Including free budget planner templates

If you are looking for free printable budget planners that can help you to save money as a family then this post is for you. All of these budget planners can help you save money and budget right.

We’ve pulled together as many creative and free printable budget planners that you can use to help you keep your money on track.

These are all perfect if you like to have a physical copy of your budget up, front and center.

How to make sure that you stick to your budget

If you are new to budgeting, then it can be hard to know where to start. Knowing your income and outgoings is the first step you need to take when you are trying to take back control of your finances.

Despite the name, creating a budget doesn’t mean you have to be frugal or only spend the same amount every week.

Having a budget means knowing exactly what you’re spending compared to your incomings.

You should also remember to account for annual costs, such as Christmas, birthday presents, car costs, etc.

Creating your budget will give you a clear starting point, so that you know where your finances stand before you decide to either start cutting back or make more money.

The first thing to work out is, do you spend more than you earn?

Use your instincts. Do you have any money left over at the end of the month? Are you eating up your savings or building up debts?

Major overspending can lead to a debt spiral and severe problems, that’s why using a budget planner every month is a good idea and can answer these questions quickly for you.

Yet before you can solve any issues it’s important to get an accurate idea of the size and scale of the problem.

Before you start using a budget planner remember that:

Your bank account lies! When you check it, it only shows you a simple snapshot of the scene that day. It misses out what payments are due in or out, when direct debits are paid, and when you need to go shopping. Never think that having cash in your bank account means your budget is balanced. Being overdrawn is definitely a good indicator that it isn’t.

Monthly budget planner

Our top budget planning tips for families who are just starting to manage their money are:

Look at the last three months

Look through your shopping bill, your last energy bill, annual bills and anything else you spend your money on. Be honest with yourself. Then divide it by three to come up with your outgoings.

The aim is to have your books balancing – so you’re not spending more than you earn. To do that, you need to work out how much you spend on and on what.

Choose your categories

Once you’ve done that, you need to scan through and decide what your categories will be. This could be petrol, Christmas saving, clothes, food, hobbies etc. Then you need to decide how much from your wages you can use for each of your categories.

So how do you keep this handy?

Put it somewhere that your whole family can see it. This could be on the fridge or in the living room somewhere. Having the whole family involved can really help get them all on board with your money-saving.

If you do prefer electric saving planners then have a look at:

Plum – Plum is a free app that helps boosts your bank balance*. It’s the smartest app for managing your money. It analyses your spending patterns and automatically puts your money away for you, so you don’t have to think about it.

It takes all the pressure off you having to do anything. By using a smart AI app, you can get a better grip of your finances and set more aside.

Read more about how Plum works here.

Download Plum for free here on Apple and Andriod devices.

Snoop – Snoop is a free money management app that was created to help you manage and save money. Snoop wants to help you make smarter choices and get on top of your money.

Snoop is free to use and you can download it here for free on your Apple or Android phone*.

Read more about how Snoop works here.

If you like the sound of saving with your phone then have a look at The 7 Best Budgeting Apps in the UK Right Now.

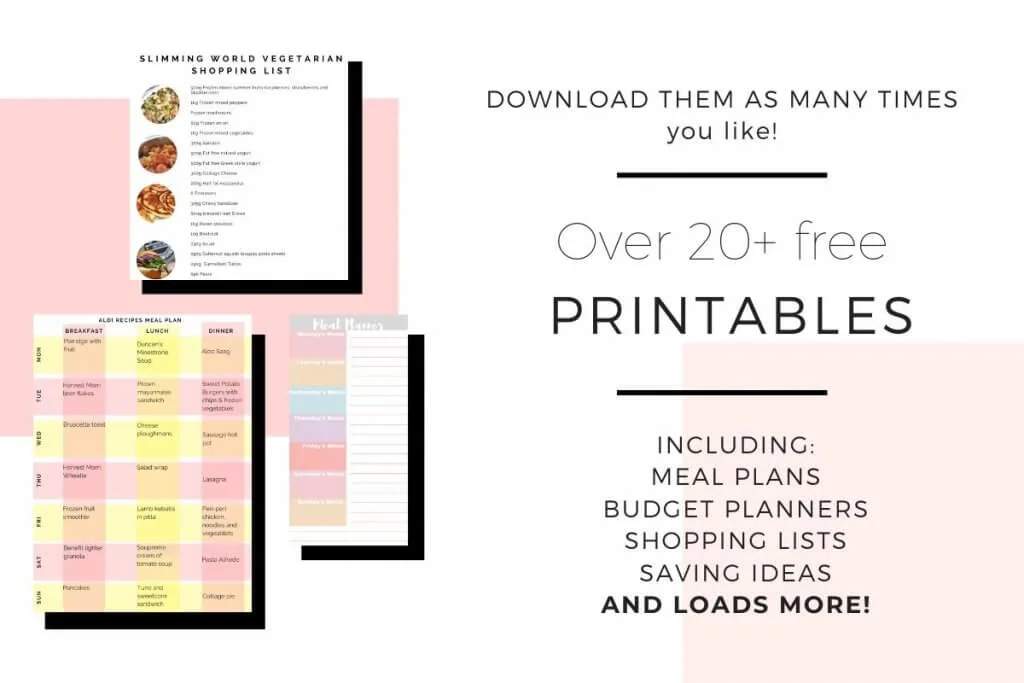

Over 20+ Free Printables

If you are looking for free printables that can save you money then come join our free Resource Vault. You can print them off as many times as you like.

