The Best Budgeting Apps For Families

After too many sleepless nights, keeping track of all your bills suddenly becomes a minefield. Using a daily expense tracker app might just be what you need to keep your finances in order, but which one is the best?

As dull as it may be, managing your money and budgeting is crucial. In fact, ignoring your cash flow completely could be one of the most dangerous things you do as an adult.

But budgets don’t have to be boring and keeping track of your money takes minimal effort.

Are budgeting apps safe?

Most budgeting apps are safe. Before you commit though, make sure that your money management app you are looking for is regulated by the Financial Conduct Authority. Just like a high street bank, all these apps have a responsibility to look after you and your money.

How do budgeting apps work?

All the budgeting apps on our list use open banking. This means that, with your permission, they can access all your bank accounts and pull the information through to their app. It doesn’t matter if you hold different accounts with different banks. With open banking, they can use this information to serve you the current accounts.

This includes current accounts and saving accounts.

The good thing about open banking is that you don’t need more than one of these apps as they pull all the information for you.

What is the best app to keep track of spending in the UK?

These are the best free budgeting apps that you can use. They do have some subscription features that may be worth investing in if you feel they might help.

When it comes to managing personal finances, choosing the right app can make all the difference. In the UK, several applications stand out for their ability to help users effectively track spending. One of the most popular options is Monzo, a digital bank that offers real-time notifications for every transaction, allowing users to see where their money goes instantly.

Another strong contender is Emma, a budgeting app designed specifically for tracking expenses and providing insights into spending habits. Emma connects with your bank accounts and categorises transactions automatically, making it easier to identify areas where you might cut back.

For those who prefer a more traditional approach, YNAB (You Need A Budget) offers robust budgeting tools that encourage proactive financial management through its unique methodology. Although it requires a subscription fee, many users find its features worth the investment.

Lastly, Spendee allows users to create shared wallets with friends and family, making it ideal for group events or shared expenses. With its user-friendly interface and colourful design, Spendee makes tracking spending both engaging and straightforward.

Ultimately, the best app for you will depend on your specific needs—whether it’s real-time tracking or comprehensive budgeting tools—but these options are certainly among the top choices in the UK market today.

If you are looking to save your family more money then have a look at:

103 Frugal Living Tips That Will Save You Thousands in 2024 – This is our biggest list of saving money tips that we use ourselves.

The Ultimate £1 Per Head Budget Meal Planning List – If you are struggling to save money on food then use our list here which has over 100 £1 a head budget meals.

25 of the Best Ways To Save Money In The UK Right Now – These are the best ways to save money as a family right now.

6-Week Money Saving Challenge

If you’re struggling to save money then why not join our FREE money saving course that takes you step by step through saving money as a family. All simple steps to help you build an emergency fund or save towards that mega holiday.

Join our FREE Money Saving Course here and I can’t wait to see how I can help you!

This is the perfect time to improve your finances.

With this free email course, we cover everything from setting financial goals to ways to earn some extra money in your free time. Over the next 6-weeks, you will receive an email that will help you save your family more money.

Come Join us now and watch your savings grow.

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

The Best Personal Finance Apps UK

So here are 7 of the best apps that make it super easy to keep tabs on your money. The best thing about all these are that they don’t just show you what you are spending but also give you tips on how to save money based on your own accounts.

They can even help you set financial goals and give you free budgeting ideas to keep you on track. These budget apps are great if you are technology-driven and have everything else on your phone.

These apps are available now and can link to savings accounts too.

Snoop

Snoop is a free money management app* that was created to help you manage and save money. Snoop wants to help you make smarter choices and get on top of your money.

The Snoop app is an innovative financial management tool designed to help users gain better control over their spending and savings. But what exactly is the Snoop app, and how does it work?

At its core, the Snoop app connects to your bank accounts and analyses your transactions in real-time. By doing so, it provides personalised insights into your spending habits, helping you identify areas where you could save money. The app uses advanced algorithms to track your purchases and categorise them, making it easy for you to see where your money goes each month.

One of the key features of the Snoop app is its ability to offer tailored savings recommendations based on your individual spending patterns. For instance, if it detects that you’re consistently overspending on takeaways or subscriptions, it will suggest alternatives or cheaper options available in the market. Additionally, the app includes a budgeting tool that allows you to set limits for different categories of spending.

Snoop also provides alerts for potential savings opportunities such as better energy deals or insurance rates. This proactive approach ensures that users are not only aware of their financial situation but are also empowered to make smarter choices with their money. Overall, the Snoop app represents a significant step forward in personal finance management by combining technology with user-centric features aimed at enhancing financial well-being.

What we love about Snoop

We love the money-saving tips that the app gives you and the ideas on how you can cut your bills by offering you switching opportunities. This saves you from having to look around yourself and making sure you are on the best deal.

