Including how to teach your child the value of money

From saving up pocket money to receiving their student loan, it’s more important than ever for our kids to grasp the concept of money.

I recently read an article that said that eight out of ten parents think it’s important to ensure their kids know how to manage money but have no idea where or how to start.

Educating children about money

Many think it should it up to the school to educate kids on money, and research from financial firm M&G found that many parents believe that subjects such as savings, value for money, and budgeting should all be taught at school.

Is it any wonder that many parents feel like this when they themselves may be in debt or struggling with day to day bills, the rise in childcare costs, and food.

While I do believe that it is a critical life skill, I still believe (rightly or wrongly) that parents are the greatest teachers. Being able to show that you are financially savvy, and have the skills and confidence to handle finances, might just be one of the most important things you can teach your child.

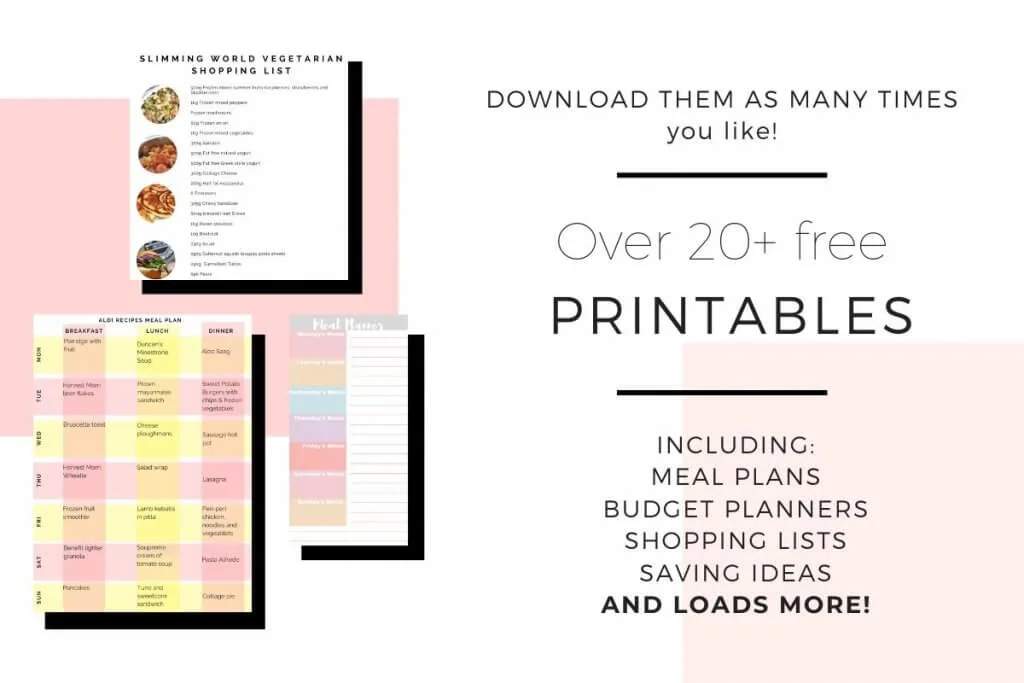

Money saving printables

If you are looking for more ways to save your family money then come join our free Resource Vault. we have packed it full with budget planners and shopping plans that you can use as many times as you like.

Join our free Resource Vault here

(By joining giving us your email address you are consenting to us emailing you about our other travel, home and lifestyle ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

How to teach your child to save money

First off, make money real.

I don’t think it’s ever too early to teach kids about money, especially now, when we, as a society are (me included) are choosing to do more and more of our banking or shopping online, deeming notes almost invisible. The most many kids see of money is it coming out of a cash machine, and think this is the norm.

For ages, my 4-year-old just assumed you got stuck your card in, and it gave you cashback. I wish!

Explaining that the hole in the wall was run by the bank really helped and that a bank was there to look after money that I’d earned working.

Playing shops with real coins helps them actually see and feel money, not just the fake plastic stuff.

Ideas for teaching money

We started at the tender age of three offering pocket money. This encouraged and reiterated the fact that this was their money, and once it was gone, it’s gone.

They both had little jars, so every time they got birthday money or did something good, say, had no accidents all week or helped tidy up, they would have 20p for their jar.

This helped encourage them to save toward something they wanted, aka sweets.

