Including money-saving Christmas ideas

We all know that Christmas is never too far away. That’s why it’s important to plan now and start saving money.

While it’s true that the best time to start saving for Christmas is right after the big day, you can still start now and have some serious money in the bank when it comes back around.

This post is going to walk you through exactly how you can start saving money now for Christmas and go into next year debt-free. That means no savings clubs or credit cards. Just your money that you’ve been slowly saving all year round.

If you are looking for more ways to save money then have a look at:

103 Frugal Living Tips That Will Save You Thousands – If you are looking to save your family money then our list here can help. This is everything we do ourselves to save money.

The Ultimate £1 Per Head Budget Meal Planning List – Use our £1 a head family meals to save money off your shopping bill. They are all simple and great for quick family meals on a budget.

The 7 Best Budgeting Apps in the UK Right Now – Using budgeting apps are a great way to help you get a handle on your money.

Money saving printables

If you are looking for ways to save your family money then come join our free Resource Vault. It’s packed full of money saving printables that you can use over and over again.

Come join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

How to save for Christmas

It isn’t easy to start saving money if you’ve never done it before. You need to start by having a look at your budget. This means really being honest with yourself and working out how much you can afford right now to save.

You can use our budget planner here in our free Resource Vault which can help you work it out.

You could also use a range of budget apps if you prefer the online world. Our favourites are:

Snoop – Snoop is a free money management app that was created to help you manage and save money. Snoop wants to help you make smarter choices and get on top of your money. Snoop is free to use and offers you loads of features from warning you before money comes out and reminding you about any annual bills.

Read more about we think about Snoop here.

You can download the Snoop app onto your Android or Apple device for free here*

Plum – Plum is a free app that helps boosts your bank balance. It’s the smartest app for managing your money. It analyses your spending patterns and automatically puts your money away for you, so you don’t have to think about it. Plum helps you to identify if you’re overpaying on bills and can switch you to a better supplier quickly, helping you save money.

Read more about how Plum works here.

Download Plum for free here. It works on iPhones and Android*.

Emma – Emma is like having your bank manager in your pocket. Like the other apps, it links all your bank accounts using open banking which means that you can see exactly what you are spending. It also gives you hints and tips on how you can save money.

Download Emma for free here. It works on iPhones and Android*.

Read more about The 7 Best Budgeting Apps in the UK Right Now

If you are struggling to work out how to save then have a look at our posts here:

How to Get Out of Your Overdraft

Money Saver: This is How we Saved Over One Thousands Pounds in a Year

Use Cashback Sites If You Are Buying Online

Cashback sites are a great way to save money. Every time you buy online make sure you are using a cashback website and see if you could get any money back.

Most are free to use and all you need to do is shop through them to get some money back. None of your rights are affected by shopping through a cashback website.

Read more about how cashback sites work here.

Our favourite cashback websites are:

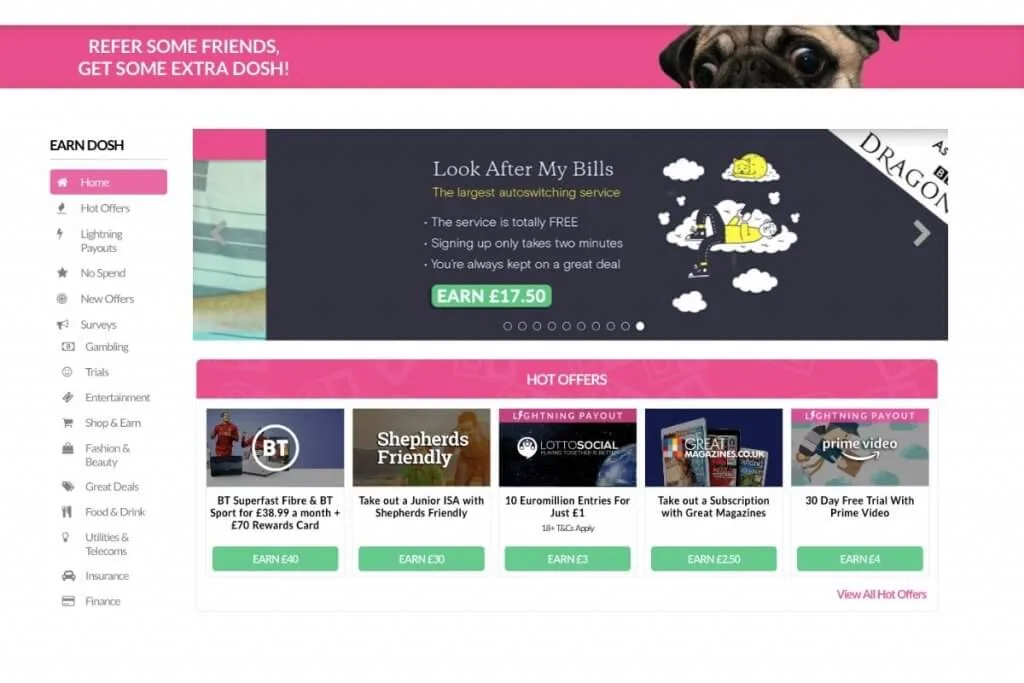

OhMyDosh

OhMyDosh is an easy to use cashback site that’s free to use. It’s not like a normal cashback site though. OhMyDosh gives you loads of ways you can make money including:

The refer a friend scheme. Refer your friends to OhMyDosh and earn yourself £5 for every sign up and your friend £1.

Competitions: Enter them for free and receive money.

Shop through them to earn the bigger rewards.

The best thing about OhMyDosh is that you only need to make £10 to “dosh out” and they pay out through your bank or through PayPal.

If you are new to OhMyDosh* then use our link here to get your first free £1*

You can read more about how OhMyDosh works here.

Quidco

Quidco is a great way to save money. We’ve saved over £200 in the last few months and their site is really easy to use.

It’s free to join Quidco and they have access to over 4,000 retailers, and a lot of these are big household names.

You can also use Quidco* to even save money on your weekly food shop with their Click Snap app.

If you want to save even more then they do offer a premium membership which costs £5 a year. This gets you around £50 a year worth of promotions. It’s not paid upfront. It’s taken from the cashback you earn. It’s all about getting better bonuses. We upgraded three months ago and have earned over 30% more than on the basic membership.

It’s really easy to get your money out. It can go straight into your bank account or via PayPal.

Money-saving challenges

We love money-savings challenges. If you’re looking to save money easily so you can treat your family then this 1p saving challenge is for you. We all know that saving our family money isn’t easy but by completing the five steps below you could be on your way to saving your family over £650.

This 365 days money saving challenge works by you saving a penny a day. So on day one, you save £3.65. On day two you save £3.64 in till you get to day 365 and you save 1p, with a massive £667.95 in the bank.

You can do it for any length of time. Try to stick to at least 30-days though so you can see the money rise.

Read more about money-saving challenges here:

1p Saving Challenge: How to Save Over £100 in 30 Days

Penny Saving Challenge: Save Over £600 in a Year

Perfection Isn’t Needed

We all want a perfect Christmas, but It never happens, however hard we try. Instead of asking “ What would make Christmas perfect?” ask yourself “What can I afford this year?” and go from there.

Like we said above, make sure you know exactly how much you can afford. Your family would much prefer to have YOU then a fancy gift.

For more help on having Christmas on a budget please look at:

31 Ways You Can Have Christmas on a Budget

Secret Santa

Instead of buying friends or extended family gifts, why not ask to do a secret Santa. They’ll be pleased because they don’t have to fork out of another junk present, and you only have to buy one of the seven cousins a gift.

Last year I was part of three. One with my close friends, our kids, and the extended family. It works.

Teenagers are hard to buy for. Have a look at this teenagers gift guide here.

Avoid Gift Cards

The issue with gift cards is that they aren’t protected like cash is in your bank account. If the store in question goes bankrupt you have no way of getting your money back.

Instead of a gift card, use the IOU system above and go shopping with a loved one after the big day.

Start Shopping As Early As You Can

We start every year in January. We have a list that we use every year and when we see something we buy it. It may sit in our cupboard for six months but it helps to spread the cost when December comes.

Find The Lowest Prices

Google shopping is a great tool when you are looking for a certain product.

Type it in and watch it bring back the prices for all the stores that stock that product online. It’s the quickest way to find the lowest price.

From there, see if certain stores will price match. It’s worth an ask. What’s the worst that can happen? Use the chat features online and see what kind of deal you could get. You can always walk away.

Use voucher codes

Whenever you buy online make sure you use voucher codes. We love UK Voucher Deals the most. They cover all vouchers and means that you can save money off your online shopping.

Make some extra money for Christmas

This may sound easier said than done but making some extra money from your own home is possible. Set yourself a monthly target and see how much you can earn.

Some of these are slow burners but can make you good money if you start them now ready for Christmas.

Remember to cash out whenever you have earned anything you are not covered in till the money is in your own bank account.