They also give you daily balance alerts for all your connected accounts. This means that you know exactly how much money is in each account which is great when you are trying to budget.

Snoop is free to use and offers you loads of features from warning you before money comes out and reminding you about any annual bills.

Read more about we think about Snoop here

You can download the Snoop app onto your Android or Apple device for free here

Emma

The Emma app is a personal finance management tool* designed to help users take control of their financial health. By connecting to your bank accounts, the app provides a comprehensive overview of your spending habits, helping you to budget more effectively and save money.

So, how does it work? Once you download the app and link your financial accounts, Emma automatically categorises your transactions into various spending categories. This allows you to see where your money is going each month. The app also offers features such as budgeting tools, spending alerts, and insights into recurring payments.

Key features of the Emma app include its ability to track subscriptions, which can help users identify any unnecessary expenses; a budgeting feature that allows for customisable limits; and savings goals that encourage users to set aside funds for specific purposes. Additionally, the app provides an intuitive dashboard that makes navigating through financial data straightforward.

What’s good about the Emma app is its user-friendly interface and the depth of insight it offers into personal finances. Users often appreciate the ability to monitor their spending in real-time and receive alerts when they approach their budget limits.

As for whether it’s worth the subscription fee, many find value in its premium features—such as advanced insights and enhanced tracking capabilities—that can significantly improve financial awareness. For those serious about managing their finances effectively, investing in a subscription may indeed be worthwhile.

Read how the Emma app works here

Join Emma for free here on Apple and Android

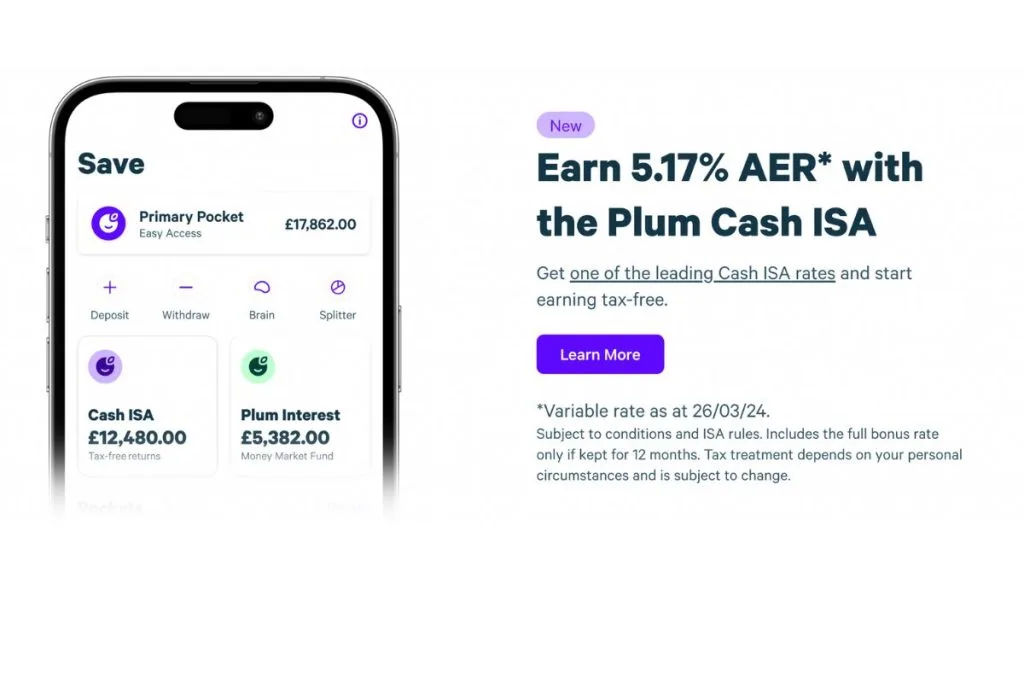

Plum

Plum is a free app that helps boosts your bank balance.* It’s the smartest app for managing your money. It analyses your spending patterns and automatically puts your money away for you, so you don’t have to think about it.

The Plum app is a financial management tool designed to help users save and invest their money more effectively. At its core, the app uses advanced algorithms to analyse your spending habits and automatically set aside small amounts of money for savings. But what exactly does this entail?

How does it work? Once you link your bank account to the Plum app, it begins tracking your transactions in real-time. Based on your income and expenditure patterns, Plum intelligently calculates how much you can afford to save without impacting your day-to-day finances. The app then transfers these amounts into a separate savings account, making saving effortless.

Key features of the Plum app include its ability to create personalised savings goals, offering users insights into their spending behaviours through detailed analytics. Additionally, Plum allows users to invest their savings in various funds directly through the app, providing an accessible way for individuals to grow their wealth over time. With its user-friendly interface and tailored approach to personal finance, the Plum app stands out as a valuable tool for anyone looking to improve their financial well-being.