If they were extra good, we would match what they had in their jars when they came to spend it, so if they had £2, we’d add £2 and add any extra birthday or Christmas money to the fund, so they knew exactly how much they had to spend, and could watch it decrease as they spent it.

Kids spending money

It may be a bit embarrassing for you, but talking to your kids about how much you earn is a great way to get everything out in the open and you all talking about money.

I used to dread it when the kids asked for an ice cream when we’re out, as I knew I just couldn’t afford it. After saying “sorry, I just don’t have enough pennies” too many times, the kids asked me why not?

So I explained, rather red-cheeked, in front of friends as well, that I work part-time, in the evenings, while they sleep. That I do earn money but it’s a little bit that goes towards making sure they can go to ballet and swimming, but not enough for treats every week.

I showed them my wallet, and they asked why the two brown coins couldn’t buy them what they wanted. I then had to explain about different coins and notes and they’re worth.

It wasn’t easy, and to be honest, was mega embarrassing for me, but I realized then that if I came clean earlier, I could have saved myself the hassle.

Now The Eldest is 4, she comes shopping and ticks everything off the list, and asks if she can extra in. It took a while, but she knows realises that mummy only has a certain amount with her and that the list comes first.

You’d be surprised how many of my friend’s kids with tweens know the value of a pair of shoes, but not a pint of milk.

Kids with money

Mine are still young, so I still pay for most things, but make them pay for sweets out of their own money. When we get home, we count out what they have left, so they understand where the money has gone.

I’m fully aware that as teens, I’m going to have to bail them out once or twice, but the pain on putting a hard fixed date on repayment, like any bank would, but without the interest. (Come on, I’m not that mean!)

How to explain money to a child

Okay, I’m not completely deluded. There’s going to come a time very soon when my 4-year-old wants something or the 2-year-old wants more sweets, and they don’t have any money left.

There’s also going to come a time when they start doing chores or start work, and realise that long hours don’t mean high pay, but isn’t this how we all learned?

That first job teaches us all that working hard brings in money, and then we get what we want.

Word of warning though, as I think they apply to any age: Trying to control what they spend their money on is a dud. Yep, it might be on something you deem stupid or a fad, but apart from mildly trying to advise them, even at 2-years-old, you’re pretty stuck.

Money tips for kids

Using coins, try and explain why you don’t have any money this week.

Take a coin out of the circle and explain that’s for the petrol, that’s for gymnastics club or soft play you did this week.

This is an easy way to try and explain the difference between a wage and disposable income.

Money ideas for kids

When the kids are older give the kids some money independence. This could come in two ways.

You could give them any pocket money on their own debit card. This means that they can spend their money when they are out and about plus they get statements – which means they can track their money and see how they spent it over the month. There are some great digital banking for kids and teens options around.

Related Posts:

- Money Saver: This is How we Saved Over One Thousands Pounds in a Year

- Bank Account Skimming: An Easy Way to Save For your Next Family Holiday

- 101 Ways to Save Money on a Tight Budget

GoHenry – GoHenry works by giving your kids access to their money and you overview. The kids can’t go overdrawn and it’s all managed online using one account. You can have multiple accounts linked to yours as well. It’s really quick to set up and you can set up an automatic weekly payment to the card if you’d prefer. You can even set up a spending limit if you prefer.

Try GoHenry for free here for one month.*

Roostermoney – Roostermoney is more about saving than spending. This gives the kids complete control over their savings. They can set up saving goals. so for example, if they want a Xbox then you set that up on Roostermoney and they can watch their saving goal rise. This stops them from just spending their money on anything. They offer different levels from goal setting right up to having a debit card they can spend with.

Try Roostermoney out for free here*

These are a great way to teach kids how important managing money is.

Laura x

If you enjoyed this post and would like some more family friendly money managing ideas, then head over to the managing money section here on Savings 4 Savvy Mums where you’ll find over 30 blog posts dedicated to helping you manage your family’s finance. There’s enough tips to help you save over £300 a month! You could also pop over and follow my managing money Pinterest boards for lots more ideas on how to keep more of your money in your pocket: Managing Money Printables, Managing Money for Families and Family Finance.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.

Money Web Issue #16: your weekly round up of the best of British blogging - Mouthy Money

Monday 26th of June 2017

[…] 7 ways to teach your kids about money […]