We all know that we need home and contents insurance. Protecting what you own is important but can feel costly.

Making sure that you change providers every year is a great way to save money. Last year we switched to Buzzvault for the first time and saved over £100 on our home contents and building insurance.

We did some research first which we suggest everyone does. Make sure you look around and get as many quotes as possible before you commit to another year.

We found Buzzvault and read some reviews. They have a high Trustpilot rating and the reviews seemed good. After getting quotes off of five other companies including the one we were with already we decided to try Buzzvault. None of our friends are with them but we’ve heard good things.

Here’s our review of Buzzvault insurance and how we found switching to them, plus how we save £100.

What is Buzzvault insurance?

Buzzvault insurance are an FCA regulated company that offer home and content insurance without the guesswork. Unlike most providers, that ask customers loads of complicated questions and try and estimate the value of their belongings, Buzzvault do a video survey that actually shows a real-life person those possessions so they can put a real price on them.

This means that if it ever comes a time that you have to claim, these items won’t be undervalued or unclaimable.

Free Printables

If you’re looking to save more money then join our free Resource Vault. We have over 15 + free printables that you can download as many times as you like.There are meal plans, shopping lists and budget planners to help you and your family stay on track.

Join our free Resource Vault here.

(By joining the Resource Vault you are agreeing to let us email you about our other money saving ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

Buzzvault Review

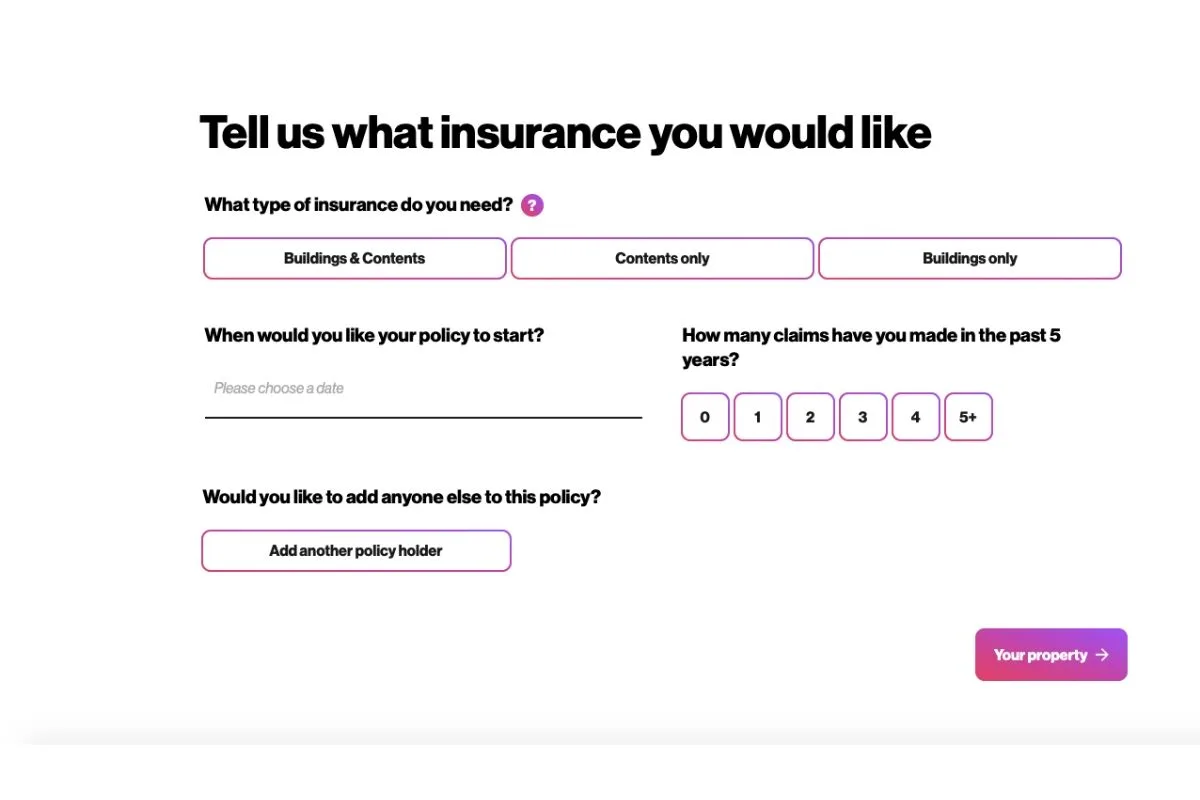

The first thing we did was to get a free quote off their website. This took about a minute or so to do.

First, you fill in the form about the kind of cover you are looking for and how many no claims you have. You can add a partner here too.

