This is how to get cheap home insurance

Struggling to find cheap home insurance? You aren’t alone. With home insurance prices rising it’s harder than ever to find a good deal to protect your home.

Using our tips below can help you save money, save time and make sure you get the cheapest deal.

When it comes to finding cheap home insurance, there are a few tips and tricks that can help you save some pounds. First off, shop around! Don’t settle for the first quote you get – compare prices from different providers to find the best deal.

Another tip is to consider increasing your excess. By opting for a higher excess amount, you could lower your monthly premiums. Just make sure you can afford the excess in case you need to make a claim.

It’s also a good idea to see if you can get discounts by bundling your home insurance with other policies, such as car insurance. Many insurers offer discounts for multiple policy holders.

So, don’t break the bank on home insurance – follow these tips and get yourself a great deal!

How to get cheap homeowners insurance

The step is making sure that you are getting the right insurance for you.

Building insurance covers the outside of your home and any fittings. Contents insurance covers the items in your home if anything happens. Items that you couldn’t afford to replace yourself.

They can both be combined into one but this might only work if your home is freehold and you own it. If you rent or lease, you may not need buildings insurance as this is something that is normally covered by your landlord or the person who owns your building.

Contents insurance though will still be up to you as the items in your home are yours.

Make sure you read all the terms and conditions carefully as what’s not included and what is can be tricky and varies between providers.

We have recently switched by using MoneySuperMarket. It’s a great way to get all the best quotes in one place.

What we liked most about them though is that you get to play around with what you want to insure and how much excess you want to pay. We try to go with a lower yearly fee and more excess as it tends to be cheaper.

We found this brought down our policy cost over the year. They even offer accidental damage cover as an extra if you need it.

Make sure you are upfront though with what you want covered and read all the terms and conditions carefully as you want to make sure your cover fits you.

Money Saving Challenge

If you’re looking to save your family more money or are unsure how to kick start your savings, then come join our free Money Saving Course. It’s a six-week money saving email course that will give you tips on how you can make everyday savings. These are simple things that the whole family can do!

Join our free Money Saving Challenge here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

5 top tips when you are looking to buy home insurance

These tips work if you are looking for a better renewal price or if you’ve never had a home insurance policy before.

1. There’s no need to over cover your actual building.

It’s what it would cost to actually rebuild your home as it is. Ignore the market value of your home. This is a common misconception. The insurance company want to know how much it would cost them to rebuild your house if it had to be rebuilt from the ground up.

Think of the cost of the materials, labor and the hotel bills while you and your family are waiting for your home to be rebuilt.

It can be daunting finding out how much this is. You can find all this information out using the survey that you had done on the house. This works best if you’ve just moved or are moving into a new home.

If you’ve been in your home for a while then have a look at the Association of British Insurers who offer a calculator which may help you get close to the sum.

2. Go over on your contents

Think of everything that you own in your home. Could you afford to replace it if the worst happened? If not, then it’s really worth making sure that you are fully covered.

Go through your house and note down the items that are most expensive. Think TVs, laptops, phones and any other devices you may have. Do you have any designer clothes or shoes? What about the furniture?

This is why we liked Buzzvault. Doing their face to face survey meant that everything is covered and there won’t be any shock if we do have to claim.

Think of it this way. If you forgot something or even guess how much your contents is worth and it’s under, you’ll only be able to claim for that amount.

3. Auto-renewing your cover costs you more

Loyalty really doesn’t pay! Make sure that you are ringing around or using as many price compassion sites as you can to find out how much your next year will cost you.

There’s nothing stopping you from then phoning your existing supplier and seeing if they can match it. What’s the worst that can happen?

Get as many quotes as possible. It’s worth it!

4. Think about better locks

Getting the best door locks and making your home secure is a great way to save money on your home insurance. Many insurance companies want to know what locks you have. This is for good reason. They want to know how easy it is to get into your home.

Did you know that if you put the wrong locks down when you buy your policy it could invalidate it? Make sure you are in the know!

If your house isn’t as secure as you think it should be then it may be worth calling your insurance company and asking them how much your policy would drop if you invested in better locks.

Think of it this way, yes, you would have to pay out for new locks now but that could save you money on your policy in the long term. It’s worth finding out.

