“The future of money is digital currency,” predicts Bill Gates.

The man has enough credibility to be taken seriously when he makes a statement. It’s already becoming apparent, too.

The rich folks are starting to accumulate crypto, and the world is transitioning into using digital currency, one day at a time. Meanwhile, this transition offers investors an excellent opportunity to pocket some profit while the prices go wild.

One of the most compelling opportunities, it seems, is Chainlink (LINK). The coin’s price has shot up over 100% in 2021 alone and stands at $26.79 as of this writing. While this may seem bleak when compared with BTC, Chainlink might just be the next multi-bagger crypto of 2021.

Chainlink has strong fundamentals backing the token’s value. In the long term, these factors could drive LINK’s price significantly upward. Here are some reasons to support this bullish thesis.

5 Reasons why LINK makes up for a compelling buy

Chainlink offers the best of both worlds

Undeniably, the future of digital agreements is smart contracts that offer two-fold benefits of enhanced trust and reduced cost. The barrier, as of today, that limits the applicability of smart contracts is the lack of a connecting link between the legacy systems and applications that make use of smart contracts.

If smart contracts are to become a day-to-day phenomenon, there must be something to bridge the gap between blockchains and the rest of the world. This technical constraint restricts smart contracts from accessing the data in our current systems, which limits a smart contract’s ability to trigger execution.

For example, a smart contract is made to depend upon the outcome of a wager at the track. When a horse wins, the individual who bet on the horse automatically gets paid. No human action is required, at all!

As of today, the lion’s share of data is not accessible by blockchain. This makes it imperative to have a link that can bridge the gap between the distributed ledger technology (DLT) and legacy systems.

This is where LINK enters the scene as a game-changer. It acts as the portal between these two systems through APIs and intends to capitalize on the data in legacy systems, thus opening up an array of possibilities for businesses. The legacy enterprise system and blockchain can potentially flourish by leveraging what Chainlink has to offer.

Most coins are too focused on replacing the legacy systems. The truth is, legacy systems will stay around at least for the foreseeable future. Chainlink, instead of focusing on replacement, focuses on integrating the legacy systems with blockchain.

For investors wondering if this is a good time to buy LINK, they must know that there has never been a better time. LINK has a defined purpose for businesses and a strong proposition that makes it one of the strongest cryptocurrencies, fundamentally speaking.

Chainlink’s partnerships

LINK has managed to rake in the interest of several market-leading corporations. This furthers confidence in Chainlink as a potential, reliable coin of the future.

Among Chainlink’s most crucial partners are Google and SWIFT.

Google, back in 2019, announced in a blog post that it had acquired LINK’s oracle services for building hybrid blockchain cloud applications with ETH and Google Cloud. Although, this is not the only large corporation that is integrating LINK into its systems.

Sergey Nazarov’s (LINK’s founder) company SmartContracts had been supplying enterprise oracle solutions for SWIFT even before LINK came into existence. For those who aren’t familiar with what SWIFT is—it is the world’s largest interbank payment messaging network.

Chainlink also has some other partnerships, and these are some of the strongest that exist in the blockchain landscape. Among LINK’s partners are reputable names such as Web3, Polkadot, OpenLaw, Accord, and Morpheus.

Chainlink has the business network required to establish itself as a go-to for off-chain computation and oracle services. Investors are drawn to Chainlink’s capability to appeal to both the blockchain universe and legacy enterprise. A fundamentally strong business network and a capable team provide investors the confidence to buy LINK. Speaking of Chainlink’s team…

The LINK team’s farsightedness

DLT is still in its infant stage and will take at least a decade to mature. This necessitates a long-term approach that takes into account not just the short-term, but long-term challenges as well.

Chainlink is focusing on the blockchain space’s long-term woes by constantly emphasizing the development of off-chain computation capabilities for smart contracts in revolutionary methods called Trusted Execution Environments (TEE).

Chainlink, by implementing Trusted Execution Environments, can provide enhanced privacy to both legacy enterprise and smart contract platforms. Privacy of smart contracts is a key concern in the blockchain world today, and the Chainlink team is focused on addressing it.

TEE also puts the smart contract platforms at ease so they can concentrate on finality settlements. This offers several benefits including quick processing, data privacy, and maintaining a completely decentralized main chain. Another intriguing phenomenon that could emerge is WASM (WebAssembly), which may enable a broader range of processes in TEEs, and expand the scope for this technology beyond smart contracts.

The Chainlink team’s consistent efforts towards developing computational features, privacy solutions, and collaboration with Cornell’s IC3 for research solidifies investor confidence with regards to its future prospects. They’re being objective by identifying the problems that are constraining scalability, adoption, and privacy, and focusing on coming up with innovative technological solutions.

LINK rules the DeFi space

Chainlink (almost) tops decentralized finance as of this writing as per CoinMarketCap. DeFi is set to disrupt the financial services industry, and LINK is at the forefront of this disruption.

DeFi will alter our approach to financial services by enabling everyone to create and use financial applications, tools, and services. This potent technology will offer users an alternative for all things financial such as borrowing, insurance, trading, savings, custody, and more.