Join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

Free printable budget templates

These free 15 weekly budget planners can really help you to save money. They range from budget binders to printable planners to financial goals.

They can all help you manage your cash flow and personal finance.

Printable Budget Planner

Our money tracker is a great daily planner that helps you to track your family expenses. This is completely free to use and can help you to keep track of your money.

Download it free here by joining our Resource Vault.

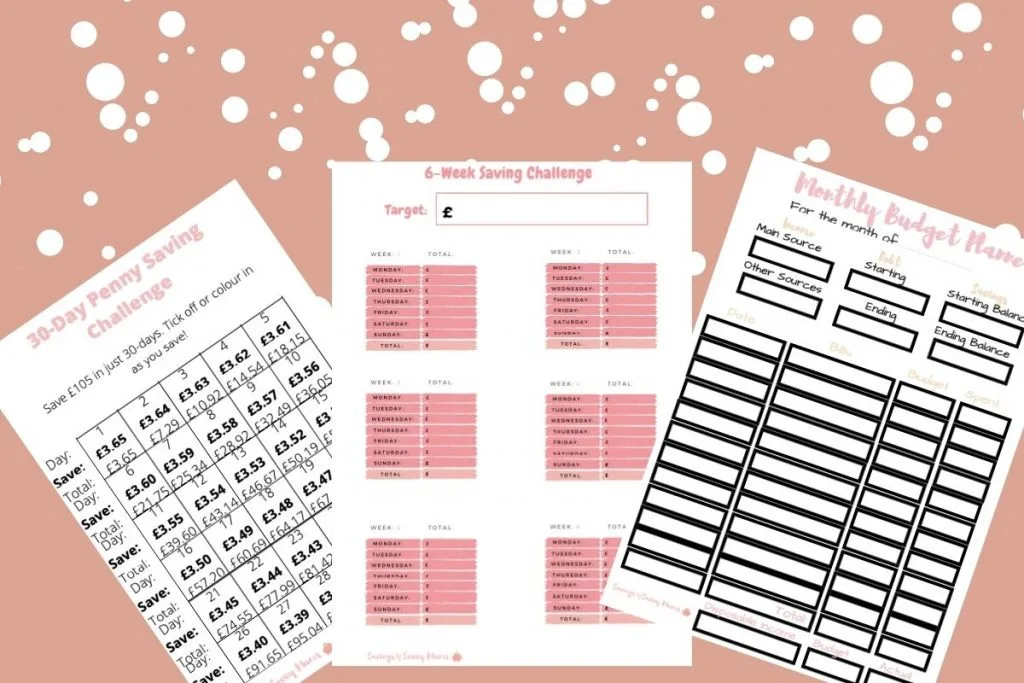

1p Saving Challenge

The idea behind this challenge is that you save an increasing amount per week for each week of the year. In week one you save £1, week two you save £2, three you save £3 until you’re saving £52 by the last week of the year.

We prefer to do it in reverse. Find out how it works by reading our post 1p Saving Challenge: How to Save Over £100 in 30 Days.

Download it free here by joining our Resource Vault.

Christmas Saving Challenge

With Christmas always around the corner, I need to save hard. There’s not a lot of saving planners out there if you want to start halfway through the year or any that will help you save a good amount of money by the 1st December.

This one is a 7-day challenge that gets you saving per days of the week and could help you save a massive £364!

Download our Christmas Saving Challenge here from our free Resource Vault

Budget Workbook

Never Be Broke Again workbook by Monethalia.com is a great way to teach your family about how to manage their income.

Print it off here and see how it can help you

Child Maintenance Planner

This is a godsend from Lee at Homely Economics to any parent trying to apply and keep track of child maintenance money. Use it and see how it can help you keep track.

52- Week Saving Challenge

If you plan to start the new year off as you mean to go on, then this saving challenge by Simplistically Living is great.

It lays it all out and gives you the option to tick off as you go.

Monthly Budget Spreadsheet

This spreadsheet is a great way to manage your monthly budget by Money Saving Central. It covers everything from utilities to home expenses.

Side Hustle Tracker

This side hustle tracker is a great way to manage your income. Write down the date and how much you received. This helps you to keep track when it’s time for self assessment too.

Download it here from the Side Hustle Directory.

Out of Debt Workbook

This binder from One Beautiful Home is a fab collection of payment trackers, budget check-ins, and irregular income reports.

Holiday Budget Worksheet

It may be September, but we’re already starting to think about next years holiday and how we can save.

We have the dreaded school holidays to now think about, so a summer holiday is now going to be that much more expensive.

That’s why I love this printable. It lays out what you expect to spend on your travels and what you actually spend.

Out of Debt Workbook

This binder from One Beautiful Home is a fab collection of payment trackers, budget check-ins, and irregular income reports.

Related Posts:

- 19 Cheap Food Shopping Hacks That Could Save You Hundreds

- How to Pay Off Credit Card Debt

- The 7 Best Budgeting Apps in the UK Right Now

Budget Printable Workbook

This is a brilliant and simple printable workbook from Lee at Homley Economics to help you budget throughout the month. Pick and choose what you need, and use it!

Monthly Budget Review

If you’re looking to completely overhaul your finances, then this planner by Cass at The Frugal Family should be right up your street. It’s really simple and shows up what you’ve been spending each month.

No Spend Days Tracker

We have a lot of no spend days here, so this tracker by Cass at The Frugal Family is really useful to help you keep track of what you’ve saved.

Free Printable Food Diary

This printable food diary by the Coupon Queen is a great way to keep track of what your food bill is every week.

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.