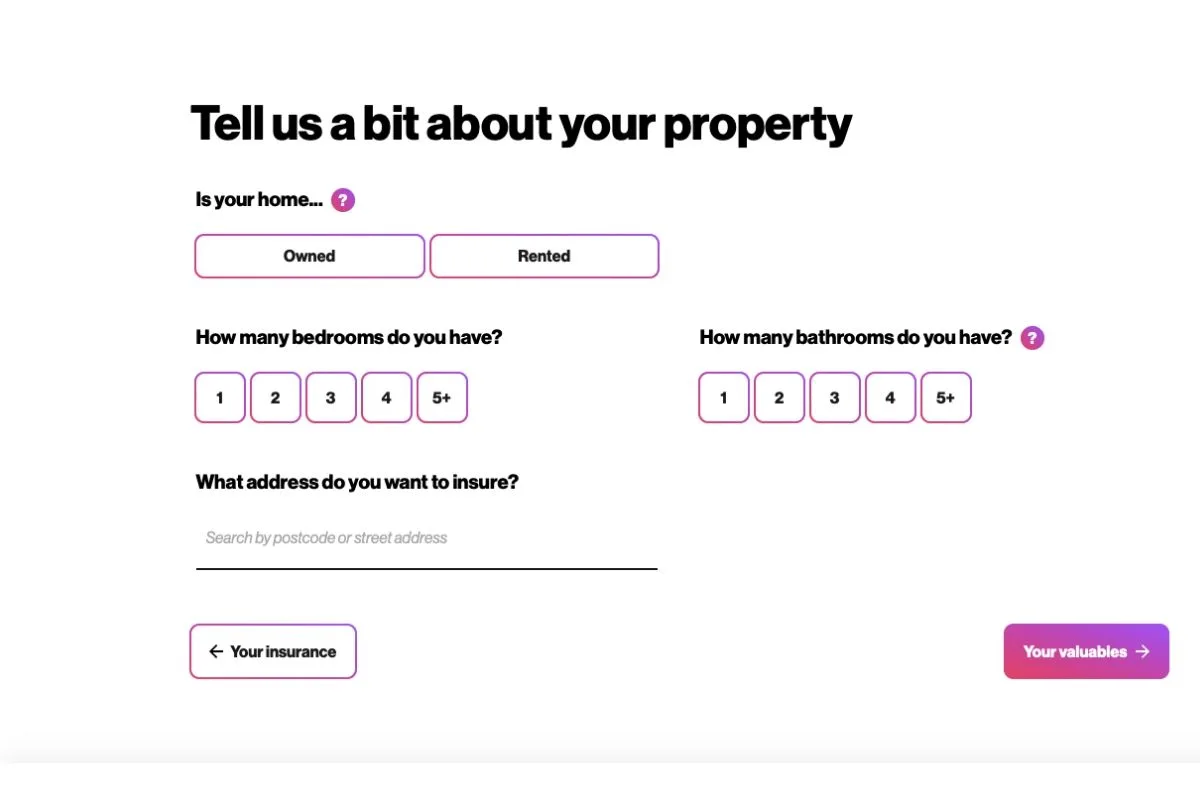

Next, you add the details about your home. This includes some details about how many bedrooms and bathrooms your home has. All the basic details.