What we love about Plum

What we love best about Plum is that it keeps track of your money for you. You can adjust how much you want to put away and withdraw your money or move it at any time.

Plum helps you to identify if you’re overpaying on bills and can switch you to a better supplier quickly, helping you save money.

Read more about how Plum works here

Download Plum for free here. It works on iPhones and Android*.

Hyper Jar

The Hyper Jar app is a financial management tool designed to help users take control of their spending and saving in an innovative way. At its core, the app allows individuals to create digital jars that can be allocated for various purposes, such as budgeting for groceries, holidays, or savings goals.

Users simply download the app and set up an account. From there, they can create multiple jars and assign funds to each one. This visual representation of money helps users see exactly where their finances are going and encourages mindful spending habits. Additionally, the app integrates with bank accounts for seamless tracking of transactions.

Key features of the Hyper Jar app include real-time transaction notifications, budgeting tools that allow users to set limits on their spending per jar, and the ability to share jars with family or friends for group savings goals. The app also offers insights into spending patterns, helping users make informed financial decisions. Overall, Hyper Jar is an effective tool for anyone looking to enhance their financial literacy and manage their money more effectively.

Join Hyper Jar for free here and download their app.

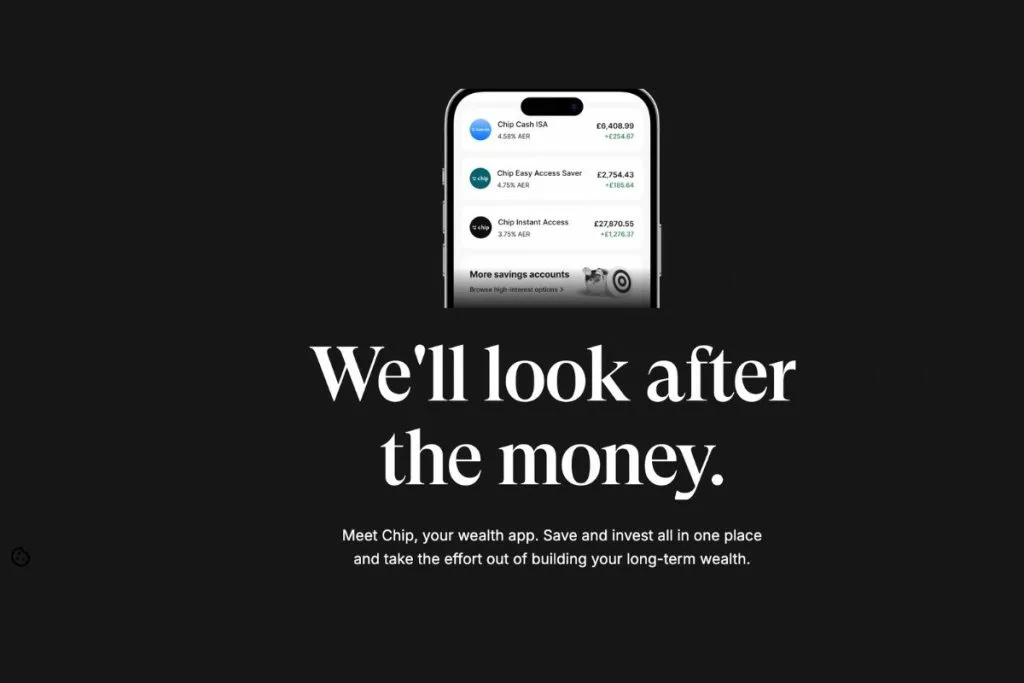

Chip

The Chip app is a financial tool designed to help users save money effortlessly*. But what exactly is the Chip app? At its core, it’s an intelligent savings application that automates the process of saving by analysing your spending habits and setting aside small amounts of money for you.

Once you download the app and link your bank account, Chip uses algorithms to assess your income and expenditure patterns. It then automatically transfers small sums of money into a separate savings account on a regular basis—without you having to lift a finger. This means that saving becomes an effortless part of your financial routine.

Key features of the Chip app include its ability to set savings goals, track progress towards those goals, and offer various investment options for your saved funds. Additionally, users can benefit from instant access to their savings whenever they need them.

What’s good about the app is its user-friendly interface and seamless integration with your banking system. It encourages healthy saving habits without imposing strict budgets or requiring constant monitoring. With its smart technology, Chip not only simplifies saving but also empowers users to take control of their financial future with ease.

What we love about Chip

We love the One-click saving. You save a set amount every month with no need to think about how much that is. You can also really quickly set saving goals that Chip will help you meet.

Chip is free to use up to £100 money saved. After that it is £1.50 every 28 days to use their full features.

Download Chip app for free now

MoneyHub

The MoneyHub app is a comprehensive financial management tool designed to help users take control of their finances. But what exactly is the MoneyHub app? In essence, it serves as a personal finance assistant that aggregates all your financial accounts in one place, allowing you to track spending, set budgets, and plan for the future.

