Including the best apps to use

Bank account skimming is a great way to save money as a family. It’s easy to take a little off the top that you hopefully won’t miss.

In under four months, we managed to save the £275 we needed to go, just by skimming our accounts and wallets a few times a week. It’s a cliché, but it does all add up.

What is account skimming?

Not to be confused with ATM skimming, in which thieves use hidden electronics to steal the personal information stored on debit and credit cards, bank skimming is where you round your bank balance down to the nearest whole number and transfer the extra money to a savings account.

How does skimming work?

Think of it this way. If I have £234.95 in my account, I would transfer £4.95 into my savings account leaving a round number.

You can do it for any amount, even a pound, and without realising it, you could have £30 a month saved.

If you can’t afford to spare £4.95, you can round down to the nearest pound and remove just the 95p. Whatever you can afford that week.

How often should you skim?

You can skim money as often as like. Some people prefer to skim every week with cash. So they bank whatever they have left in their wallets at the end of the week.

Some people prefer to do at the end of the month once all the bills have come out. The only issue with saving at the end of each month is that you may have spent all your money by then. It’s a fine balance between paying bills and remembering to save instead of spend.

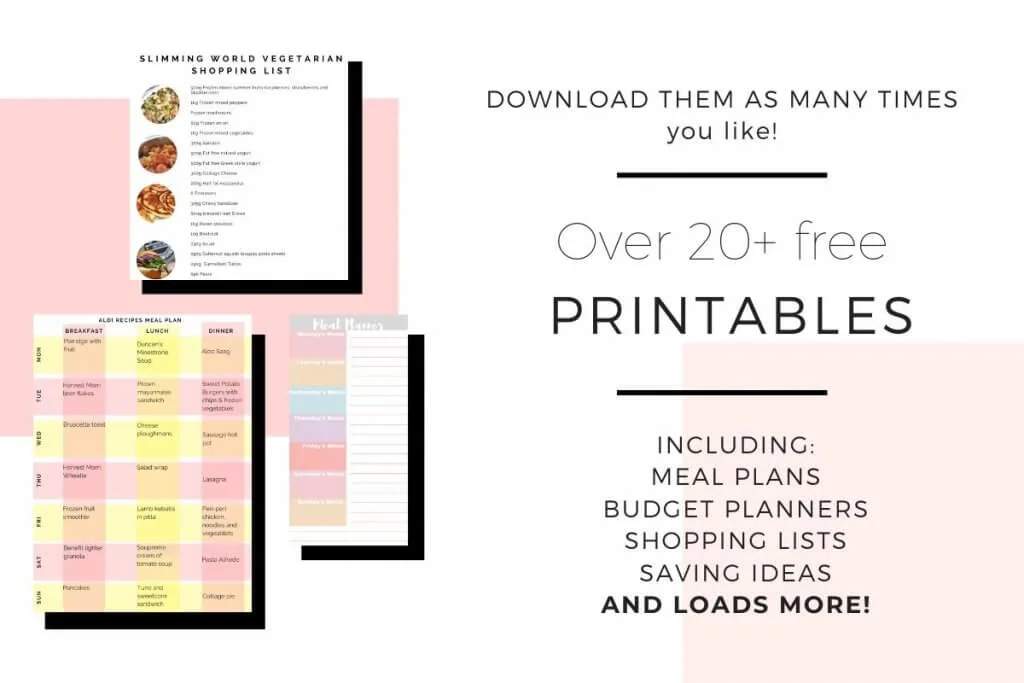

20+ money saving printables

If you are looking for more ways to save money then come join our free Resource Vault. It’s packed full of money saving resources for the whole family which include budget planners and meal plans that you can print off as many times as you like.

Come join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

How to start skimming?

There are loads of ways to skim your money, but the three main ways are:

Skimming your online account

So like above, every time you log in to your online account, daily, weekly, monthly, whenever, you just transfer over the amount to make your account a round number again.

