Including how safe is Emma?

If you are looking for a money budgeting app that helps you manage your finances on your phone then have a look at Emma. The Emma app is an all in one place app that aims to help you save money.

There are loads of budgeting apps on the market, so why is this one so special? Well, Emma is really easy to use and is a great tool to help you keep track of your savings.

One of the key functionalities of the Emma app is its ability to track spending across multiple bank accounts and credit cards. By aggregating this data, users can gain a clearer understanding of their financial habits. The app categorises expenses automatically, allowing for easy identification of where money is being spent and helping users to identify potential areas for savings.

Additionally, the Emma app offers budgeting tools that enable users to set financial goals and monitor their progress over time. Users can create custom budgets based on their income and spending patterns, ensuring they stay on track with their financial objectives.

Another noteworthy feature is the insights provided by the app. Emma analyses spending behaviour and offers tailored recommendations for improving financial health. This could include suggestions for better savings options or alerts about upcoming bills.

Also, security is a top priority for Emma; it uses bank-level encryption to protect user data, giving peace of mind while managing finances online.

Download the Emma App for free here on Apple or Android phones*

If you are looking for other budgeting apps then have a look at our huge post here called The 7 Best Budgeting Apps in the UK Right Now.

If you are struggling with money right now then have a look at:

103 Frugal Living Tips That Will Save You Thousands – This runs through all the ways that we save money as a family. It includes everything from food to saving money on household bills.

No Money for Food? This is What You Do When You Really Have No Money To Feed your Family – If you are struggling then this post helps you to find the right people that can help.

Money Saver: This is How we Saved Over One Thousands Pounds in a Year – If saving is your goal then read here how we save money ourselves.

Free 20+ money saving printables

If you are looking for more ways to save your family money then come join our free Resource Vault. It’s packed full of printables that you can use for free over and over again.

Join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

What is Emma app?

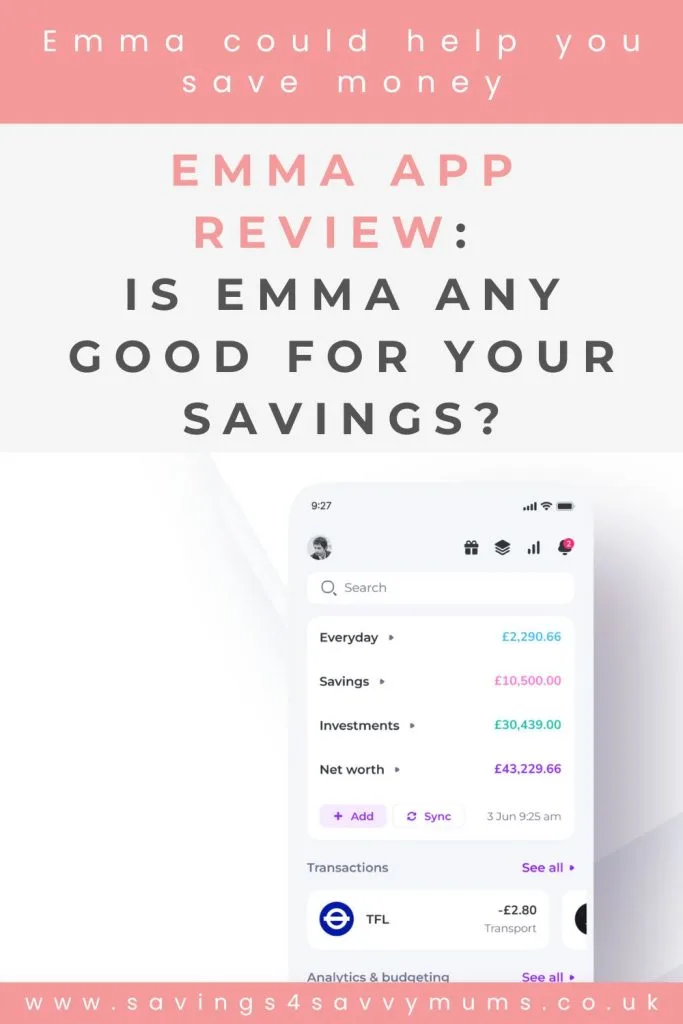

Emma is a money management app that uses open banking. This means that you can link all your bank accounts to the app and see all your accounts in one handy place. With its user-friendly interface and comprehensive features, it stands out in the crowded market of financial management applications.

