This is how to save hundreds off your car insurance

You’ve probably felt the pinch already, but with car insurance premiums at their highest level, and set to rise further, it’s now been estimated that the average policy costs a staggering £462.

We’ve all seen the headlines recently. More rises are coming and are predicted to increase all our premiums by around £75 for the “average” driver, while younger, those under twenty-two and older, those over sixty-five will be the worst hit, with increases suggested of up to a staggering £1000.

To avoid being hard hit by this upward cost, here are 9 ways you can save money on your car insurance costs.

If you are looking for more saving money tips then have a look at:

103 Frugal Living Tips That Will Save You Thousands in 2022 – If you need to save some serious money then start by looking at our blog post here. We cover everything you need to keep more money in your pocket. All these, we do ourselves!

How to Pay Off Credit Card Debt – If you have credit card debt that feels huge then you need help. Read our post on how to get out of debt and the free help you can get.

The Best Way To Save For a House – Saving for a house can feel like a huge goal but with our saving tips here you can make it quicker than you think.

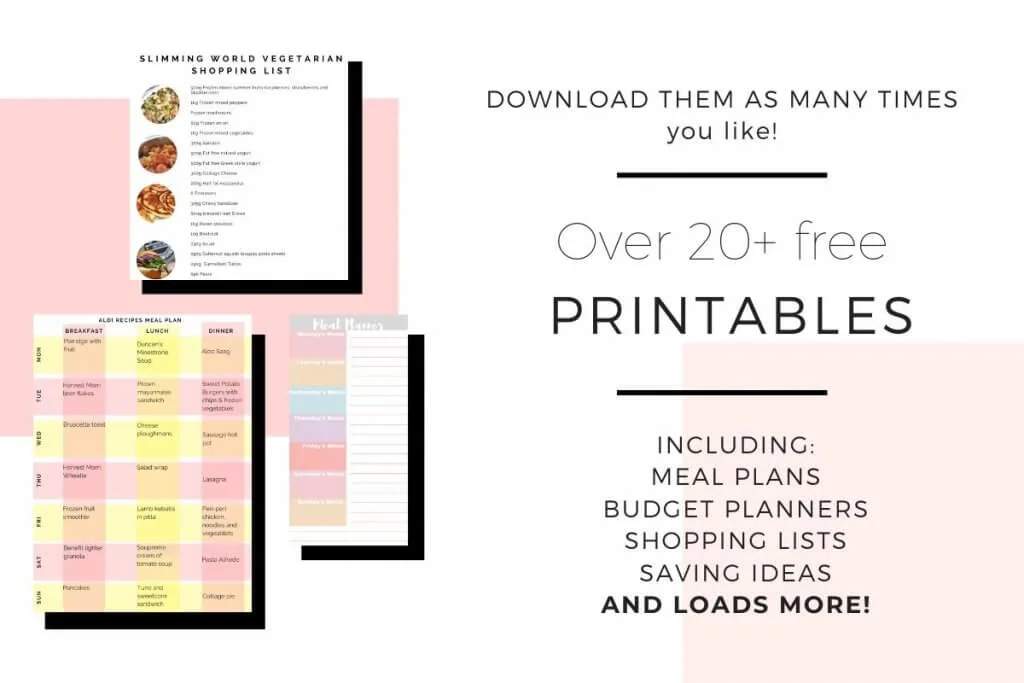

Free Money Saving Resources

If you are looking for more ways to save your family money then come join our free Resource Vault. It is packed full free printables that you can use over and over again.

Join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

What is car insurance?

Car insurance is a legal requirement for anyone who owns a car. It covers your car for anything that could happen to it like if it’s stolen or if you have an accident. It protects you if you accidentally hurt someone else’s property.

The cost of your own car insurance all depends on your risk factor. An insurer decides how much risk you could be at. So for example; how likely you are to have an accident.

If you are a new driver or a young person then they may deem you a risk factor as you have less experience than other people on the road.

That said, if you have had a few accidents and you’ve had to claim then you may again be deemed a risk.

You have no control over how much risk a car insurance company thinks you are. They base it on a range of factors that only they know. You must tell the truth though as lying about your policy can make it invalid.

Even if you don’t drive your car it must still be insured unless you declare it off the road officially. This means that you will never drive it.

9 ways to get cheap car insurance

Over the coming year, car insurance premiums will rise, without a doubt, and it’s not just yours, but millions of businesses will be affected too.