You could make over £50 a month by:

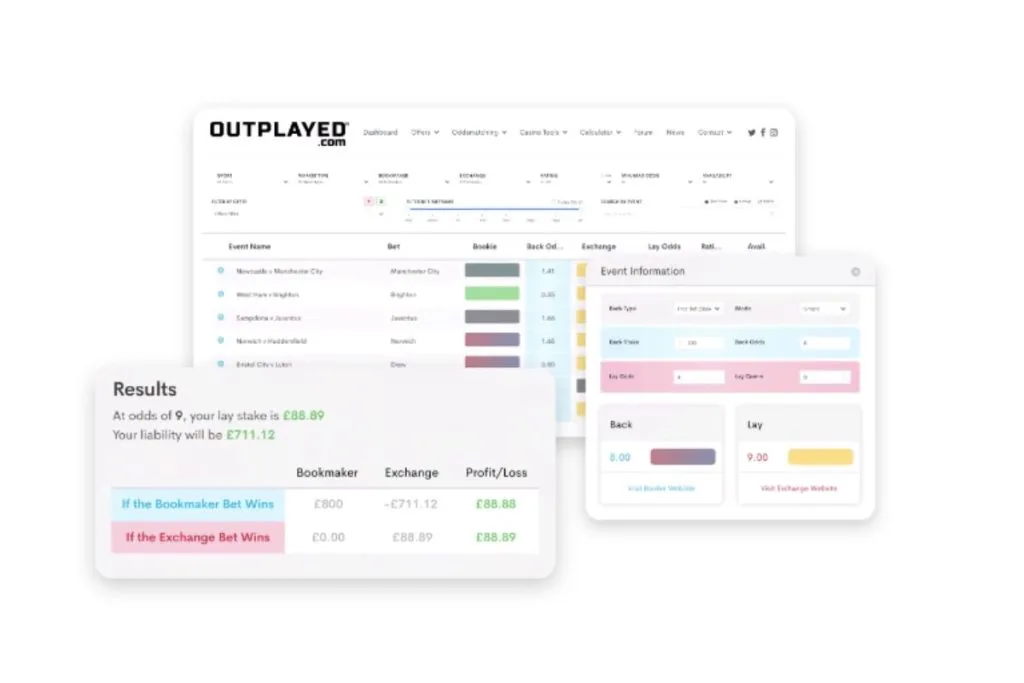

Matched Betting

Matched betting is a completely legal, tried and tested way to make money online while you’re at home. It basically turns the tables on the bookmakers, to give you their free bet offers, so you can’t loose.

If you’re doing it correctly, you will never loose any money, but you do need to take your time and be really careful to avoid any mistakes. Using a company like Profit Accumulator means that you don’t have to work out the odds or be worried that you’re doing it all wrong.

Make sure you understand fully before you deposit any money. Follow our guide below to make your first £45 matched bet.

Start your free trial with OutPlayed here and they will help you make up to £45*

Read more about how matched betting works here

Blogging

Blogging can be a great hobby, but also a very good way to earn money and go places with your family that you’ve never even dreamed of before.

You need to find a topic that you are passionate about. Don’t worry if you don’t enjoy writing, you can vlog on YouTube or even just start with a Facebook page.

The good thing about blogging is that you can start for free and earn money in a load of different ways like advertising, through sponsored posts (this is where a brand asks a blogger to write about their branded products), affiliates (where someone buys something after a blogger has written about them), products and courses.

You can start a blog really quickly and easily but will need a domain name, host and website which you can sort yourself quickly. We use WordPress to build Savings 4 Savvy Mums and TSO Host for our domain name. They also offer hosting too and with our code S4SM10%OFF you can get 10% off*.

Don’t forget to sign up to a email marketing provider. Many offer you a free service till you hit a certain amount of subscribers. This is a great way to keep all your readers involved in what you’re working on. We use Mailerlite as they offer a great customer service and are very easy to use!

Read about how we set up our blog here, which also gives you a step by step account.

Related Posts:

- 25 of the Best Ways To Save Money In The UK Right Now

- 103 Frugal Living Tips That Will Save You Thousands in 2021

- How to Get Out of Your Overdraft

Dropshipping

Dropshipping is when a store doesn’t keep any stock they are selling. When the store sells a product it gets it from another supplier and gets them to deliver it straight to the customer. This means the store doesn’t touch the product at all.

Start by deciding which platform you want to start selling on. We found the easiest to be eBay and Shopify but do your research on both to see which one you find personally easier. There’s nothing stopping you from trying both at the same time.

Read more about how Dropshipping works here

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.