5. Set a reminder three weeks before your policy is due

This is a strange one but many compassion websites have said that they have found their customers better deals when they renewal three weeks before they are actually due.

We don’t know if there’s something in it but it’s worth having a look if your policy is due soon.

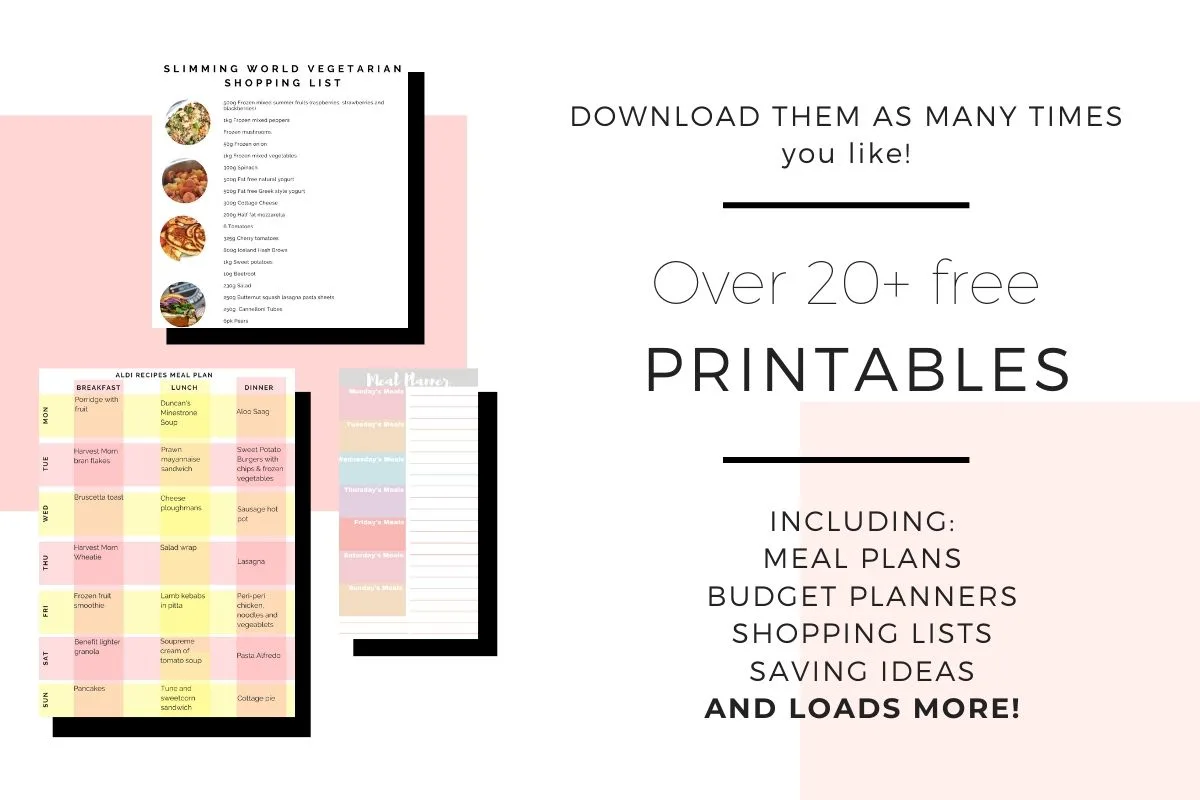

Free 20+ Money Saving Printables

Use our free money saving printables to help you and your family save more money. You can download our printables as many times as you like!

Our printables included everything from meal plans and shopping lists to budget planners and IOUs for gifts. This also gives you access to our free Money Saving Mums Facebook group too.

Join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

How to buy cheap home insurance

Here are our steps for making sure that you get the cheapest home insurance quotes with the best home insurance cover you can.

It does take time but it’s worth it.

If you’ve done all these steps before then have a look at MoneySupermarket. You can get a free quote from them and if you use our link here, you could also get some of your money back on your policy too.

Please note that none of this is advice. This is just our own experience and we hope this helps you too.

Look at comparison sites

Pick three that also offer you some sort of incentive like money off movies or days out. We pick three as no one site covers the whole market and this way you really do get to see a wide range of quotes.

Don’t worry about these affecting your credit score. These are soft searches. The only time these might affect you is when you actually come to apply for the insurance.