Already 12% higher than last year, and adding in this new hike, car insurance is now more expensive than ever, with the younger and older generations taking the biggest hit.

These 9 tips will hopefully save you hundreds of pounds.

Paying monthly is a killer

Think of it like a high-interest loan, as that’s what it is. Most companies charge a whopping 25% APR, which is a crippling amount.

If you can’t afford to pay your car insurance off in full, then have a scout about for a 0% spending credit card, or at the very least a low APR one, making sure your repayments are big enough to clear it in time.

Loyalty doesn’t pay!

Anyone else get frustrated when your renewals quote doubled last year and sticking your details in as a new customer lowers by half? Yep, we’ve all been there.

Use price comparison sites, call around for some comparable car insurance quotes then call your insurer directly and haggle, if they match it, or better beat it, you’re quids in!

Use price compassion sites to get an idea of how much your premium should be. This gives you a good idea or base range to then haggle with your own insurance company first or switch if the quotes are a lot cheaper.

Third party cover

You may think that a third party is the cheapest option because it offers a lesser cover, but you couldn’t be more wrong.

Insurers base everything on how risky they think you are. Think of it this way, if you’re a new driver, chances are you’re going to bang into something at some point, hence, you’ll have to pay more.

If you have a few years no claims behind you, your proof that you are a safer driver, and look after your car by storing its safety, then you’re deemed less risky.

By picking a comprehensive cover, the insurer already feels like you are TRYING to lower the risk, hence, normally the lower price.

Make sure your car insurance cover is correct as it could save you more in the longer term, especially if something happens to the car.

Add a second or third driver

I know it sounds crazy, but by adding a driver or two that the insurer deems “experienced” could cut your costs by £1000!

It doesn’t just work on younger drivers either. It worked on mine recently. By just adding my husband, who is six years older and who has five years of no claims, reduced my premium to £265. Remember, by law, insurers can’t discriminate over gender, but driving experience and history can really make a difference.

Try different insurers and add different people; see what happens. Never add someone as the main driver if they’re not. It’s fraud and could make your claim invalid.

Tweak your job description

Something as simple as changing your title from an editor to a journalist could save you hundreds of pounds. MSE has a great car insurance job picker tool, that can help you see if changing your role could save you cash.

Many insurance companies use different job descriptions to decide risk. As long as you are NOT lying then it is ok to have a play around with what you call yourself.

Switching early could save you money

With prices rising now, it’s more important than ever to make sure you are paying what you can afford. Switching early could save you a bundle in the long run, especially if you’ve never tried it before.

If you haven’t claimed on this policy, cancel it, and get a refund for the remainder of the year.

Sometimes, there’s an admin fee, anything from £25-£50, but your savings should far outweigh this.

Tip: The longer you’ve got on your policy, the more likely you’ll save by switching. We found around the 20-day mark to be a good time to start switching.

Have a look at the cash back sites too. We use:

OhMyDosh which is a great cashback site that is free to use. Search their site before you commit to anything and see how much money you could get back.

Use our link here to sign up to OhMyDosh* and have £1 added to your account.

Read our review of OhMyDosh here.

Quidco is another great cashback site to check out. We love them because they are easy to use and they pay quickly once you’ve purchased them.

Use our link here to sign up to Quidco for free.

Like all cashback and price compassion sites, make sure you check the terms and conditions before you agree to the policy to make sure that you receive your cashback.

Some insurance companies also offer other benefits like breakdown cover, no claims bonuses, or travel insurance. Shop around and see what you are offered.

Keep it simple

If you’re lugging the kids to and from gymnastics and only do the school run, then those tinted windows and fat boy tyres your brother-in-law talked you into are properly a bad idea. Apart from security, changes made to a car will be added to your insurance premium.

The best way to save? Add extras like an alarm or an immobilizer and watch your premium drop considerably.

Use multi-car insurance

If you have more than one car registered at your home then multi-car insurance could be for you.

make sure you check how much it would cost you as an individual than under one policy.

Related Posts:

- The Best Saving Water Tips for Families

- How to Afford Maternity Leave in the UK

- Saving on Electricity: How to Save Electricity at Home

Higher voluntary excess

By agreeing to pay more excess if you have an accident, could bring your premium down by hundreds.

Make sure you can afford the excess, though, just in case, and remember if it’s set at £500, and you could get the damage repaired cheaper yourself, then it’s worth doing that.

All these tips may take a little time, but they really can save you money, and in my case, hundreds of pounds off your car insurance policy.

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.