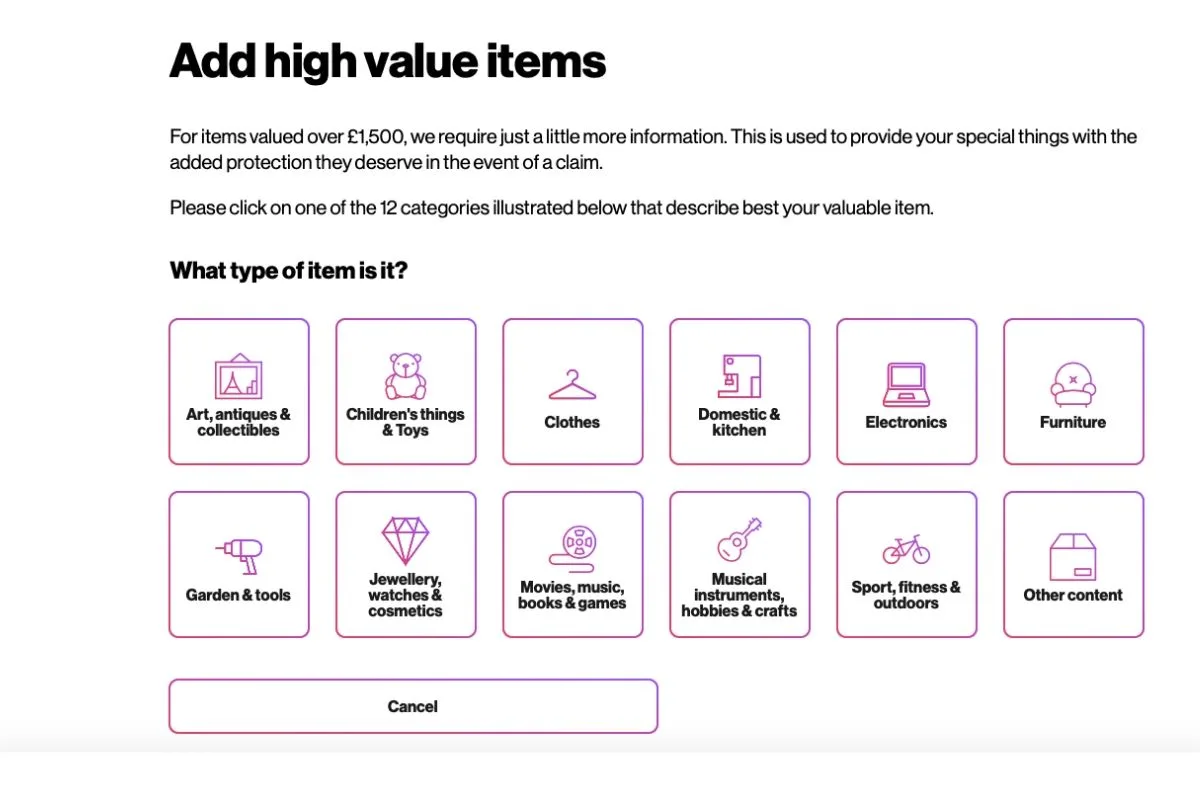

Then you add your high-value items over £1500. This can include anything from arts, kids toys, clothes, jewelry, electronics. Pretty much anything that you think is worth over £1500.

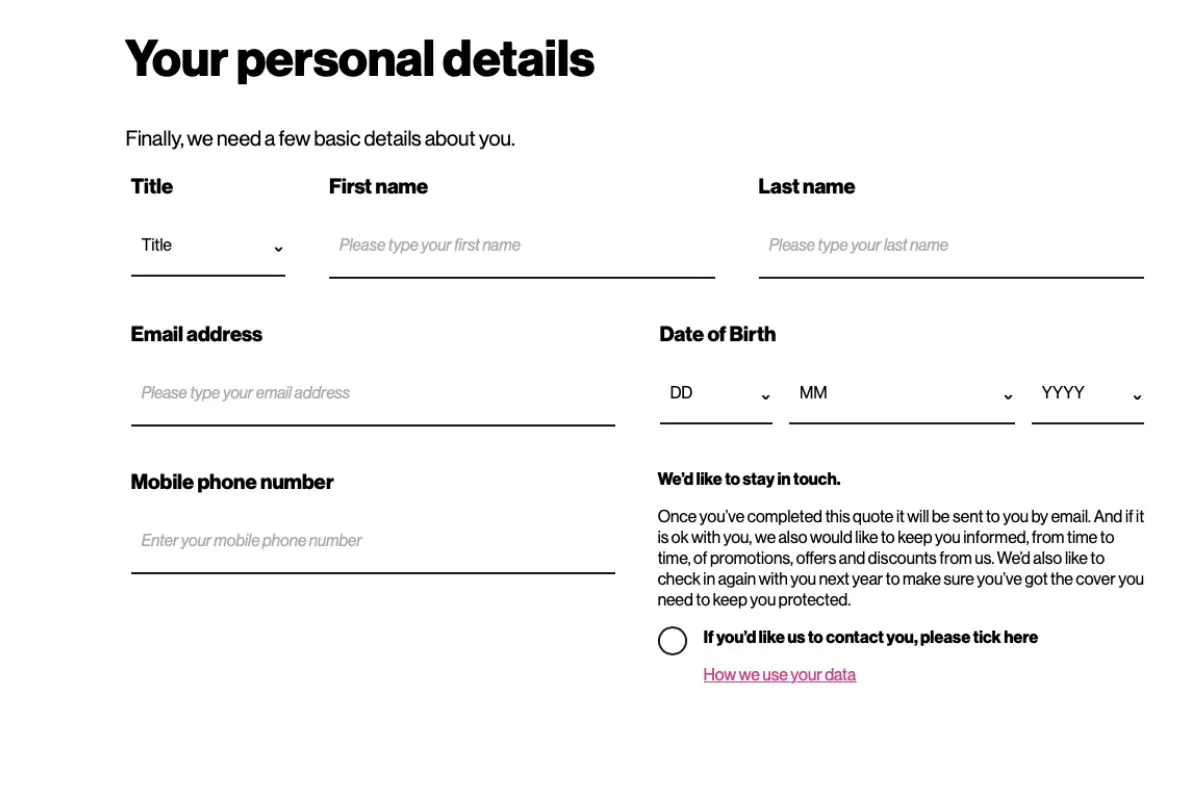

Next, you add your personal details. Please remember to tell you the whole truth as it may affect any claim you put forward.

