So, you’ve probably heard of this thing called “crypto”, perhaps at a dinner party or in passing chatter on the subway. At its core, cryptocurrency (or just “crypto” for the cool kids) is digital or virtual currency, secured by cryptography. It’s not backed by physical commodities or governmental fiat, which gives it a certain maverick charm and its fair share of volatility.

But, before you start imagining Matrix-like code or underground hacker conventions, let’s simplify things. Think of it as a new-age form of money, with its own set of rules and game strategies. That brings us to our agenda for the day: “5 Crypto Investment Strategies for Beginners”.

In this article we will give you a glimpse into the possibilities of earning with crypto. These strategies involve “Staking and Earning Yield”, “Day Trading”, Swing Trading”, “Dollar-Cost Averaging (DCA)” and “Value Investing”. Whether you’re looking for a brief flirtation with crypto or a long-term relationship, this guide’s got you. Now, pour yourself a cup of tea (or a glass of wine, we don’t judge) and let’s start.

Staking and Earning Yield

Crypto staking is akin to the age-old concept of depositing money in banks. Rather than merely earning interest on your savings, with staking, you play a role in validating operations on a blockchain, and in return, you earn crypto rewards.

Ethereum offers a practical example. It transitioned to a “Proof of Stake” system with Ethereum 2.0. In this system, instead of “mining” Ethereum with computational energy, individuals “stake” or lock up their Ethereum. As a staker, you support the network’s operations and, in turn, receive potential returns. Back in January 2022, this could lead to an annual return ranging from 5-15%, though this rate can fluctuate.

Day Trading

Day trading is akin to a high-speed financial dance. It revolves around purchasing and selling stocks within the confines of a single day. The primary goal is to capitalize on short-term stock price movements and extract quick profits.

To paint a clearer picture: Suppose a day trader spots an attractive stock price early in the morning and buys 1,000 shares. A mere 1% increase in its price by the afternoon can culminate in a tidy profit if they decide to sell.

Day traders often use an analysis method called “technical analysis” which studies historic price movements to predict future prices. There are many different techniques traders use like indicators that help you understand if a market is overbought or oversold, or charting techniques to gauge where a trend might be going.

Swing Trading

Think of swing trading as the middle path in stock trading, somewhat reminiscent of a surfer who waits for the bigger waves. Swing traders don’t hop in and out of the market multiple times daily. Instead, they seek profit from larger stock price shifts that happen over several days or even weeks.

A combination of tools and insights fuels their decisions. For instance, swing traders might employ chart patterns to speculate on future price directions, while simultaneously delving into the company’s financial health and other pertinent metrics to inform their moves. For beginners, we actually recommend starting with Japanese candlestick patterns as people have relied for centuries on trading with these patterns. You simply look at the chart and if you spot a pattern you take a trade in the indicated direction.

A great example of a swing trader is Paul Tudor Jones, as in the lead-up to Black Monday in October 1987, he had been analyzing the markets and spotting some worrying signs of over-valuation in stocks. Along with his team at Tudor Investment Group, he spent hours poring over graphs of the Wall Street crash of 1929, looking for patterns and insights that could help him anticipate what was coming next.

Two weeks before Black Monday, Tudor Jones started positioning his fund to trade against the market aggressively, betting that the bubble was about to burst. He was one of the few traders who saw the writing on the wall and acted on it, while the rest of Wall Street remained either oblivious or unprepared for the coming storm.

When Black Monday finally arrived, the Dow Jones dropped a whopping 22% in just one day, shattering records and sending shockwaves through the financial world. But Tudor Jones was ready. He had anticipated the swing, and he rode it all the way to a $100 million profit.

Dollar-Cost Averaging (DCA)

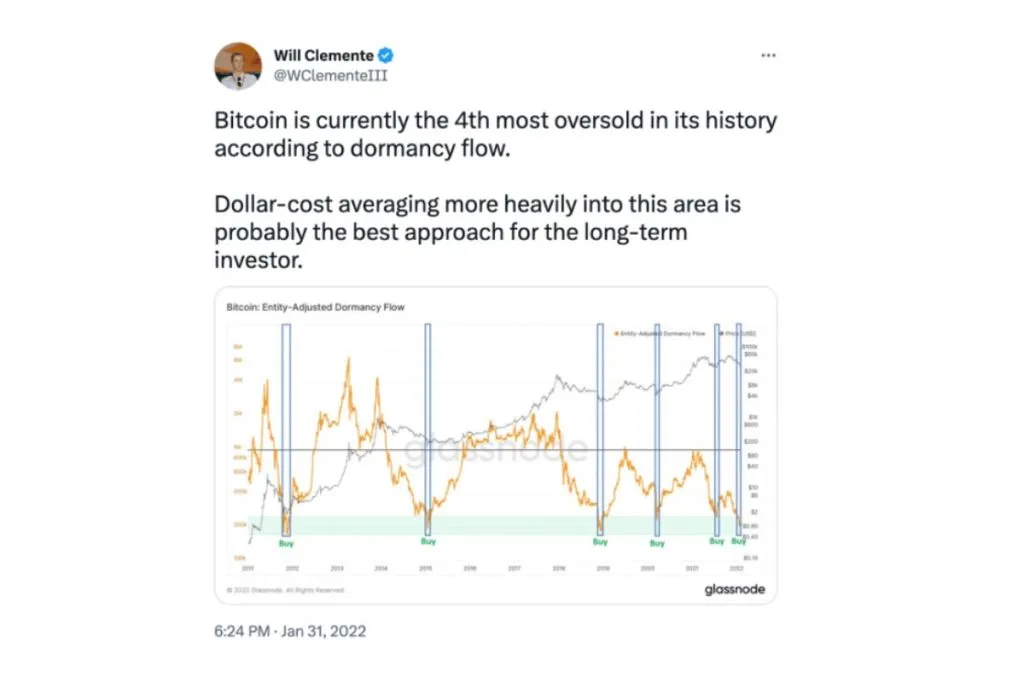

Peter Lynch aptly said, “The only problem with market timing is getting the timing right.” Enter dollar-cost averaging. It’s a strategy where you invest a fixed amount in an asset at regular intervals, irrespective of its price, effectively spreading out the risk.

While it might sound simplistic, its beauty lies in its consistency. By investing regularly, both novice and expert investors can potentially buffer themselves against market volatility.

Value Investing

In the volatile realm of cryptocurrencies, the intrinsic value represents a currency’s true worth. This value is derived from foundational pillars like its underlying technology, rate of adoption, utility, and network security, rather than fleeting market trends.

A good way to think about it is by considering the cryptocurrency’s core aspects. If its value surges rapidly and then crashes, did its base technology or user adoption change in that short timeframe? Typically, the answer is “no.” Such fluctuations usually reflect market sentiments rather than core value changes. As investor Bill Ackman wisely states, “Investing should be devoid of emotions. It demands a pure, rational approach where decisions are grounded in facts, not feelings.”

Understanding cryptocurrency is like mastering a new language; it requires patience, practice, and continuous refinement of strategy. As famed investor Warren Buffett once said, “Risk comes from not knowing what you’re doing.” Exploring various strategies is not just about maximizing returns, but also about minimizing unforeseen pitfalls. Consider the example of early Bitcoin investors who diversified their approach; while some benefitted immensely from holding, others reaped rewards through day trading during its volatile spikes. By diving deep into the diverse strategies discussed, you’re not only broadening your investment toolkit but also fortifying your position in this rapidly shifting digital landscape. It’s about crafting your unique crypto narrative, informed by both wisdom and experience.