As parents, we all know that we need to save more toward our children’s future. Giving your child a helping hand when they need it the most is one of the most rewarding things you can do as a parent when your kids are older.

We all know that it’s easier said than done though, with the cost of raising a child to the age of twenty-one estimated to be over £220,000. With that eye-watering number in our minds, we could all do with putting a bit away to help ease the financial burden later on.

While the low saving rates are still a challenge, it’s still worth trying to put a bit away for your kids.

Think of it this way. If you could put £50 a month away in till your child reaches twenty-one then that could give them a nice £12,600 towards a mortgage or a car.

So here’s how to achieve your savings goals and build a little nest egg for your kids future.

1. How Much Can You Afford To Save

It’s easy for someone to say you need to save but in reality, you may not be able to.

Start by going through your monthly budget or starting one. That way you know what you have left over if anything that month. You can use my FREE downloadable budget planner to help.

Using your budget planner, work out how much you can afford to save starting this month and have your end saving goal in your mind.

If you’re unsure how much you “should” be saving, use our below formula to help:

The total amount you want to save by your child’s 21st birthday \ how many years you want save = annual saving goal

Annual saving goal / 12 months = how much you need to save a month

Now check if it matches your affordable figure from your budget plan. It’s ok if it doesn’t. Circumstances change over our lifetime as we become more financially aware.

2. Start as Early as You Can

As the above shows, if you can start from the month your child is born then you should have a small sum saved. In our strained economy, it is vital to start saving as soon as you can. This means that your monthly amount won’t have to go up. If you’re starting a bit later, then you need may need to add extra incremental amounts over time to help you reach your saving goal.

3. Save in the Right Place

Once you’ve worked out how much you can afford to save then work out how or where you want to save it.

Back in the day our parents would have just opened a standard child’s savings account and would add money when they had it. Now, with interest levels so low these accounts offer very poor returns.

Many of us have now become savvier with money and look at more share-based or ISA based accounts. Shepherds Friendly offer many different tax-effective options which could help make your money go further.

Do your research and find out what is going to work best for you and your family. Ask questions like:

Do I need to get to this quickly?

Can I have it tied up for a long period of time?

Can I 100% stick to putting the same amount in every month?

How much risk do I want to take on and is it worth the gain?

4. Minimise Fees

These lead to less money on the other side and can slowly eat away at your hard earned savings.

Shop around and find out upfront how much commission costs or fees you may have to pay. Will you have to pay any tax or are they free to use?

Knowing this will save you money later on and help you achieve your saving goal.

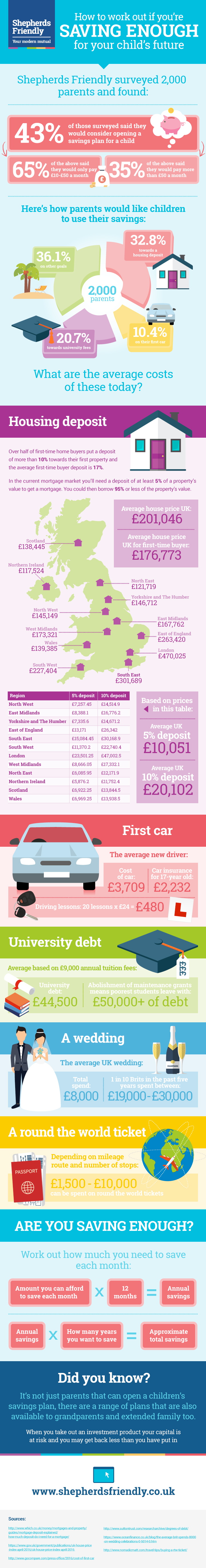

It’s not just parents that can save, grandparents or anyone else in the family can too. So are you saving enough?

This is a collaborative post.