Look at the insurance companies that aren’t on compare sites

Think Direct Line and Aviva. It’s worth checking their prices too.

Related Posts:

- 9 Secrets To Saving Money on Your Car Insurance

- 101 Frugal Living Tips That Will Save You Thousands in 2020

- 23 Best Ways to Save Money and Reduce Food Waste in the UK

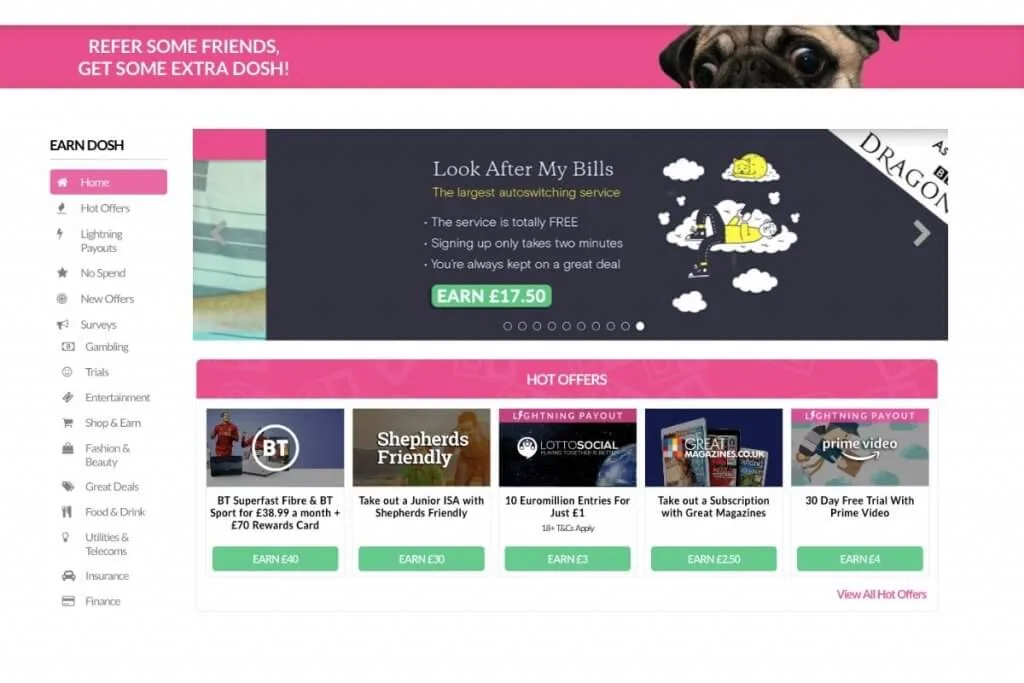

Check cashback sites too

You never know but find out how much cashback you could get back for buying your insurance through a cashback site then direct.

Our favourite cashback sites are:

OhMyDosh* – Use our link here to get £1 added to your account now. They are free to use and are a great option when you are buying online.

Read our review of OhMyDosh here and how we find them.

Swagbucks* – More than just a cashback site, Swagbucks also helps you make money by entering surveys as well.

Read our review of Swagbucks here.

Quidco* – Quidco offer new and existing members loads of offers and extra ways to make more money.

Searching the cashback sites to mean that you are guaranteed to be getting the best deal you can.

Make sure that you read all the terms and conditions before you buy through a cashback website as you may not get the cashback if you haven’t adhered to all their rules.

Also, make sure you cash out straight away. It’s not cash or your money in till it’s in your own bank account.

We’ve been lucky before though and got our insurance through a cashback website and got more than out policy in money back!

Have a look at our post here on The Best Cashback Sites to Save £100s When Shopping Online

Check the policy

Your home insurance policy will only be cheap if it works for you. If you haven’t read all the terms and conditions or been honest then it could end up costing you thousands of pounds.

Double-check everything. Is the final amount right? Is your buildings cover correct? Have you covered for all your content?

Look at the excess payments. Play around with them to see if this lowers your policy. Make sure you can afford to pay it though if the worst happens.

If you think something is wrong after you’ve brought the policy then first off ring your insurance company. If you are still not happy then make a formal complaint with them.

You can go further to the Financial Conduct Authority if you feel like you aren’t getting anywhere too. Make sure you know your rights.

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.