Is the Emma app trustworthy?

Emma is a personal finance management app designed to help users track their spending, budget effectively, and manage their financial health. One of the key aspects of trustworthiness lies in how the app handles data.

Emma employs robust encryption protocols to protect users’ personal and financial information. Additionally, it only partners with reputable banks and financial institutions, ensuring that sensitive data remains secure. The app also adheres to strict privacy policies which outline how user data is collected, used, and stored.

User reviews provide further insight into the trustworthiness of the Emma app. Many TrustPilot users report positive experiences regarding Emma’s ease of use and effectiveness in managing finances.

However, as with any digital tool, it’s important for potential users to read through both positive and negative feedback before making a decision.

Of course, while no application can guarantee absolute security or satisfaction for every user, Emma appears to be a reliable choice in our opinion for those looking to enhance their financial management skills, but always consider your individual needs and conduct thorough research before committing to any financial tool.

Is the Emma app safe to use?

Yes, the Emma app is safe to use. They are registered with the Financial Conduct Authority and unlike a bank, don’t hold your money. They show all your accounts in one place and try to advise you on ways you can save money.

That does mean that they are handling a lot of your financial data though. This done using bank-level security and they only have read-only access. This means that they can’t move any money or do anything without your permission, pretty much like a retail bank.

Download the Emma App for free here on Apple or Android phones*

Emma app features

The Emma app is pretty impressive. It offers a lot of useful features that can really help you save money.

Money dashboard – This is where you can see all your accounts in one simple app. You connect everything from your credit cards to your debit and investment accounts. What we like is that it’s really simple to add the accounts and looking over your whole portfolio really helps to keep your money in check.

Spending habits – What we like the most is that you can set Emma up however you want to manage your spending habits. You can have the app look from payday to payday to see how much you are spending and what on or do it weekly. Whatever fits in with your current financial plans.

Monthly budgeting – The Emma app can help you to budget. It looks over what money is coming in, what you are currently spending, and works out how much you can save and how much needs to go to your bills.

Manage subscriptions – A great thing about the Emma app is that it tracks wasteful subscriptions and lets you know which one’s you need to cancel.

Custom categories – You can set the app to sort out all your finances in handy categories so you can quickly see how much you are spending on lunch or on your bills.

Spending tracker – The app can go into real detail on what you’ve spent or saved. You can really dig down into the data if you want to.

Bill saving – The app reviews all your bills and can suggest places where you could be saving money. This could be on your mobile phone bill, energy bill, or insurance.

Set saving goals – You can set saving goals and Emma can help you reach them. The app can suggest how much you can afford to save as well as how much you need to save to reach your goal.

Bank fees – The app can show you quickly which accounts are incurring charges.

Cashback – One plus is that they offer cashback on any offers you take up within the app. So for example, if you use their switching service for your energy bills then you’ll receive some money back.

Friend mode – They have a mode that means you can show a friend how the app works without showing them your account details. They also have a great referral scheme if you recommend a friend.

Download the Emma App for free here on Apple or Android phones*

How does the Emma app work?

If you haven’t already, download the Emma App for free here on Apple or Android phones*. The app will then talk you through how to add all your accounts to it.

You can even start with just one if you prefer until you really get the feel for it. if you are used to online banking then this will be really easy for you. If you’ve never used a banking app before then you may need a little help to get started as you do need to enter in your bank account details.

The whole idea of the app is for it to help you keep track of your money and plan for the future. Think of it like a fitness app tracker. It’s there to keep you on track and informed of your progress.

