litre when you spend £25. Use them, they are worth it!

Oyster card

If you live in London then using your debit card as an Oyster can be good value and save you the queue at the ticket office.

Avoid traffic

Plan your drive to avoid traffic. The more you touch the break or sit still the more petrol you use.

Petrol v diesel

If you drive a long way every day then think about switching to a diesel car where you can get more miles per gallon.

Check your boot

Check your boot and empty anything you don’t need. The more weight the more petrol that is used to get you moving.

How to save money on leisure

Plan ahead

Planning ahead can save you money. Look out for local deals in your area like cheap snacks or admissions.

Bring your own snacks

Bring your own popcorn or snacks to the cinema.

Offers online

Sign up to as many newsletters as you can. Many cinemas or local attractions offer discounts to those on their list.

Local paper

Check your local paper for codes on cheap days out.

Buy in bulk

Buy in bulk with friends as group discounts will save you all money.

Free festivals

Look for free festivals in your area. Many are kid friendly and have loads to do for the whole family for free!

Plan for dinner

If you’re planning to go out for dinner, then check out Vouchercloud or use a cashback site like OhMyDosh* which are free to use. Many also offer discount codes online so search before you go. Never pay full price!

Free trials

Sign up for free trial weeks at your local gym. You and the family can use them, even if it’s just for a day. That saves me on average £10, but for four over eight-years-old that would be a saving of £20.

Save condiments

Save any condiment packets and keep them in your bag. You never know when you have to pay 10p each for them and this saves a meltdown when out too!

Super Tuesday

Most cinemas have a cheap night or day. Mine has kids showings for £2.50 each or Super Tuesday where tickets are half price.

Travel plan

Use sites like Compare the Market that offer you buy one get one free on cinema tickets if you buy a product through them. We bought a £2.99 travel plan with them and now receive this offer for a whole year. So even if we go once, we would have already made our money back.

Pay as you go

Unless you are on a strict exercise regime, paying as you go will always be cheaper. Even if you go twice a week, paying as you go is cheaper than a monthly membership.

Fun days out

Don’t buy expensive programs for your day/night out. Most will be available online anyway for free.

Free days out

If you need a FREE day out, then there are plenty of museums that offer a fun family experience.

National Trusts

Many National Trusts offer cheap annual passes for the family that you can use over and over again for about £30.

Take your own lunch

Take your own lunch everywhere you go. Use these budget friendly lunch ideas for when you go out and about.

Bring your own equipment

Take your own equipment. Ice skating, tennis, football, anything that you’d normally have to pay a few quid extra to borrow.

Student cards

If you’re a student, then remember to flash your card everywhere you go. You’d be surprised how much you could save.

Supermarket loyalty cards

Some supermarket loyalty cards offer money off top attractions at certain times of the year. Find out when and go.

Tap water

Ask for tap water while out. If the restaurant serves alcohol then by law they have to supply free tap water.

Save money on food

Grocery shopping can be a huge burden on your income. These are the best ways to save money when money is tight.

Have a look at our budget meal ideas here to help fill up your meal plan:

The Ultimate £1 Per Head Budget Meal Planning List

101 Aldi Recipes That Will Give You Dinner Ideas For Tonight

One Month of Family Meal Ideas on a Budget

Meal plan

Plan your meals and make a shopping list. Stops you from going crazy around the supermarket and buying double items that you already have. You can use my FREE shopping list and Meal plan here.

Make all your own food

It really is cheaper when money is tight and you can always make more for leftovers the next day. Read our guide here; The Ultimate Guide to Food Shopping on a Budget which can help you save money while cooking from scratch.

Beginner cook

Use a service like Spicentice for a couple of weeks. They send you spices with a complete shopping list and step-by-step instructions on that help you cook really great family meals from nothing.

You can then keep these to try again next time. We’ve made loads of meals, using them like:

Really Easy Homemade Beef Burgers For Under £1 a Head

The Best Southern Fried Chicken Recipe For Under £1 a Head

Spaghetti Meatball Recipe For 73p a Head

Try Spicentice and get 20% off using our code LASAVE20.*

Reduce portion sizes

Try making your normal one big meal past for two.

Weigh everything

Pasta, rice, even cereal. Check the recommended per person portion and stick to that.

Buy a joint

Buy a joint and use it for multiple meals. We buy gammon a lot and use it for two to three meals.

Cupboard staples

Live out your cupboard once a month to clear out any old tins you’ve forgotten about. This helps make dinner exciting again.

Check what you have

Always check your cupboards, freezer and fridge before you go.

Never go hungry

Never go food shopping hungry. it will cost you a fortune.

Use everything

Turn any overripe fruit or vegetables into after-school smoothies.

Buy frozen

Buy frozen fruit and vegetables. They keep longer and you only need to use what you need for each meal.

Grate vegetables

Grate vegetables if you can. It helps bulk the meal out but you’re still using the same amount of veg.

Shop late

Go shopping late if you can. Items are normally reduced after 730pm.

Price match

Many supermarkets offer you 10% off your shop if they are more expensive.

Cook more

Cook extra so you have leftovers for those days that you need a quick meal.

Ignore offers

Don’t get sucked into buy one get one free offers. Only buy them if you WILL use them.

Take lunch

Remember to make lunch for work too. If you normally buy coffee or a donut on the train, then buy it with your shopping and take it with you. You could save an extra £5 a day by doing this alone!

Debrand

I always start from the bottom and work my way up. Did the kids notice that you bought a different brand of yogurt or ice cream? Did the other half comment on the new tea? If not, then swap them. You’d be surprised how much you could save here.

Shop online

Shopping online could save you money. Remember to pick a free delivery time slot though and keep track of how much you’re spending as you go.

Cook more

Have a week of just cooking from scratch and using your kitchen staples. Yep, it takes time but you’ll soon notice how much cheaper it is to make than buy.

Make your own

No need to buy expensive cleaning solutions. Grab yourself some Bicarb and white vinegar and watch your kitchen shine up like it’s new.

Related Posts:

- The Ultimate £1 Per Head Budget Meal Planning List

- 103 Frugal Living Tips That Will Save You Thousands in 2021

- The Ultimate Guide to Food Shopping on a Budget

Save money on kids items

Second hand

Buy second-hand toys and clothes where you can. They really don’t care and won’t even notice.

Box up toys

Box up toys that aren’t used and rotate them. They think they have new toys and it stops them from asking for more.

Own gifts

Make your own gifts for family members. Handprints, drawings, and writings make Grandparents very happy.

Reuse clothes

Reuse clothes between the family. Has your sister-in-law just had a baby? Can they use the clothes? Do they have an older sibling you could borrow from? Only buy what you need.

Freeze baby food

Freeze baby food or snacks as you go. Making a huge batch then taking it out when you need it stops you buying jars or quick snacks when the kids are hungry.

Use Facebay

Use sites like Facebay and Gumtree to pick up free toys for your kids. Look at our 15 Free Baby Stuff For Expecting UK Mothers post for more help on getting freebies.

Uniform

Don’t buy to much uniform. Spread the cost and the waste by buying just what you need and then buying as your kids grow.

Buy against the seasons

Buy all the summer stuff in winter when it’s in the sale and winter in the summer. Yes, you have to guess sizes but at 3 and 5 I can kind of guess what size they will be.

Label everything

Label everything so it doesn’t go walkabout.

Use the library

Use the library for books. It’s free and they can normally take home four each on your library card.

Stains on clothes?

Don’t worry. Leave them in the sun and watch the stain disappear!

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.