Why Do You Need Insurance

It is better to be safe than sorry. This is the most basic factor behind taking an insurance policy. It provides premises to keep you secure in case disaster strikes. Disasters have their own stress like losing a loved one, car accidents, unexpected illness, or more. If you are prepared, you will not have an added stress or financial burden.

The financial burden is transferred to the insurance company in case of any such unforeseen circumstances. A good insurance policy with as many insurance coverage options as possible will be more helpful than you think as compared to when disaster strikes and you are insured. It is best to take your insurance policy when you are well and healthy and still insurable to the insurer.

There are many different kinds of insurance available now for every need of yours. There are four main types of policies which could prepare you for life and many unexpected turns it can bring:

Life Insurance

If you have family members who are dependent on you financially to pay basic bills even, it’s best to have life insurance, so, in case of death, they still can cover their expenses. Taking into consideration the daily living cost, mortgage payments, any outstanding debts, child care, etc, can determine what amount of life insurance is going to be best for your dependants. You can also choose between whole life and term life insurance.

Disability Coverage Insurance

Accidents happen at the most unexpected time and even if one is healthy. A bad accident can cause disability which can prevent them from working for the rest of their life or for some time until they recover. In factories and other places where one is working with heavy machinery, work-related accidents are very common. Good disability-related insurance will ensure you can pay your bills apart from those which are medically related. And provide you with the needed rest.

Health Insurance

Medical problems especially prolonged illnesses can be expensive to deal with. If not insured, it could lead to bankruptcy. Even a minimum policy to cover your basic medical bills can be helpful in the long run. Many companies provide health insurance to all their employees but it can be expensive for small businesses. If your company cannot provide you and your family with health insurance, it would be a good idea to contact reputable health insurance brokers florida (or indeed elsewhere) and discuss your affordability to get an insurance plan that works for you.

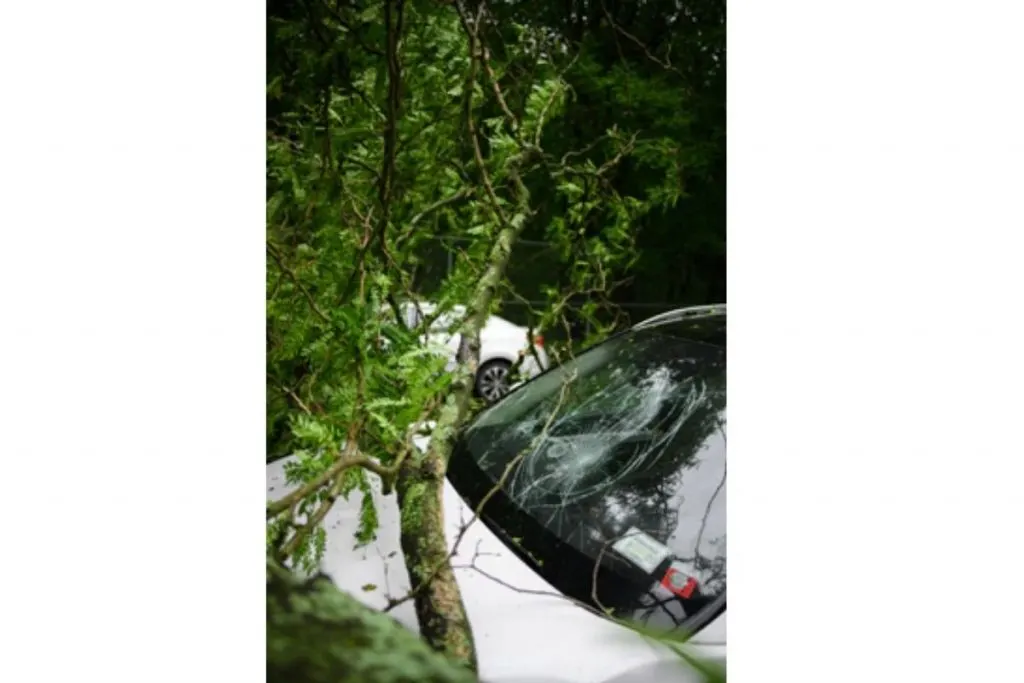

Car Insurance

Your automobile plays an essential role in your life right from getting to work, picking up the kids from school, going for a drive to relax, or picking up your groceries. In many countries, car insurance is even mandatory to make sure you are covered in case you have an accident. When you are insured, you will be guarded financially if you, your passenger, or anyone else is injured during the accident. Also, it protects your car in case of theft or vandalism.

Final Thoughts

The above four are the most basic types of insurance policy needed for the majority of people. However, there are more specialized policies available now, even for your pets! Assuring that you are insured from any risks that life can bring, it’s best to be prepared to concentrate on overcoming financially at the quickest.