By adding all your accounts, the Emma app can really see where you are financially and help to guide you depending on your goals. It can even look at historical financial data if you want to dig deeper into your own financial history.

Can anyone use Emma?

The Emma app really is for anyone that needs help to manage their money. Don’t worry if you aren’t overly technical as the app is really easy to use and their in-app help guide lays out step-by-step how each feature works.

It does what it says on the tin really. Once loaded, you add your accounts and you can set your goals and it will help you to reach them.

We use it more for the dashboard and to see all our accounts in one place. It has helped us to save money though especially on our energy bills.

Download the Emma App for free here on Apple or Android phones*

How much does the Emma app cost?

The Emma app is designed to help users manage their finances more effectively, and understanding its pricing structure is essential for anyone considering its use. The app offers a free version that includes basic features such as budgeting tools, expense tracking, and financial insights. However, for those seeking a more comprehensive experience, Emma also provides a premium subscription option.

As of now, the premium version costs approximately £4.99 per month or £29.99 for an annual subscription. This upgraded plan unlocks additional features such as enhanced budgeting options, customisable savings goals, and advanced analytics to give users deeper insights into their spending habits.

Why use the Emma app?

We like the Emma app as it is really easy to use and doesn’t take any brainpower to work out what is going on with our money as the app works it all out for us.

They support loads of the major retail banks including American Express, TransferWise, and Ulster Bank which some of the other budgeting apps don’t.

Download the Emma App for free here on Apple or Android phones*

Investment wise they support all the big names but don’t currently support FreeTrade, Vanguard or MoneyBox.

We use it mainly for its budgeting capabilities really. It lays out really simply what you’ve spent in categories and you can set these for whatever time period you like.

Related Posts:

- Bank Account Skimming: An Easy Way to Save For your Next Family Holiday

- How to Pay Off Credit Card Debt

- The Best Children’s Savings Accounts – Which Account is Best?

We set ours over a month and can clearly see that at times we’ve done over our “takeaway budget” a few times but are under on our “petrol budget”. All these details can be pulled up quickly. The app can also give you an average spend looking at past data so you can quickly see how much you “normally” spend on certain items.

The Daily Balance tool is also really useful. Because it syncs all your accounts, you can quickly see what is actually in your account. We set up a morning notification so it bings straight to my phone.

Does the emma app affect your credit score?

Emma is a personal finance management tool designed to help users track their spending, budget effectively, and manage subscriptions. Importantly, using the Emma app itself does not directly affect your credit score.

Credit scores are influenced by various factors, including payment history, credit utilisation ratio, length of credit history, types of credit used, and recent inquiries. Since Emma does not involve applying for new credit or making any financial transactions that would typically be reported to credit bureaus, it remains neutral in terms of affecting your score.

However, while the app does not impact your credit score directly, it can indirectly contribute positively to your financial health. By providing insights into spending habits and helping you stay on top of bills and payments, Emma can encourage responsible financial behaviour that may improve your overall creditworthiness over time. Therefore, while there is no direct correlation between using the Emma app and changes in your credit score, utilising such tools can certainly support better money management practices that benefit your financial standing in the long run.

Are personal finance apps really helpful?

Personal finance apps like Emma have gained significant traction in recent years, prompting many to question their actual effectiveness. These applications offer a range of features designed to help users manage their finances more efficiently. From budgeting tools that track spending habits to investment tracking capabilities, personal finance apps aim to simplify the often daunting task of financial management.

One of the key benefits of these apps is their ability to provide real-time insights into one’s financial health. Users can easily categorise expenses, set savings goals, and receive alerts for upcoming bills, which promotes better financial habits. Additionally, many personal finance apps utilise data analytics to offer personalised recommendations tailored to individual spending patterns.

However, it is essential for users to approach these tools with realistic expectations. While they can be incredibly helpful in organising finances and providing guidance, they are not a substitute for professional financial advice or thorough knowledge of personal finance principles. Ultimately, the effectiveness of personal finance apps largely depends on how actively individuals engage with them and incorporate their insights into daily financial decisions.

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.