Upon downloading the app, users can link their bank accounts and credit cards securely. The app then automatically categorises transactions and provides insights into spending habits. This feature enables users to understand where their money goes each month and identify areas for improvement.

Key features of the MoneyHub app include its budgeting tools, goal-setting capabilities, and financial health score. Users can create custom budgets based on their income and expenses while setting specific savings goals for things like holidays or home renovations. The financial health score offers a quick overview of one’s overall financial well-being based on various metrics.

What is good about the app? Many users appreciate its user-friendly interface and robust analytical tools that simplify complex financial data into digestible insights. Additionally, it promotes better saving habits by encouraging users to be more mindful of their spending patterns.

As for whether it’s worth the subscription fee, this largely depends on individual needs. For those serious about managing their finances effectively or seeking to improve their monetary habits over time, the investment in a subscription may prove beneficial in achieving long-term financial goals.

What we love about MoneyHub

Star Features: The handy calculators are great. Taxes, pensions and house prices can be added, to help you reach your long-term goals.

MoneyHub is free to use.

All of these apps are great for helping you to save money and budget.

Download the free app here at the App Store

Related Posts:

- 93 ways to save energy at home

- Bank Account Skimming: An Easy Way to Save For your Next Family Holiday

- How to Save for a Baby: 27 Ways to Save Before Your Baby Arrives

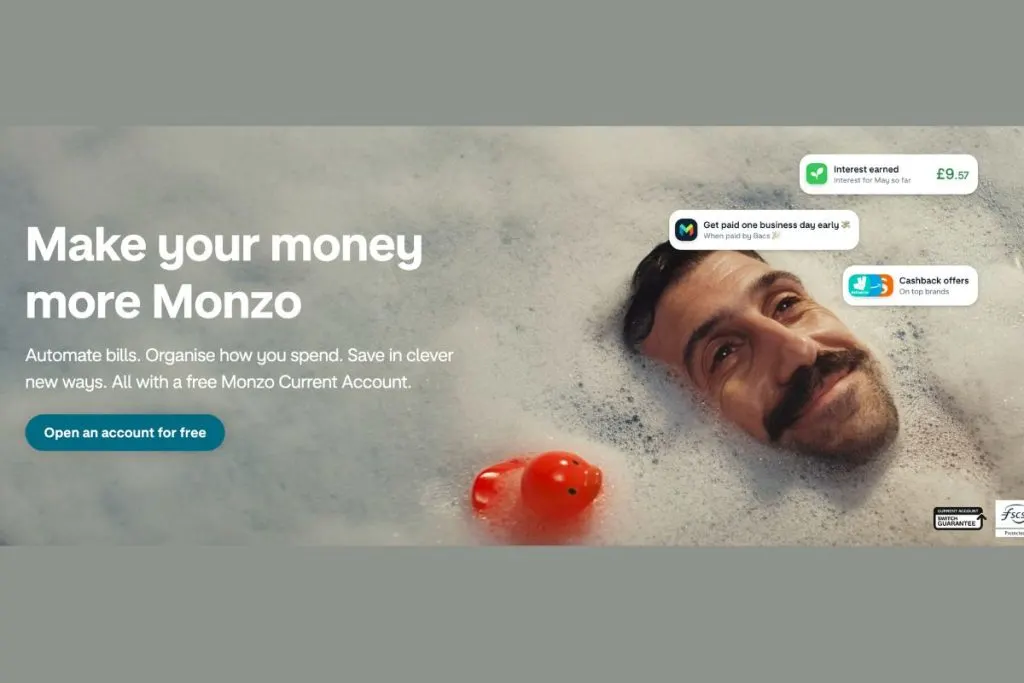

Monzo

The Monzo app has gained significant popularity as a digital banking solution, but many users often wonder: is Monzo a safe app to use? The answer is yes!

Monzo employs robust security measures, including two-factor authentication and instant notifications for transactions, ensuring that users are alerted to any unusual activity on their accounts. Additionally, funds held in Monzo accounts are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Monzo boasts a variety of features designed to enhance the banking experience. Users can easily manage their finances with budgeting tools that track spending by category and provide insights into financial habits. The app also allows for instant money transfers between Monzo users and offers features such as savings pots for specific goals, bill splitting with friends, and overseas spending without hidden fees.

As for cost, using the basic features of Monzo is free; however, there are premium options available. A standard account comes with no monthly fee but has limitations on certain services. For those seeking additional benefits like travel insurance or enhanced customer support, Monzo offers paid plans starting at £5 per month. Overall, whether you’re looking for an efficient way to manage your finances or simply want a user-friendly banking experience, the Monzo app presents a compelling option worth considering.

I really hope this post helps you to find a budget solution that works for you.

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.