What makes Chainlink stand out in the DeFi universe is that it has adopted a streamlined approach to solving the problems that plague the DeFi space and hinder its adoption. Chainlink is spreading its wings and raking in partners that can give it the momentum needed to build this new ecosystem.

Some key DeFi names that have integrated Chainlink’s oracles include Kyber Network, Graph Protocol, AVA, Synthetic, Opium Network, and bZx. To top these off, Chainlink is also associated with the Chinese government’s national blockchain project for the integration of Chainlink oracles into the country’s national blockchain services network (BSN).

Essentially, Chainlink hopes to tie smart contracts and off-blockchain data to ease the exchange of information between blockchains and financial services. This might be a slow process, but in the long run, it may be a fruitful endeavor. Chainlink is set to lead the path to DeFi adoption, and this will factor into the token’s value as time passes.

LINK’s tempting technicals

The reasons to buy Chainlink we discussed in points 1 through 4 are based on LINK’s fundamental strength. Some investors, though, like to look at technicals—and that is what reason 5 will touch on.

Investors may have friends and family who are convinced that Bitcoin is probably the only crypto asset that will offer the best returns. Maybe, there is some substance in their contention, maybe not. Nevertheless, this bodes well for investors hoping to still put in some money into LINK.

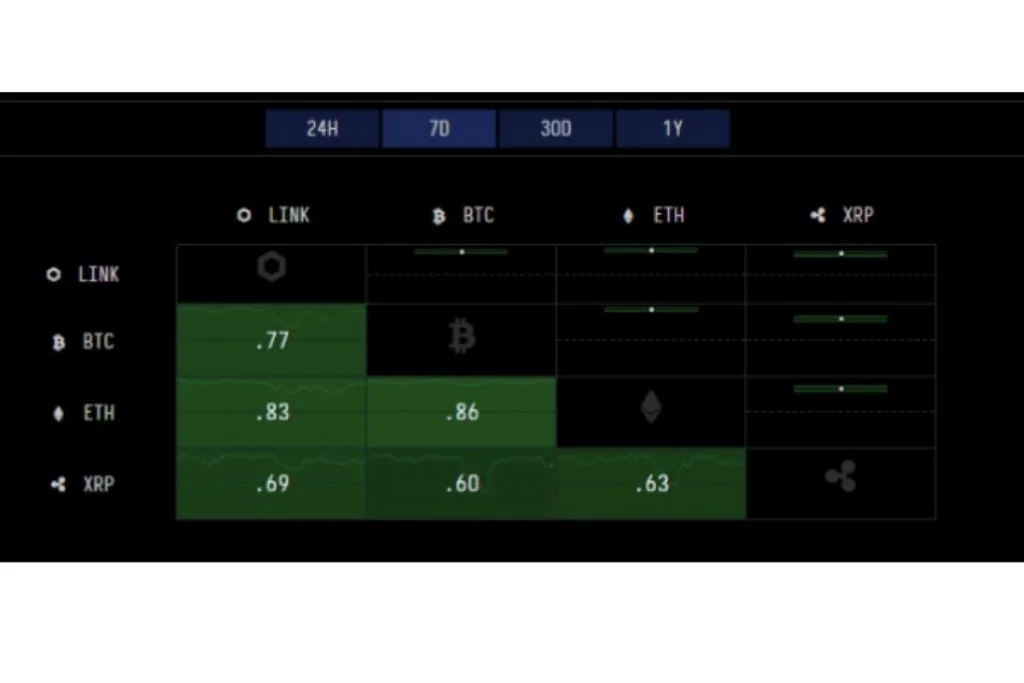

LINK and Bitcoin’s quarterly averaged prices show an r of 0.83.

r represents the correlation coefficient. In simple words, LINK and Bitcoin’s quarterly averaged prices move in the same direction 83% of the time. The correlation coefficient drops to 0.662 (66.2%) for daily prices. This is understandable, though, given how parabolically volatile crypto prices can be. That being said, the short-term correlation can fluctuate a good deal. The 7-day correlation as of this writing stands at 0.77:

Of course, investors that plan on holding on to their LINK tokens over a longer time frame will find the 83% correlation more relevant. This means investors will derive (more or less) similar benefits by investing in LINK as they would have by investing in Bitcoin, in terms of percentage.

If the fundamental strength doesn’t appeal to investors, its correlation with BTC might. It’s important to understand, though, that LINK will not always imitate BTC’s movement—but there’s a good (83% over the longer-term) chance that it will.

Conclusion

As eventually traditional markets’ potential to offer decent returns declines, investors will start to look at fundamentally strong assets to diversify their portfolio. As an asset that is highly uncorrelated with equities and bonds and fundamentally strong, Chainlink will shine on many portfolios soon.

Chainlink’s ability to offer the best of both worlds, powerful business network, capable team, strong grip on the DeFi space, and favorable technicals makes it a strong contender against big names like BTC and ETH—especially owing to their current valuation.

Chainlink’s price isn’t going to reach for the sky tomorrow, and therefore, investors shouldn’t put all their money in at once. It’s best to allocate a small percentage of the portfolio to LINK to start with. If the prices turn red, the loss will not cause the investors to go homeless. If they turn green, the portfolio’s average return will shoot up.