Then click get a quote. Here you can change and amend any details.

Next is the video call. This has to be done within 28-days of you taking your policy out.

Just like a video call with a friend, Buzzvault’s video call can be done through Skype or FaceTime. You have a call with one of their team who chats you through what you have at home and what should be insured. It can take 15 minutes so make sure you have loads of time.

It’s free and is a digital inventory of what you have and need to insured.

If you buy something that needs insurance please remember to add it on. You can do this by downloading their app and adding your items.

You do need to complete the video call to make sure your policy active.

What we liked the best is that it means that our final quote is based on what we actually own and not on a guess on how much our items are worth.

It’s very detailed and accurate and hassle-free. This made our quote cheaper than our last insurer too.

Use our link here to get a free quote.

Can you tailor your insurance?

Yes, you can tailor the insurance to what you need. You can add Accidental Damage and Out-of-home Contents cover depending on the protection you need. You can change the excess level as well.

Make sure you keep Buzzvault up to date on any changes you make to your home or anything expensive you buy to keep your claim up to date.

Why pick Buzzvault insurance?

We picked Buzzvault insurance as we generally found them cheaper. The video call they do means that they know exactly what you are insuring meaning that nothing is left to chance.

The video call only takes 15 minutes which we thought was great. We liked it, as they explained to us that the more they know about what we have, the less money we pay as it reduces the risk of us claiming for something they know nothing about.

We liked the option that we could pay monthly. We didn’t and paid yearly as it’s still cheaper. If you can afford to pay for it yearly then do.

It’s really easy to get a quote online. We did ours within about a minute then had a callback.

You do have to give extra evidence if you own anything over £5000. We don’t but it made sense.

There are a few optional extras that they chat through including accidental damage and out of home cover. We didn’t take that up but you can if you want to or need too.

We had a great experience with Buzzvault and it’s worth getting a free quote if you and when your home insurance is up for renewal.

Use our link here to get a free quote.

Free Money Saving Challenge

If you’re struggling to save money then join our Money Saving Challenge. It’s a six-week free email course that emails you weekly with money saving family tips and tricks that can help you save more.

Join our FREE Money Saving Challenge here.

(By joining the Resource Vault you are agreeing to let us email you about our other money saving ideas. You can unsubscribe at any time by clicking the link at the bottom of every email.)

Related Posts:

- 19 Cheap Food Shopping Hacks That Could Save You Hundreds

- 101 Frugal Living Tips That Will Save You Thousands in 2020

- How to Get a Free Holiday

Top Home Insurance Tips

If you are looking to change your buildings or contents insurance then our five top tips are:

1. Don’t over cover your building. It’s worth noting that you need to cover how much it will take to rebuild not the current market value. Most policies do cover paying for you to stay somewhere while your home is rebuilt so that is factored into the cost.

2. Make sure you declare any expensive items. Not doing this could really affect your claim and mean that some items won’t be replaced. Being honest is the best idea here.

3. Loyalty means nothing. Make sure you look around every single year as it really can save you money. Try to get a quote off of at least three companies so you have a ballpark figure.

4. Renewal a bit earlier. By doing this you could save money. This does depend on how much risk an insurer thinks you are though.

5. Paying for better locks can pay for themselves. Ever wonder why an insurer asks you what locks you have on your home? That’s because they want to know that the house is as secure as possible. Work it out. Find out from your supplier how much your renewal would go down if you had better locks. It’s worth an ask!

Laura x

If you enjoyed this post and would like some more money saving ideas, then head over to the saving my family money section here on Savings 4 Savvy Mums where you’ll find over 50 money saving tips to help you save your family more. There’s enough tips to help you save over £300 a month! You could also pop over and follow my family saving Pinterest boards for lots more ideas on how to stop spending and save more; Money Saving Tips for Families and Managing Money for Families.

Love this post? Then why not save it to Pinterest so you can easily find it later.

What the * means

If a link has an * by it, then this means it is an affiliate link and helps S4SM stay free for all. If you use the link, it may mean that we receive a very small payment. It will not cost you anymore that it would normally.

You shouldn’t notice any difference and the link will never negatively impact the product. The items we write about are NEVER dictated by these links. We aim to look at all products on the market. If it isn’t possible to get an affiliate link, then the link, or product is still included in the same way, just with a non-paying link.