More of us are finding it harder and harder to control our debt. During this challenging time, it’s better to get on top of your debts before they get out of control.

If you feel like they are too far gone already then please get help. The earlier you get help and let someone know that you are having issues paying the easier and quicker it is to get on top of the debt. Please do not leave it!

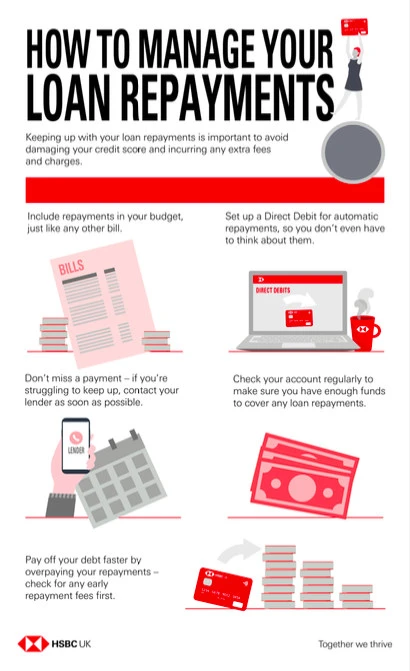

This post walks you through how to manage your loan repayments and will hopefully help you to get on top of them and feel like you are moving forward.

Step 1: Make sure you know how much debt you are in.

This may sound simple but it’s common for a lot of us to not actually know how much debt we have. Debt counts as everything from your mortgage payments to energy bills, credit cards, and any loans you have outstanding.

Use a budget planner to work out how much debt you have and your exact incomings. Remember to list things like birthdays and Christmas into the budget planner at the end to make sure that these don’t cause you any more financial pain.

Are your debts bigger than your income? If they are please don’t panic. There is always a way through and a way to solve the problem. There is always hope!

Step 2: Get help early

Don’t feel like bankruptcy is your only way out. It isn’t and is only used as a last resort. Even then there will still be a clear path you can use to get back on top of your money.

Asking for help means that you are taking responsibility and will help you to tackle your debt head-on.

If you are at the stage where you can still pay the minimum then now is the time to get hold of those companies before your debt gets out of control. Most, if not all will want to help you and can come to an agreement with you.

Do it now before you miss any payment.

Step 3: Stop spending

This may seem obvious but it’s really not. Make sure you are checking your account daily and finding out if anything is coming out that you haven’t accounted for. If it’s something that you can stop then do it.

Be brutal.

Stop all and any subscriptions you don’t need. Take lunch to work and walk if you can. These may seem like small steps but as the saying goes, they all build up.

Step 4: Check what you are entitled too

You may think that you aren’t entitled to any help but how do you know unless you check? Even getting some benefit help could mean that you can start to pay off your debt. Use the government site that will run through what you could be owed. It’s free to use and takes under 15 minutes.

Step 5: Pay your mortgage

Having a roof over your head is the most important thing right now. Can you make your repayments? If you need help then have a look at the Government scheme that can help you make your monthly repayments even if you are in arrears

Step 6: Lower your interest rate

Sometimes it feels like an upward battle when all you are doing is paying off the interest. It may be worth switching or looking around to get the amount of interest down.

First, check your credit score for free to make sure that nothing is going to stop you from switching.

Then start looking around. Could you swap your credit card debt to an interest-free one for a number of months? Would a new loan cover all your debts at a cheaper interest rate? Is remortgage possible? It makes sense to find out the best loan deals available to you as quickly as possible.

Sit down and work out the numbers. Could you be better off by switching?

Step 7: Start overpaying if you can

If you find that you have a little more money one month then overpay if you can. Saving rates are so low and really won’t help you in the longer term.

Paying off your debt is the best way to get financially secure, so any extra money you have use it!

This is a collaborative post.