A lot of accounts offer this feature for free, like Lloyds, who call it Save the Change. You don’t have to have the accounts with the same bank though, I don’t, I just transfer mine manually whenever I’m on it.

Some days it’s just pence because I know a big bill is due, sometimes it’s over £10. That’s the good thing about skimming, you can save as little or as much as you like on your own timescale!

If you are looking to save money then make sure you have a look at:

101 Ways to Save Money on a Tight Budget – This is our full list on saving money as a family. It includes saving money on food and on your bills. It also talks you through meal planning.

The Ultimate Guide to Food Shopping on a Budget – This is the best guide to how to do your food shop on a budget. It talks you through everything from how to make a shopping list to budget planning.

Budget saving apps

If you don’t like the sound of doing this manually, as it can take some time, have a look into some budget apps.

We use Snoop to connect all our bank accounts. Snoop is a free money management app that was created to help you manage and save money. Snoop wants to help you make smarter choices and get on top of your money.

They also give you daily balance alerts for all your connected accounts. This means that you know exactly how much money is in each account which is great when you are trying to budget.

Snoop is free to use and offers you loads of features from warning you before money comes out and reminding you about any annual bills.

Read more about we think about Snoop here

You can download the Snoop app onto your Android or Apple device for free here

We have also used Plum.

Plum is a free app that helps boosts your bank balance. It’s the smartest app for managing your money. It analyses your spending patterns and automatically puts your money away for you, so you don’t have to think about it.

Plum helps you to identify if you’re overpaying on bills and can switch you to a better supplier quickly, helping you save money.

Read more about how Plum works here

Download Plum for free here. It works on iPhones and Android*.

If you like the sound of budget saving apps then make sure you have a look at our post here with explains all the best apps that we have used before.

Skimming your wallet

If you don’t have online access or don’t like the idea of taking money out of your account, then apply the above concept to your wallet.

We have two jars. One is the ‘holiday jar’ and the other is the ‘emergency fund’. Both get my loose change after a day out, but the ‘holiday jar’ never gets broken into. The other is there just in case I need 90p for a loaf of bread or the kids want a chocolate bar or something.

They don’t have to be anything fancy, even old lunchboxes will do.

After a day out, I just empty my wallet of any loose change and leave the pounds and notes alone. All the change goes straight into both jars, and when it’s time to pay for the holiday, but will get emptied and used.

Money saving challenge

There’re loads of this kind of challenges knocking around. This one is for those of us that want to save a strict amount and need a target.

The idea is that you save a fixed amount every week and have a nice pot at the end of the year.

So for this example, it’s all about pennies. Day 1 you save 1p. Day 2 you save 2p. Day 3 you save 3p etc until the year ends. Just doing this will have your jar or savings account holding a massive £667.95!

Now, if you know that saving £3.65 on 31st December just isn’t going to happen, then why not do it backward and save £3.65 on the 1st January and work your way down. (£3.65 on Day 1. £3.64 Day 2. £3.63 Day 3 etc.)

Read more about our money saving challenges here:

1p Saving Challenge: How to Save Over £100 in 30 Days

Penny Saving Challenge: Save Over £600 in a Year

You can start any day of the year, and even stop if it gets too much. The good thing about skimming this way is that the money is a fixed amount and a guaranteed good amount at the end.

You can also join our free money saving challenge.

If you’re struggling to save money then why not join our FREE money saving course that takes you step by step through saving money as a family. All simple steps to help you build an emergency fund or save towards that mega holiday.

Join our FREE Money Saving Course here and I can’t wait to see how I can help you!

Related Posts:

- How to Stop Spending Money Right Now

- How to Get Out of Your Overdraft

- 101 Ways to Save Money on a Tight Budget

Does bank account skimming work?

Well, it worked for me. I managed to save £10,000 in a year by doing all the above. It paid for most of my wedding, and while we were very hard-core about it, knowing that the big bill was coming, we still didn’t miss out on much.

Have you ever skimmed? Do you think it could help your family save?

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.